CIMB credit card holders often face confusion and frustration when trying to cancel their cards. The process can seem overwhelming with multiple cancellation methods, required documentation, and concerns about impact on credit scores.

Without proper guidance, cardholders risk incomplete cancellation, lingering subscriptions, or unexpected fees. This comprehensive guide walks you through the exact steps to cancel your CIMB credit card properly.

From preparation checklist to post-cancellation confirmation, we cover every detail to ensure a smooth cancellation process. Follow these proven methods to close your CIMB credit card account efficiently and avoid common pitfalls.

Before You Cancel: Essential Preparations

Before canceling your CIMB credit card, take a few important steps to protect yourself. First, check your current card balance and look for any pending charges. Write down all automatic payments linked to your card. Make sure you have another payment method ready for your regular bills. Having all this information ready will make the cancellation process much smoother.

Understanding Your Current Credit Card Status

Log into your CIMB online banking account or check your latest statement. Note down your exact balance as of today (October 24, 2024). Look for any recent purchases that haven’t appeared yet. Check when your next bill payment is due. Having these details ready will help you avoid any missed payments during cancellation.

Pre-Cancellation Checklist

Follow these key steps before cancellation:

- Pay off your entire card balance

- Download your last 3 months of statements

- Take screenshots of any reward points

- List all automatic payments

- Have your ID and card number ready This checklist ensures you won’t face any issues later.

Automatic Payments and Subscriptions Review

Look through your recent statements to find all recurring payments. Common ones include streaming services, gym memberships, and utility bills. Contact each company to update your payment method. Some may require you to fill out forms or provide new card details. Complete this process before canceling your CIMB card.

Official Methods to Cancel CIMB Credit Card

The quickest way to cancel your CIMB credit card is by contacting their customer service hotline for assistance.

Method 1: Cancellation via Phone

Call CIMB at +65 6333 6666 during business hours. Have your card number and ID ready. Tell the representative you want to cancel your credit card. They will ask about your reason for canceling. Answer their questions clearly. Write down the cancellation reference number they give you.

Method 2: Email Cancellation Process

Send your cancellation request to sg.cardcenter@cimb.com. Include your full name, card number, and reason for canceling. Attach a copy of your ID. CIMB will reply within 3-5 business days. Keep this email as proof of your cancellation request.

Method 3: Branch Visit and Form Submission

Visit any CIMB branch with your ID and credit card. Ask for a card cancellation form. Fill it out completely. Submit it to the bank officer. Get a copy of the form with a received stamp. This method gives you immediate confirmation of your request.

Required Documentation

Prepare these basic documents for CIMB credit card cancellation:

- Valid government-issued ID

- Most recent credit card statement

- Completed cancellation form

- Proof of address (less than 3 months old) Keep digital copies of everything you submit.

Essential Documents Checklist

For Singapore residents (as of October 2024):

- NRIC or passport

- Latest utility bill

- Recent credit card statement

- Signed cancellation request letter For foreigners, include employment pass or work permit.

Identity Verification Requirements

CIMB requires current photo identification. Singapore citizens must show NRIC. Permanent residents need their PR card. Foreigners must provide passport and valid visa. All IDs must be unexpired. Bank staff will verify your signature against bank records.

Supporting Documents

Additional papers you might need:

- Death certificate (for deceased cardholders)

- Power of attorney (if acting for someone)

- Company authorization letter (for corporate cards)

- Bankruptcy discharge papers (if applicable)

During the Cancellation Process

The bank reviews your documents and checks for pending transactions. They confirm your rewards points balance. You’ll get updates via SMS or email. Most cancellations take 5-7 working days. Keep using your backup payment methods during this time.

Common Issues and Solutions

Common problems include:

- Missing documents (bring extras)

- Pending transactions (wait for clearance)

- Linked subscriptions (cancel first)

- Outstanding balance (pay in full) Contact customer service immediately if you face these issues.

Processing Time

Standard processing takes 5-7 working days. Emergency cancellations happen within 24 hours. International cardholders might wait up to 14 days. Final confirmation comes by mail or email. Keep checking your online banking during this period.

