Wondering about the ins and outs of financing your dream boat, Let’s dive in, When it comes to boat loans, one burning question often arises: how long can you finance a boat? Well, the answer is not set in stone, but rather floats along the waves of various factors.

Boat financing typically offers a range of loan terms, from a quick dip of just a few years to a leisurely cruise of up to 20 years. This flexibility allows you to tailor your loan to suit your budget and boating dreams. So, whether you are eyeing a sleek yacht or a sturdy fishing vessel, there’s a loan term out there to suit your needs.

How boat loans work

Boat loans function much like other types of loans, where lenders provide borrowers with a sum of money to purchase a boat, which is then repaid over a specified period with interest.

Typically, borrowers apply for boat loans through banks, credit unions, or online lenders, comparing rates and terms to find the best option for their needs.

Once approved, borrowers receive the loan amount, which they can use to purchase their desired boat, making monthly payments to repay the loan over the agreed upon term.

What are typical boat loan terms?

Boat loan terms vary based on factors like boat type, loan amount, and borrower’s credit score. Typical terms range from 3 to 20 years, with varying interest rates. Here are some key points:

- Boat loan terms range from 3 to 20 years.

- Longer terms result in lower monthly payments.

- Interest rates may vary based on loan duration.

- New boats generally qualify for longer terms.

- Used boats might have shorter loan terms.

- Borrower’s credit score influences loan terms.

- Loan amount and boat type also impact term length.

What is the average interest rate for a boat loan?

The average interest rate for boat loans typically ranges from 4% to 6% in the United States. However, rates can vary based on factors like the borrower’s credit score, loan term, and the type of boat being financed.

Generally, borrowers with higher credit scores may qualify for lower interest rates, while longer loan terms may result in slightly higher rates. It is essential to shop around and compare offers from different lenders to secure the most favorable interest rate for your boat loan.

Use a boat loan calculator

Using a boat loan calculator simplifies financial planning for purchasing a boat. It helps estimate monthly payments, total interest costs, and loan terms based on factors like loan amount, interest rate, and repayment period. By inputting relevant details, borrowers can make informed decisions and understand the affordability of different financing options.

Factors that Effect Boat Financing Terms

Several factors influence boat financing terms, including the borrower’s credit score, loan amount, and the type and age of the boat. Lenders consider these factors to determine the loan duration, interest rate, and monthly payments. A borrower’s financial stability and creditworthiness play a significant role in securing favorable loan terms for boat financing. These commonly include:

Size of the Loan

The size of the loan directly impacts the loan term, with larger loans typically offering longer repayment periods. Smaller loans may come with shorter terms but higher monthly payments to ensure timely repayment.

Age of the Boat

The age of the boat influences the loan term, with newer boats often qualifying for longer repayment periods. Older boats may have shorter loan terms due to potential depreciation and maintenance concerns.

