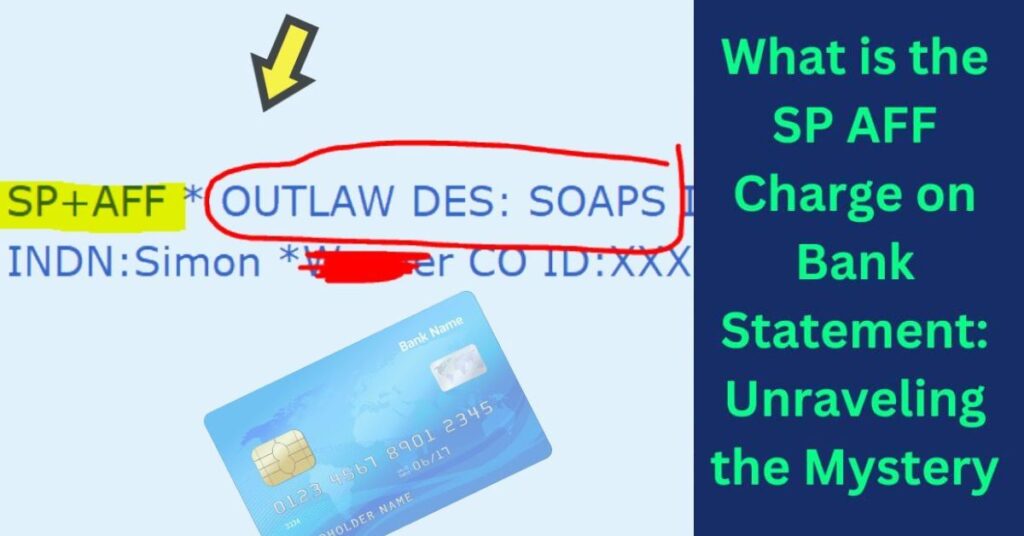

SP AFF charge on the bank statement means service provider Affirm, indicating a transaction made through Affirm’s Buy Now Pay Later service. This is a legitimate payment method, not a scam, usually used for flexible and convenient purchases.

Want to know about the mysterious SPAFF charge on your bank statement, Do not panic, this is only a prompt for transactions made using Affirm’s Buy Now Pay Later service, which is a legal payment method for flexible purchases. this is a legitimate service that is typically used to spread payments over time. Let’s unravel the SP AFF mystery and ease your financial worries.

What Does AFF Mean On Bank Statement?

On a bank statement AFF typically stands for Affiliate. This signifies that the transaction or charge is associated with a subscription or membership service through an affiliate or third party website. It is a straight forward indication of the origin of the charge in your financial records.

What Is This Charge For?

This charge, often labeled SP AFF, is for transactions made through Affirm’s Buy Now Pay Later service. It allows users to make purchases and pay over time, providing flexibility in managing expenses. The charge reflects payments or purchases facilitated by this reputable financial service.

Is The SP AFF* Charge A Recurring Charge?

Yes, the SP AFF charge is recurring, appearing on your bank statement regularly. This indicates that you are enrolled in Affirm’s Buy Now Pay Later service, and the charge recurs according to the agreed upon frequency. If you wish to stop these recurring charges, consider canceling your subscription or membership.

Can I Get A Refund For The SP AFF Charge?

Whether you can get a refund for the SP AFF charge depends on the company’s policy. Reach out to the company directly, inquire about their refund policy, and provide details about the charge. Some companies may offer refunds within a specific timeframe, while others may have different policies.

What Does Sp Aff* Stand For?

Sp AFF stands for “Service Provider Affirm, indicating a transaction made through Affirm’s Buy Now Pay Later service. It’s a straightforward notation on your bank statement reflecting the use of this financial service for your purchase.

What Is Affirm?

Affirm is a financial technology company offering a Buy Now Pay Later service, allowing users to make purchases and pay over time. It provides flexible repayment options and is commonly integrated into online retailers’ checkout processes. Affirm aims to make shopping more accessible by breaking down payments into manageable installments.

Why Would You See An Sp Aff Charge?

You would see an SP AFF charge on your bank statement when you have used Affirm’s Buy Now Pay Later service for a purchase. It indicates that you’ve opted for flexible payments and is associated with various categories like online shopping, electronics, travel bookings, and more. The SP AFF charge serves as a reminder of your choice for financial flexibility with Affirm.

How Does SP AFF Appear On Bank Statements?

The SP AFF charge appears on bank statements as a specific line item, typically starting with “SP AFF*,” followed by the name of the merchant where the purchase occurred. This notation helps users identify transactions made through Affirm’s Buy Now Pay Later service. For example, SP AFF AMAZON” indicates a purchase made at Amazon using Affirm, simplifying the process of tracking and understanding expenditures.

Within the bank statement, the SP AFF entry not only provides the merchant’s name but also includes the specific details of the transaction. This may encompass the type of purchase made, such as electronics or fashion items, offering users a comprehensive overview of their spending. The clarity in transaction details ensures users can easily recognize and manage their expenses associated with Affirm’s flexible payment service.

