Permanent life insurance is a type of insurance policy that provides coverage for your entire life, as long as you continue to pay the premiums. Unlike term life insurance, which covers you for a specific period, permanent life insurance remains in effect as long as the premiums are paid.

Permanent life insurance includes a death benefit, which is the amount paid to your beneficiaries upon your death. Additionally, it has a cash value component that grows over time. This cash value can be accessed through withdrawals or policy loans and can serve as a source of funds for emergencies or other financial needs.

Permanent life insurance offers lifelong coverage and typically has fixed premiums. It combines a life insurance policy with an investment component, allowing the cash value to accumulate over time. This cash value can be used by the policyholder during their lifetime, providing both protection and a financial asset.

How Does Permanent Life Insurance Work?

Permanent life insurance works by providing coverage for your entire life as long as you continue paying the premiums. It includes a death benefit that is paid to your beneficiaries when you pass away, ensuring financial security for your loved ones.

Additionally, permanent life insurance has a cash value component that grows over time. This cash value accumulates based on a portion of your premium payments and earns interest on a tax-deferred basis. You can access this cash value through policy loans or withdrawals, providing you with a financial resource during your lifetime.

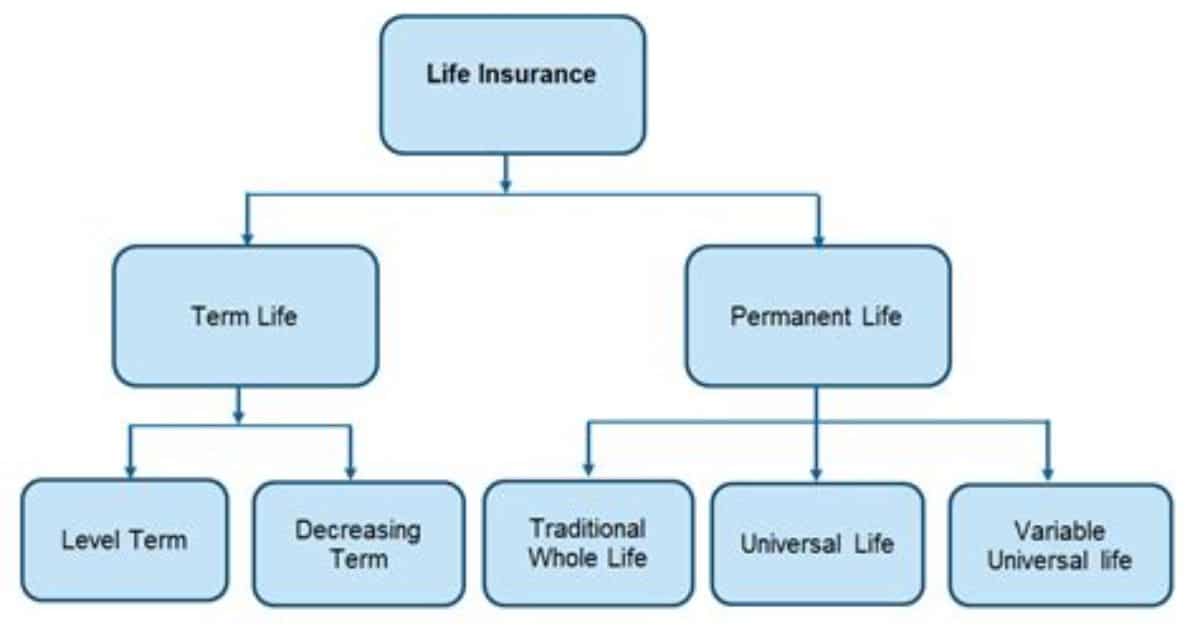

Types of Permanent Life Insurance

There are three main types of permanent life insurance:

Whole Life Insurance:

Whole life insurance is a type of permanent life insurance that offers coverage for your entire life, with fixed premiums and a guaranteed death benefit. It also accumulates cash value over time, providing a savings component that you can access.

Universal Life Insurance:

Universal life insurance is another form of permanent life insurance that offers flexibility in premium payments and death benefits. The cash value component grows based on current interest rates set by the insurer, giving you potential for growth.