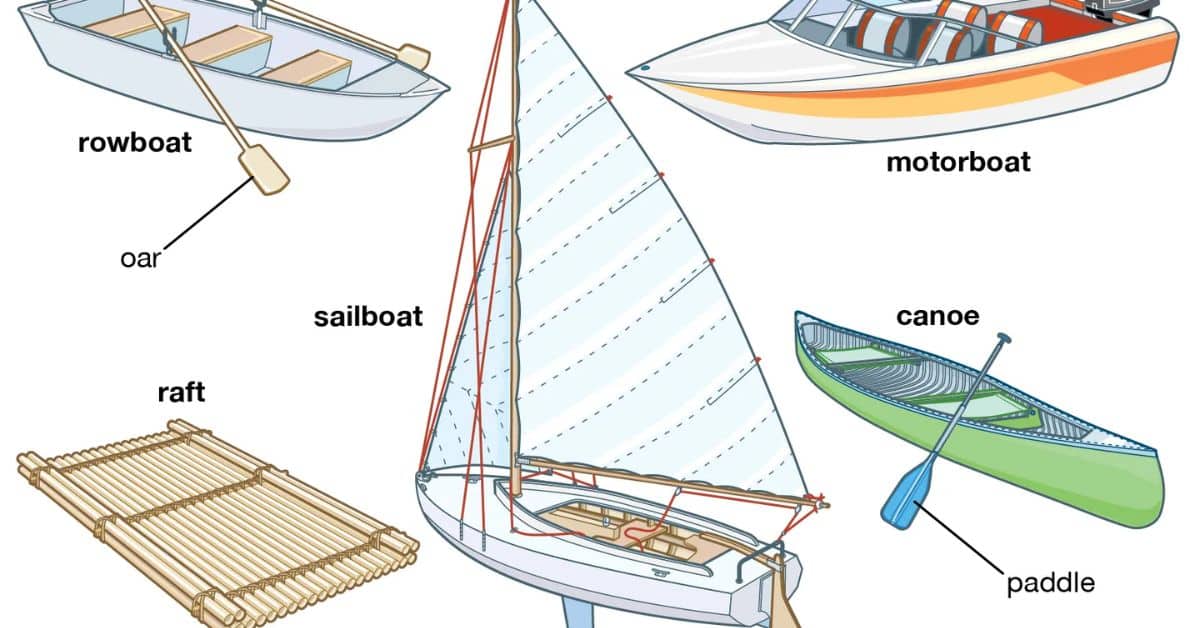

Type of Boat

The type of boat impacts loan terms; smaller boats may have shorter loan durations while luxury yachts may qualify for longer terms. Factors to consider include:

- Shorter loan terms for smaller boats.

- Longer loan terms for larger vessels.

- Loan durations tailored to match the boat’s value and expected lifespan.

Also Read: How To Get Approved For Snap Finance

How does the length of the loan affect the total monthly repayments?

The length of the loan directly influences total monthly repayments; longer loan terms typically result in lower monthly payments but higher overall interest costs. Conversely, shorter loan terms often mean higher monthly payments but lower total interest expenses over the loan duration.

How to calculate the monthly repayments by loan length

To calculate monthly repayments based on loan length, first, utilize online calculators provided by lenders. Input the boat’s cost, loan duration, and interest rate to determine the monthly payments. Remember to deduct the down payment, typically between 10% and 30%, from the boat’s price before calculations.

For example, consider a $30,000 boat purchase with a 5% interest rate. Deducting a 10% down payment, a $27,000 loan yields varying monthly payments: $509.52 for a 5-year term, $286.38 for 10 years, and $178.19 for 20 years.

For a pricier $65,000 boat with a 5% interest rate and a 10% down payment, resulting in a $58,500 loan, monthly repayments differ: $1,103.97 for a 5-year term, $620.48 for 10 years, and $386.07 for 20 years.

Ready to Secure Boat Financing?

Ready to secure boat financing? Begin by assessing your financial situation and determining your budget. Then, research various lenders to compare loan terms, interest rates, and eligibility requirements.

Once you’ve chosen a lender, gather all necessary documentation, including proof of income, credit history, and personal identification. Submit your loan application and await approval, ensuring to carefully review the terms and conditions before signing any agreements.

Where to find a boat loan

Looking to find a boat loan? Start by exploring options from banks, credit unions, and online lenders, which often offer competitive rates and flexible terms. Additionally, consider marine finance companies specializing in boat loans, as they may provide tailored financing options suited to your needs.

Another option is to inquire with boat dealerships, as they often have relationships with lenders and can assist in securing financing for your purchase. Do not forget to compare rates, terms, and eligibility requirements from multiple sources to ensure you’re getting the best deal possible.

Banks, credit unions and online lenders

Banks, credit unions, and online lenders all provide options for securing boat loans, catering to diverse financial needs and preferences.

Credit unions often offer competitive rates and personalized service, making them a favorable choice for borrowers seeking a more community oriented approach to financing. Online lenders like BoatLoan.com offer convenience and flexibility with easy access to competitive rates, providing a streamlined application process for borrowers.

Dealer financing

Dealer financing is another option to consider when purchasing a boat, allowing buyers to arrange financing directly through the boat dealership.

While dealer financing offers convenience, it’s essential for buyers to compare rates and terms with other lenders to ensure they’re getting the best deal possible.

Marine brokers

Marine brokers serve as intermediaries between boat buyers and lenders, assisting in securing boat financing tailored to the buyer’s needs.

These professionals leverage their expertise and industry connections to help buyers navigate the financing process, ensuring they obtain competitive rates and favorable terms.

Working with a marine broker can streamline the boat financing process, providing buyers with access to a wider range of lenders and loan options.

Types of boat loans

Boat loans come in various types, catering to the diverse needs of buyers in the marine market. Here are some of the most common types of boat loans and what they mean for you as a borrower:

Fixed rate vs. variable rate

Fixed-rate boat loans maintain the same interest rate throughout the loan term, providing stability in monthly payments.

Variable rate boat loans feature interest rates that can fluctuate over time based on market conditions, potentially leading to varying monthly payments.

