Ever wondered about the earning potential of a Finance Manager at a dealership? Finance Managers play a crucial role in the automotive industry, handling financing and insurance for vehicle purchases. Their salaries can vary based on several factors, including location, experience, and the dealership’s size. Let’s explore how much a Finance Manager at a dealership can expect to make.

Finance Managers at dealerships typically earn between $80,000 and $150,000 per year, depending on their experience and the dealership’s location and size.

However, top performers and those in high-cost-of-living areas can earn significantly more, with some Finance Managers earning upwards of $200,000 or more annually. It’s important to note that these figures are estimates and actual salaries can vary based on individual circumstances and market conditions.

Understanding the Role of a Finance Manager at a Dealership

At a dealership, the Finance Manager plays a vital role in the vehicle purchasing process. They are responsible for arranging financing options for customers, assisting them in securing loans or leases, and explaining financing terms and conditions in a clear and understandable manner.

Additionally, Finance Managers offer various insurance products to protect the customer’s investment, such as extended warranties and gap insurance. They work closely with customers to ensure they understand their financial obligations and make informed decisions that meet their needs and budget.

Factors Influencing Finance Manager Salaries

Location: Finance Manager salaries can vary significantly based on the geographical location of the dealership. Cities with higher costs of living generally offer higher salaries to attract talent, while salaries may be lower in rural areas.

Experience: The level of experience a Finance Manager brings to the role often correlates with their salary. Those with more years of experience and a proven track record of success may command higher salaries than those who are newer to the role.

Dealership Size: The size of the dealership can also impact Finance Manager salaries. Larger dealerships with higher sales volumes and larger finance departments may offer higher salaries to their managers compared to smaller dealerships with fewer resources.

Also Read: how many days does a dealership have to find financing

Salary Range for Finance Managers at Dealerships

Finance Managers at dealerships typically earn competitive salaries, influenced by various factors such as location, experience, and dealership size.

Average Salary: The average salary for Finance Managers in the automotive industry ranges from $100,000 to $200,000 per year. However, top performers or those in high-demand locations may earn significantly more.

Location Impact: Salaries can vary based on the region. In metropolitan areas with a high cost of living, such as New York City or San Francisco, Finance Managers may earn salaries upwards of $250,000 or more. In contrast, salaries in smaller cities or rural areas may fall within the lower end of the range.

Experience and Performance: Experienced Finance Managers with a proven track record of success often command higher salaries. Additionally, performance-based incentives such as bonuses or commissions can significantly augment their earnings.

Job Outlook and Future Trends

The job outlook for Finance Managers at dealerships is projected to remain favorable in the coming years, with steady demand expected due to the ongoing need for automotive financing expertise.

Technological Advancements: With advancements in technology, Finance Managers are likely to see changes in their roles, including increased use of digital tools for loan processing and customer interactions.

Evolving Responsibilities: As consumer preferences shift and regulatory requirements evolve, Finance Managers may need to adapt by acquiring new skills and staying updated on industry trends to remain competitive in the marketplace.

Tips for Maximizing Earnings as a Finance Manager

Leverage Product Knowledge: Deep understanding of finance and insurance products allows for effective upselling, contributing to higher commissions.

Focus on Customer Relationships: Building trust and rapport with clients fosters loyalty, increasing the likelihood of repeat business and referrals.

Stay Updated on Industry Trends: Keeping abreast of market changes and regulatory updates enables you to offer relevant and competitive solutions to customers.

Optimize Sales Techniques: Enhancing sales skills through continuous training and refinement helps capitalize on opportunities and maximize revenue.

Track Performance Metrics: Monitoring key performance indicators allows for targeted improvement efforts, leading to enhanced productivity and earnings.

F&I Manager Pay plans and Commission

Manager Pay plans and Commission F&I

- Dealerships typically use pay plans outlining sales goals for F&I Managers to determine commission rates.

- For instance, an F&I Manager might earn a 12% commission if they achieve a 50% product penetration rate, meaning they sell at least half of the products they offer.

Qualifications and Hiring Process:

- When evaluating F&I job applicants, dealerships consider their track record in the industry, F&I training, and job stability.

- Factors such as past success, certification, and job tenure influence a dealership’s decision to hire an F&I Manager.