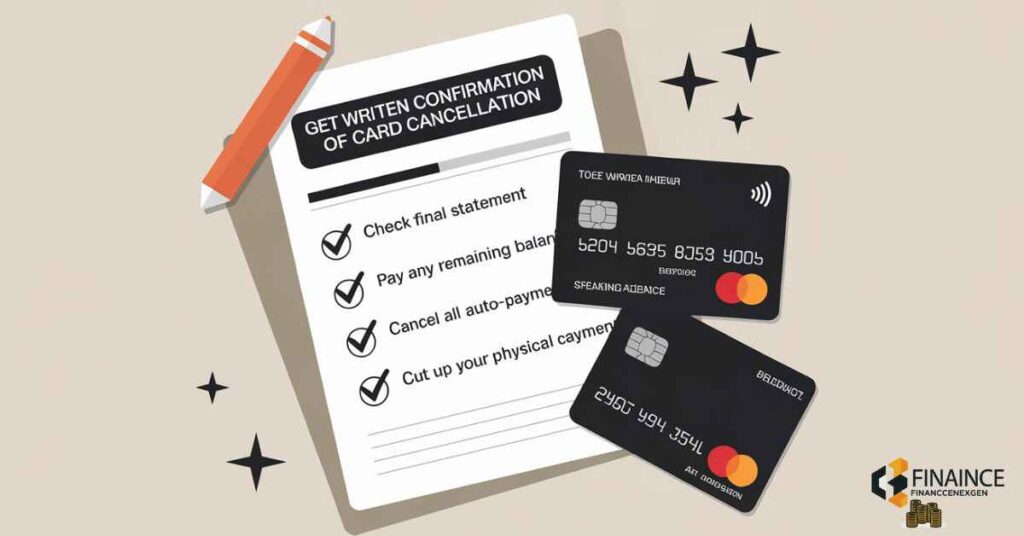

Post-Cancellation Steps

After cancellation approval:

- Get written confirmation

- Check final statement

- Pay any remaining balance

- Cancel all auto-payments

- Cut up your physical card

Final Statement Settlement

Your last statement arrives within 30 days. It shows any final charges or credits. Pay the full amount immediately. Keep this statement for your records. Call CIMB if you notice any errors.

Disposal of Physical Card

Cut your card into small pieces. Destroy the chip and magnetic strip. Cut through the card number. Dispose of pieces in different trash bins. Never throw away a whole credit card.

Impact of Cancellation

Canceling your CIMB credit card affects several areas of your banking. Your credit utilization ratio will change. Any automatic payments will stop. Your rewards points have a 30-day expiry deadline. Consider these impacts before canceling to avoid surprises.

Effect on Credit Score

Canceling a credit card can lower your credit score temporarily. This happens because your total credit limit decreases. The impact is usually small if you have other active credit cards. Your score should recover within 3-6 months if you maintain good payment habits.

Rewards Points and Benefits

| Reward Type | Expiry After Cancellation |

| Points | 30 days |

| Cashback | Next statement |

| Miles | 14 days |

| Discounts | Immediate |

Use or transfer your rewards before canceling. They expire after the periods shown above.

Future Banking Relationship

Canceling your credit card doesn’t affect other CIMB accounts. Your savings, investments, and loans stay active. You can apply for a new CIMB credit card after 6 months. Keep your online banking access for other services.

Read This Blog: Who Pays Health Insurance While on Long-Term Disability?

Alternative Options

If you’re not ready to cancel your CIMB credit card, downgrading to a card with fewer benefits and lower fees is a flexible alternative.

Card Downgrade Options

Instead of canceling, consider switching to a basic CIMB card. This keeps your credit history intact. Basic cards have lower fees and simpler rewards. The bank can transfer your credit limit to the new card.

Balance Transfer Possibilities

Transfer your balance to another bank’s card before canceling. Most banks offer 0% interest for 6-12 months. Submit balance transfer applications early. Wait for transfer confirmation before canceling your CIMB card.

Other CIMB Credit Card Options

CIMB offers several alternatives (as of October 2024):

- CIMB Basic Card (no annual fee)

- CIMB Rewards Card (lower points rate)

- CIMB Zero Card (no rewards, no fees) Ask about switching to these options.

Also Read: The Complete Guide to Wdroyo Insurance TCNEVS: Everything You Need to Know in 2024

Special Situations

If you’re overseas, CIMB offers a specific cancellation process that can be completed remotely through customer service or online channels.

Overseas Cancellation Process

Cancel from overseas through these methods:

- Email to sg.cardcenter@cimb.com

- International collect call to +65 6333 6666

- Online banking secure message Include clear scans of your ID and signed cancellation letter.

Emergency Cancellation

For urgent cancellations (lost card, fraud):

- Call emergency hotline 24/7

- Block card immediately

- Submit cancellation documents within 7 days The bank processes emergency requests within 24 hours.

Supplementary Card Cancellation

Main cardholders can cancel supplementary cards anytime. Supplementary cardholders need main cardholder’s approval. All supplementary cards cancel automatically if you cancel the main card. Submit separate forms for each supplementary card.

FAQ

Can I cancel my CIMB credit card online?

No, CIMB doesn’t offer online cancellation. Use phone, email, or branch visit methods.

What happens to my rewards points after cancellation?

Points expire in 30 days after cancellation. Redeem or transfer them before canceling.

How long does the cancellation process take?

Standard processing takes 5-7 working days. Emergency cancellations complete within 24 hours.

Can I reopen a cancelled CIMB credit card?

No, you cannot reopen a cancelled card. Apply for a new card after 6 months.

Will cancellation affect my credit score?

Yes, temporarily. Your score may drop slightly but recovers in 3-6 months.

What happens to pending transactions after cancellation?

They will appear on your final statement. You must pay all pending charges.

Can I cancel if I still have an outstanding balance?

No, clear all balances before cancellation approval.

Are there any cancellation fees?

No, CIMB doesn’t charge cancellation fees. Pay only outstanding balances.

Conclusion

Canceling your CIMB credit card doesn’t have to be complicated. Follow the proper steps, prepare your documents, and clear any outstanding balances. Remember to handle your rewards points and recurring payments before cancellation. Keep all confirmation documents for future reference.

With this guide, you can confidently complete the cancellation process and maintain your good financial standing.