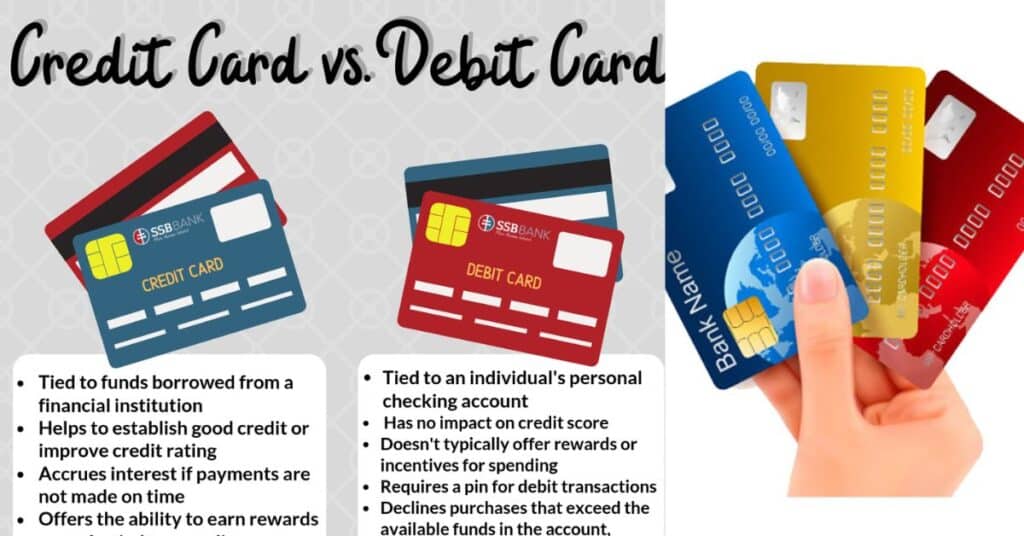

Sp+Aff Charge On Debit Card And Credit Card

Whether on a debit or credit card statement, the SP AFF* charge remains consistent in its representation of transactions made through Affirm. This notation appears as a clear identifier, usually starting with “SP AFF*, followed by the merchant’s name. It signifies a payment method widely used for its flexibility and accessibility, allowing users to make purchases and manage payments over time.

Regardless of the card type, the SP AFF charge ensures transparency in financial records, making it easy for users to track their spending. Whether it is a debit or credit card transaction, the appearance of SP AFF* simplifies the identification of Affirm related purchases, fostering clarity in financial management.

Users can confidently navigate their statements, recognizing the notation as a legitimate representation of transactions facilitated through Affirm’s Buy Now Pay Later service.

How Do I Cancel My Subscription Or Membership?

To cancel your subscription or membership associated with the SP AFF* charge, first identify the company by searching its name followed by “SP AFF” online. Once identified, follow the specific cancellation process outlined by the company.

This may involve logging into your account on their website or contacting their customer service for assistance. Be mindful of any cancellation deadlines mentioned in the terms and conditions to prevent further charges.

What If I Don’t Remember Signing Up For This Subscription Or Membership?

If you do not recall signing up for the subscription or membership linked to the SP AFF charge, contact the company directly for clarification. They can provide information about the transaction and assist in canceling the subscription if necessary.

Prompt communication with the company helps address any potential misunderstandings or unauthorized charges on your account. Stay proactive in resolving such situations for a hassle free financial experience.

Why Is AFF Important?

AFF is crucial on a bank statement as it indicates transactions associated with third party subscriptions or memberships. This notation offers clarity, allowing users to discern the nature of charges and manage their financial records more effectively. Understanding the significance of AFF promotes informed financial decision-making and ensures accurate tracking of expenditures.

Frequently Asked Question ?

What Does SP Mean On Bank Transaction?

On a bank transaction, “SP” typically stands for “Settlement Processed,” indicating the completion of the transaction and successful fund transfer between banks. It signifies that the payment has been settled with the merchant or vendor.

Do Banks Refund Scammed Money?

Banks may refund scammed money based on their policies and the circumstances of the fraud. It is essential to report the scam promptly to your bank, providing details for them to investigate and determine if a refund is applicable.

Can The Bank Find Out Who Used My Debit Card?

Yes, banks can often trace unauthorized debit card transactions by investigating transaction records, security footage, and other means. Reporting any suspicious activity promptly to your bank increases the likelihood of identifying the culprit.

Can A Scammer Be Traced?

Tracing scammers can be challenging, but law enforcement agencies and cybersecurity experts use various methods to track and apprehend them. Reporting scams to the relevant authorities increases the chances of identifying and prosecuting the perpetrators.

Why Would I See An SP AFF Charge On My Statement?

The charge appears when you use Affirm for purchases, indicating payments made through their Buy Now Pay Later service.

How To Avoid Credit Card Fraud

To avoid credit card fraud, regularly monitor your statements for unauthorized transactions and report any suspicious activity to your bank promptly. Safeguard your card details, refrain from sharing sensitive information online, and consider using secure payment methods.

Summary

The SP AFF charge on bank statements, deciphered as “Service Provider Affirm, indicates transactions facilitated through Affirm’s Buy Now Pay Later (BNPL) service. It is not a scam but a legitimate representation of payments made using Affirm’s flexible financial service. Affirm allows users to make purchases and pay over time, offering a convenient alternative to traditional payment methods.

Affirm is a reputable financial technology company, and the SP AFF charge reflects the user’s choice to manage payments through their BNPL service. It is a transparent and secure method commonly used for various purchases, from electronics to travel bookings.

Understanding that the SP AFF charge is a legitimate aspect of financial transactions with Affirm ensures clarity and confidence in navigating modern payment options.