Fixed rate loans offer predictability and protection against interest rate increases, while variable rate loans may offer lower initial rates but carry the risk of rising payments in the future.

Secured loan vs. unsecured loan

Secured boat loans require collateral, such as the boat itself, which the lender can seize if the borrower defaults.

Unsecured boat loans do not require collateral, relying solely on the borrower’s creditworthiness, which typically results in higher interest rates.

Secured loans offer lower interest rates but pose the risk of losing the collateral, while unsecured loans don’t require collateral but often come with higher interest rates.

Alternatives to boat loans

Explore alternatives such as personal loans, home equity loans, or peer to peer lending platforms if traditional boat loans are not suitable for your financing needs.

Home equity loans or lines of credit

Consider utilizing a home equity loan or line of credit, leveraging the equity in your home to finance your boat purchase, potentially offering lower interest rates and tax-deductible interest payments.

However, remember that defaulting on a home equity loan puts your home at risk of foreclosure, so proceed with caution and ensure you can comfortably manage the payments. Additionally, compare the terms and interest rates offered by different lenders to find the most favorable option for your situation.

Personal loans

Personal loans are another option for financing a boat purchase, offering flexibility and convenience without requiring collateral. You can use a personal loan from a bank, credit union, or online lender to cover the cost of your boat, but keep in mind that interest rates may be higher compared to secured loans.

Before applying for a personal loan, consider factors such as your credit score, loan terms, and repayment schedule to ensure it aligns with your financial goals and budget. Comparing offers from multiple lenders can help you secure the best terms and rates for your boat financing needs.

Pay cash

Paying cash upfront is a straightforward method for purchasing a boat without the need for financing. It eliminates interest charges and loan terms, providing immediate ownership and full control over the vessel.

However, this option requires significant upfront funds and may limit financial flexibility for other investments or expenses. Additionally, paying cash can be advantageous when negotiating the boat’s purchase price, as sellers often prefer immediate payment.

Also Read: what happens if you crash a financed car with insurance

Compare Boat Loan Offers

When comparing boat loan offers, it is essential to consider factors such as interest rates, loan terms, and repayment options. Look for lenders offering competitive rates and flexible terms that align with your financial goals and budget.

Additionally, pay attention to any additional fees or charges, such as origination fees or prepayment penalties, which can affect the overall cost of the loan. Comparing multiple loan offers allows you to find the best option that suits your needs and ensures you get the most value for your investment in the long run.

Frequently asked questions

What is the oldest boat a bank will finance?

Banks may finance boats that are 10 to 25 years old, depending on the lender’s policies and additional criteria. However, older boats may come with shorter loan terms to mitigate the lender’s risk.

Why are boat loans so expensive?

Boat loans tend to be more expensive because boats are considered non-essential assets compared to houses or cars. This higher risk for the lender results in higher interest rates for boat loans.

Will a bank finance a 20-year old boat?

While it’s possible to finance a 20-year-old boat, lenders may offer shorter loan terms to protect their interests in the asset. The exact terms will vary depending on the lender’s policies and your financial situation.

Can you finance a boat for 30 years

Typically, boat loans have terms ranging from a few years to 10 to 20 years. However, it’s uncommon to find financing for boats with terms extending up to 30 years due to the depreciation and risk associated with such long loan periods.

What credit score is needed to buy a boat?

The credit score needed to buy a boat can vary depending on the lender and the type of boat you’re purchasing. Generally, a higher credit score, ideally above 700, increases your chances of securing favorable loan terms and lower interest rates.

How old of a boat will a bank finance?

Banks may finance boats that are several decades old, but the loan terms offered could be shorter compared to newer boats. The age limit for financing varies among lenders and may depend on factors like the boat’s condition and value retention.

Summary

Boat financing terms can vary widely depending on factors like the lender’s policies, your creditworthiness, and the type of boat you’re purchasing. Generally, boat loans can have terms ranging from a few years to as long as 10 to 20 years. However, it is rare to find financing options extending up to 30 years due to the depreciation and inherent risks associated with such lengthy loan periods.

The length of the boat loan term ultimately depends on your financial situation and preferences. While shorter loan terms may result in higher monthly payments, they can help you pay off the loan faster and reduce the total interest paid over time.

Conversely, longer loan terms may offer more manageable monthly payments but may result in higher overall interest costs. It is essential to carefully consider your budget, the boat’s depreciation rate, and your long-term financial goals when determining the ideal loan term for your boat purchase.