Variable Life Insurance:

Variable life insurance is a permanent life insurance policy that allows you to invest the cash value in various sub-accounts, similar to mutual funds. The cash value and death benefit can fluctuate based on the performance of these investments.

Indexed Universal Life Insurance:

Indexed universal life insurance combines elements of universal life insurance with investment options tied to stock market indexes. This allows for potential growth of cash value based on market performance while providing a death benefit.

Guaranteed Universal Life Insurance:

Guaranteed universal life insurance is a type of permanent life insurance that offers a guaranteed death benefit with flexible premium payments. It provides lifetime coverage and a cash value component, making it a stable option for long-term financial planning.

Benefits of Permanent Life Insurance

Permanent life insurance offers several key benefits that make it an attractive option for many policyholders:

Lifelong Coverage:

Permanent life insurance ensures coverage for your entire life, providing financial protection for your loved ones regardless of when you pass away, offering peace of mind and security.

Cash Value Accumulation:

Permanent life insurance policies accumulate cash value over time, which can be accessed through withdrawals or loans, serving as a tax-deferred savings component for emergencies or financial needs.

Fixed Premiums:

Permanent life insurance typically comes with fixed premiums that do not increase with age, allowing you to budget and plan for consistent payments throughout the policy’s duration.

Estate Planning and Legacy:

Permanent life insurance can be a valuable tool for estate planning, offering tax benefits and ensuring your beneficiaries receive a tax free death benefit, which can help offset estate taxes and leave a financial legacy.

Also Read: Ally Life Insurance: Is This No-Frills Policy Right for You?

Drawbacks of Permanent Life Insurance

Higher Premiums: Permanent life insurance policies generally have higher premiums compared to term life insurance due to the lifelong coverage and cash value component.

Lower Death Benefit for the Premium: The death benefit relative to the premium paid might be lower in permanent life insurance compared to term life insurance with the same premium.

Fees and Expenses: Permanent life insurance policies often come with various fees and expenses, such as administrative fees and cost of insurance fees, which can reduce the policy’s returns.

More Expensive Upfront Costs: While permanent life insurance offers lifelong coverage and cash value growth, it typically comes with higher initial costs compared to term insurance.

Who Needs Permanent Life Insurance?

Permanent life insurance is suitable for individuals seeking lifelong coverage and financial protection for their loved ones regardless of age. Young families with children often opt for permanent life insurance to ensure continuous financial support if the breadwinner passes away unexpectedly.

High net worth individuals also find permanent life insurance beneficial for estate planning, as the tax-free death benefit can help offset estate taxes when passing on an inheritance to beneficiaries.

Permanent Life Insurance Riders

These are additional benefits that policyholders can add to their permanent life insurance policies for added protection and flexibility.

Accidental Death Rider:

Provides an extra death benefit if the insured dies due to an accident, offering financial security beyond the base policy.

Disability Rider:

Allows policyholders to waive premiums if they become totally disabled, ensuring the policy remains active during difficult times.

Chronic Illness Rider:

Enables early access to a portion of the death benefit if the insured is diagnosed with a chronic illness, providing financial support for medical expenses.

Ally Permanent Life Insurance Options

Ally offers several options for permanent life insurance to meet various financial needs and goals:

Whole Life Insurance:

- Lifetime coverage with fixed premiums.

- Builds cash value over time on a tax-deferred basis.

- Guaranteed death benefit and potential dividends.

Universal Life Insurance:

- Permanent coverage with flexible premiums.

- Option to adjust coverage and premiums based on changing needs.

- Cash value growth based on current interest rates.

Variable Life Insurance:

- Lifetime coverage with investment options for cash value.

- Offers potential for higher returns but carries investment risk.

- Premiums can vary based on performance of underlying investments.

Ally’s diverse range of permanent life insurance options allows policyholders to choose a plan that aligns with their financial objectives and risk tolerance.