F&I Manager Salary Is On The Rise

F&I Manager Salary Is On The Rise

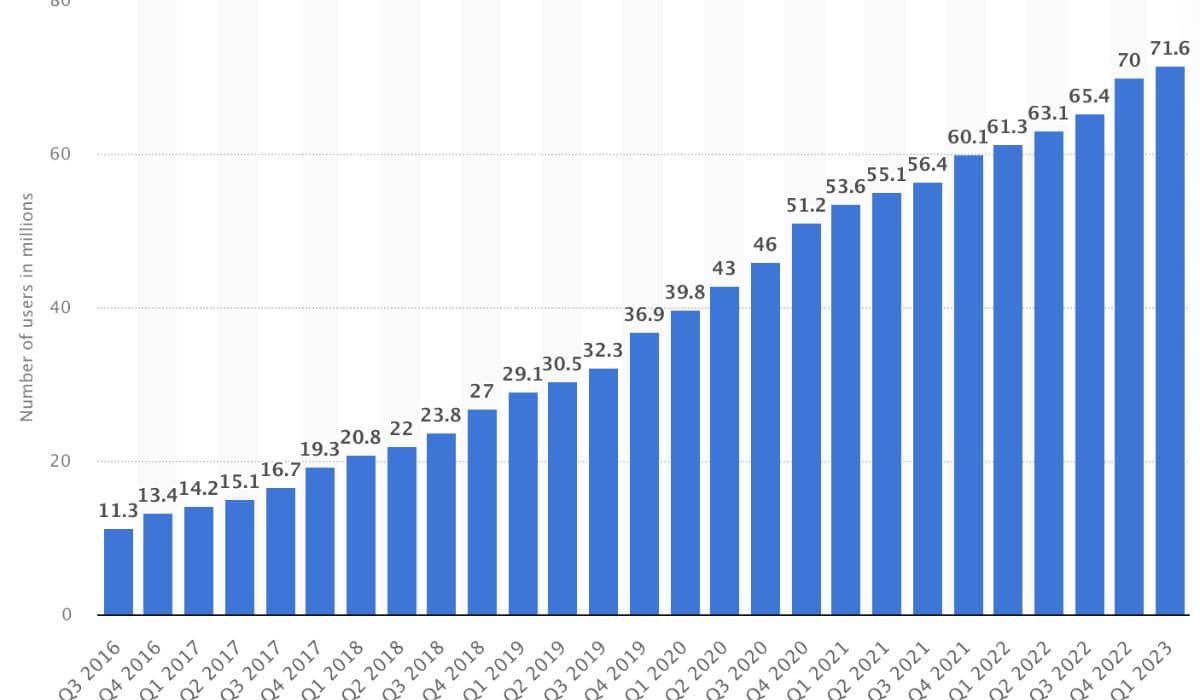

- Recent surveys highlight a significant upward trend in F&I Manager salaries, reflecting a growing demand for skilled professionals in the automotive industry.

- From 2016 to 2023, there has been a notable increase in average F&I Manager income, indicating a positive trajectory for compensation in this field.

Factors Driving Salary Growth:

- Contributing to this surge are factors such as increased product penetration rates and a rise in dealership profitability, leading to higher commissions and bonuses for F&I Managers.

- Additionally, ongoing developments in automotive finance and insurance products have expanded revenue opportunities, further bolstering F&I Manager earnings.

F&I Income Poll

According to recent polls conducted by industry organizations, F&I Managers are reporting substantial incomes, with a majority earning over $100,000 annually. These polls reveal that approximately 54% of surveyed F&I Managers earn more than $100,000 per year, showcasing the lucrative nature of the role.

Furthermore, nearly 20% of F&I Managers surveyed boast annual incomes exceeding $151,000, indicating the potential for high earnings in this profession. The survey also highlights that F&I Directors, the next level up from F&I Managers, enjoy even higher incomes, with over 58% reporting average earnings surpassing $151,000 per year.

How much do AutoNation F&I Managers Make?

For F&I Managers at AutoNation, one of the largest car dealer groups in the nation, the average annual salary is approximately $113,427 according to data from PayScale.

This figure provides insights into the earning potential for F&I Managers at AutoNation, although it is essential to note that these estimates may vary based on factors such as experience, location, and additional bonuses.

It is worth considering that salary calculations at AutoNation may not always include extra perks like company cars, 401k matching, and other incentives offered by some dealerships.

F&I Manager Hours

They often work long hours, typically spanning 10 hours a day, and are frequently required to work weekends.

While some states may enforce dealership closures on Sundays, many dealerships operate seven days a week.

What is an example of an F&I Manager schedule?

An example of an F&I Manager schedule could be as follows:

Sunday: Off

Monday: 9am to 8pm

Tuesday: 9am to 8pm

Wednesday: 9am to 6pm

Thursday: Off

Friday: 9am to 6pm

Saturday: 9am to 6pm

Finance Manager Training: Salaries for F&I Managers in 2023

In 2023, the salaries for F&I Managers witnessed a significant rise, reflecting the growing demand and importance of their role in the automotive industry.

According to Finance Manager Training, the average estimated salary of an F&I Manager in the United States surged from around $61,000 in the mid-2000s to over $150,000 in 2023.

This notable increase in income signifies the financial rewards awaiting F&I Managers, with a substantial portion earning well above $100,000 annually, further solidifying the attractiveness of this career path.

Also Read: how long can you finance a side by side

Finance Manager Training & Salaries in 2024

In 2024, Finance Manager Training continues to play a pivotal role in preparing professionals for lucrative careers in the automotive industry.

Salaries for finance managers in 2024 vary based on factors such as location, experience, and the specific dealership. However, elite finance managers have the potential to earn up to $250,000 per year, showcasing the significant earning potential in this field.

Finance Manager Training equips individuals with the necessary skills and knowledge to excel in finance management roles, contributing to their success and the overall growth of the automotive industry.

Summary

Finance managers at dealerships are often among the highest-paid employees in the automotive industry, with salaries averaging over $100,000 per year.

Earnings can vary based on factors like location, experience, and dealership size, with top performers potentially earning up to $250,000 annually. Overall, the role of a finance manager offers significant earning potential and lucrative opportunities within the automotive sector.

Frequently asked question

How much does a finance manager make at a car dealership in Missouri?

The salary for a finance manager at a car dealership in Missouri typically ranges from $99,900 to $163,200, with variations based on factors like experience and dealership size.

What does a finance manager do at a dealership?

At a dealership, a finance manager helps customers secure financing for vehicle purchases, collaborates with lending agencies, and educates buyers on aftermarket options and warranties.

is it hard to be an F&I manager?

Becoming an F&I manager requires strong organizational skills and the ability to handle multiple deals simultaneously, making it challenging but rewarding for those who excel in paperwork and customer service.

How do dealers make money from finance?

Dealerships profit from finance by offering in-house financing with marked-up interest rates, enabling them to earn additional revenue from the interest paid by customers.