Saturday is a day many people look forward to for leisure and errands. However, when it comes to banking operations, there’s often confusion about whether Saturday qualifies as a business day for banks.

In general, Saturday is not considered a business day for banks. While some banks may have limited operations on Saturdays, such as shorter hours or specific services, most major banking transactions and operations occur during the traditional business week from Monday to Friday.

This distinction is important to note, as it can impact the processing times for various banking activities such as deposits, withdrawals, and transfers. Customers should be aware that transactions initiated on Saturdays may not be processed until the next official business day, which is typically Monday.

Understanding Business Days

Business days refer to weekdays when banks and businesses conduct regular operations. This typically excludes weekends (Saturdays and Sundays) and official holidays. Understanding business days helps individuals plan banking activities and transactions efficiently.

Knowing the distinction between business days and non-business days ensures timely processing of financial transactions. While business days are standard for banking operations, weekends and holidays may delay transactions until the next business day, providing clarity for customers’ banking schedules.

Saturday and banking: General offices

In the banking sector, general offices traditionally viewed Saturdays as full working days, aligning with earlier banking practices to provide customers with more accessible financial services.

Over time, however, banking hours on Saturdays have undergone significant changes, with some financial institutions opting for reduced operating hours or complete closure, impacting customer convenience and operational costs.

Is Saturday a bank day?

Saturday is not universally recognized as a bank day, as its status varies among different financial institutions and regions, with some banks choosing to operate on Saturdays while others do not.

The decision to work on Saturdays involves a trade-off between customer convenience and operating costs, as extended hours may incur additional expenses for staff, utilities, and infrastructure maintenance.

Effects of Saturday banking

Operating on Saturdays in the banking sector brings both benefits and challenges. For customers, the availability of banking services on Saturdays offers convenience, allowing them to manage their finances without interrupting their workweek.

However, from the bank’s perspective, Saturday operations entail additional costs such as staff wages, utility expenses, and maintenance of infrastructure, impacting the overall cost-effectiveness of extending services to Saturdays.

Also Read: What Is The Hum Compben E Mer Transaction On Your Bank Statement?

Furthermore, the decision to work on Saturdays can affect the work-life balance of bank employees, potentially leading to increased stress or dissatisfaction due to extended working hours.

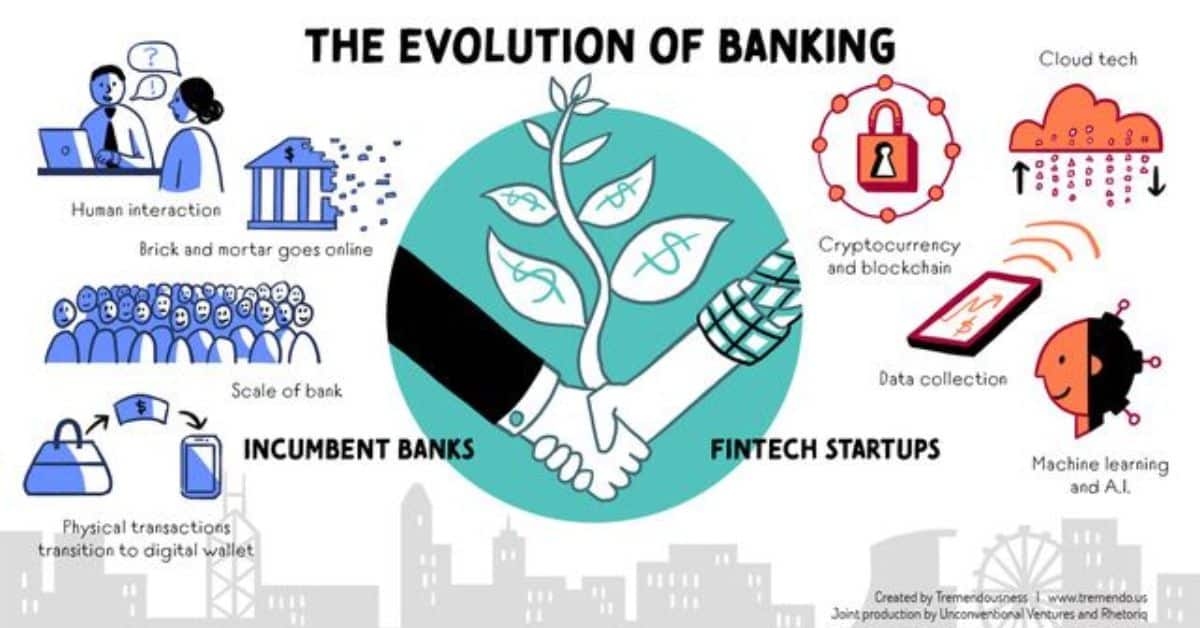

Alternatives and innovations

Digital banking innovations have reshaped traditional banking standards, offering customers the flexibility to transact and access services outside regular banking hours, reducing reliance on Saturday banking for convenience.