Also Read: aeonscope Insights: Navigating the World of Business Intelligence

Getting a Quote for Ally Permanent Life

Getting a quote for Ally Permanent Life Insurance is a straightforward process that can be completed online:

Visit Ally’s life insurance website and click “Get a Quote.

- Provide basic personal information like name, date of birth, and contact details.

- Choose the type of life insurance you want a quote for, such as whole life or universal life.

- Answer health-related questions accurately to receive an accurate quote.

Review your personalized quote generated by Ally in minutes.

- Refine the quote by adjusting coverage amount, policy length, or adding riders.

- Compare pricing and coverage options before making a decision.

- Proceed to formal application and payment submission if satisfied with the quote.

Obtaining a quote for Ally Permanent Life Insurance is a simple and efficient process that allows individuals to explore different coverage options and make an informed decision.

Applying for Ally Permanent Life Insurance

Complete an application online or through an Ally insurance agent.

- Provide personal and health information accurately.

- Authorize access to medical records for underwriting purposes.

- Schedule any required medical exams if necessary.

Underwriting process:

- An underwriter reviews your health history, medical records, and exam results.

- Your premium amount is determined based on your risk class.

- An approval decision is made regarding your coverage eligibility and pricing.

Receive your policy:

- If approved, you receive a policy reflecting your specific risk class and coverage details.

- Premium payments are set based on the approved policy terms.

- You gain access to the benefits and features of your Ally Permanent Life Insurance policy.

Applying for Ally Permanent Life Insurance involves providing accurate information, undergoing underwriting evaluation, and receiving approval for coverage based on your risk profile.

Choose the best life insurance for you

Choosing the best life insurance policy depends on your individual needs and financial goals. Consider these factors:

Financial Stability: Evaluate your current financial situation and determine the coverage amount that would adequately protect your loved ones in case of your untimely death.

Budget: Determine how much you can comfortably afford to pay in premiums. Compare quotes from different insurers to find a policy that fits within your budget.

Coverage Length: Decide whether you need coverage for a specific period (term life insurance) or for your entire life (permanent life insurance).

Health Status: Your health condition may impact the type of policy you qualify for and the premiums you’ll pay. Consider getting quotes from insurers that offer policies suitable for your health status.

Ultimately, the best life insurance policy is one that provides adequate coverage, fits within your budget, and aligns with your long term financial goals. It’s essential to review and compare multiple options before making a decision.

Frequently asked question

What does permanent life insurance include?

Permanent life insurance includes a death benefit paid to beneficiaries upon the insured’s death and a cash value component that grows over time, which policyholders can access during their lifetime.

What is a disadvantage of permanent life insurance?

A disadvantage of permanent life insurance is its higher cost compared to term life insurance, along with potentially lower returns on investment within the policy’s cash value component.

What is the permanent death benefit?

The permanent death benefit is the guaranteed amount paid to beneficiaries upon the insured’s death, providing financial security and support to loved ones.

Who needs permanent life insurance?

Individuals who need lifelong coverage, want to leave an inheritance, or have dependents requiring ongoing financial support often opt for permanent life insurance.

can you withdraw from permanent life insurance

Yes, you can withdraw funds from the cash value of a permanent life insurance policy through loans or withdrawals, though it may impact the death benefit and policy performance.

What happens if you cancel a permanent life insurance policy?

If you cancel a permanent life insurance policy, you may forfeit your premium payments, and the amount you receive, if any, depends on the policy type and accumulated cash value.

can you cancel permanent life insurance

Yes, you can cancel a permanent life insurance policy, but it’s essential to understand the potential consequences, such as losing coverage and any accumulated cash value.

summary

Ally Permanent Life Insurance provides lifelong coverage as long as premiums are paid, offering a death benefit to beneficiaries and a cash value component that grows over time. Unlike term life insurance, it remains in effect throughout your life, providing financial security and serving as a financial asset with potential for growth.

To apply for Ally Permanent Life Insurance, you can complete an online application or consult with an Ally insurance agent. The application process involves providing personal and health information, authorizing access to medical records, and undergoing underwriting evaluation. Upon approval, you’ll receive a policy tailored to your risk profile, providing lifelong coverage and access to the cash value component.