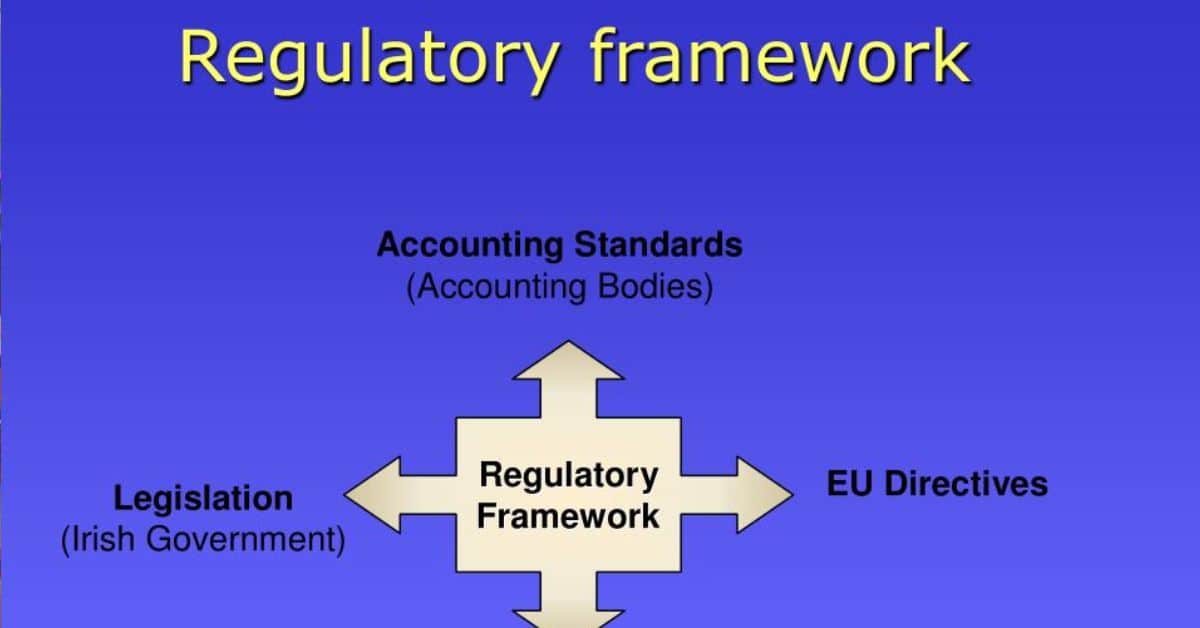

Regulatory Framework

The regulatory framework established by governments and financial institutions plays a crucial role in shaping bank operating hours, reflecting cultural, regulatory, and operational differences worldwide. These regulations help maintain consistency and transparency in banking practices across different countries and regions.

Customer experience on Saturday

For customers, the availability of banking services on Saturday brings both advantages and disadvantages. While it offers added convenience for some, others may encounter limited services or functional constraints due to reduced staffing or operational hours.

Future Trends and Forecasts

Future trends and forecasts in banking point towards a significant shift in how financial services are delivered to customers. Advancements in technology, such as artificial intelligence and blockchain, are expected to streamline banking operations and enhance security measures.

Additionally, personalized customer experiences are likely to become a key focus, with banks leveraging data analytics to offer tailored financial solutions and improve overall customer satisfaction. These trends suggest a future where banking services are more efficient, accessible, and tailored to individual needs.

The Evolution of Saturday Banking

Over time, Saturday banking has evolved significantly, transitioning from full working days for banks to reduced hours or complete closure in some institutions. This shift is influenced by changing customer preferences, technological advancements, and operational efficiency considerations.

Historically, banks operated on Saturdays to accommodate customer needs and enhance accessibility. However, with the emergence of digital banking solutions and alternative channels, the importance of Saturday banking has diminished, leading to adjustments in banking hours and service availability on weekends.

Also Read: What Is the PAI ISO Charge on Your Bank Statement?

Saturday and Banking: Global Overview

Saturday banking policies vary globally, with some countries considering Saturday a business day for banks while others do not, reflecting cultural and regulatory differences. Understanding these global variations is crucial for customers and financial institutions navigating international banking operations.

Frequently asked question

Are all banks closed on Saturdays?

Not all banks are closed on Saturdays; some banks may choose to remain open with shortened hours or specific services available.

Do banks in different countries follow the same Saturday schedule?

The Saturday schedule for banks varies across different countries. Some countries may consider Saturday a business day for banks, while others do not. It depends on the banking regulations and practices in each country.

Is Saturday a business day for banks in Canada?

In Canada, most bank branches operate on a six-day working week, including Saturdays. However, some branches may choose to open on Sundays as well.

Does Bank of America do deposits on Saturday?

Bank of America processes deposits made on Saturdays, but the availability of funds may vary depending on the specific deposit method and time of deposit.

Do banks work on Saturday in South Africa?

Banks in South Africa typically have branches open on Saturdays, usually from 8:30 am to 11:00 am or slightly longer hours, providing banking services to customers during that time.

What is the difference between a banking day and a business day?

The difference between a banking day and a business day lies in their definitions. A banking day refers to a day when a bank’s office is open to the public to perform banking functions, while a business day is any day when regular business operations take place, which may or may not align with banking days.

Do banks process checks on Saturday?

Banks generally do not process checks on Saturdays as weekends are typically non-business days for banks. Checks deposited on Saturdays are usually processed on the next business day, which is often Monday.

Summary

Saturday is generally not considered a business day for banks in most countries, including the USA and UK. While some banks may have limited operations on Saturdays, such as shorter hours or specific services, major banking transactions are typically conducted during the traditional business week from Monday to Friday.

The availability of banking services on Saturdays offers convenience to customers, allowing them to manage their finances without interrupting their workweek. However, this also poses challenges for banks, as operating on Saturdays incurs additional costs such as staff wages, utility expenses, and infrastructure maintenance, impacting cost effectiveness and employee work life balance.