Snap Finance might just be the solution you have been searching for. It is like having a financial ally in your corner, offering flexible payment options to help you navigate life’s ups and downs with ease.

Snap Finance is not your average lender, it is a game changer. Instead of solely relying on credit scores like traditional institutions, Snap Finance takes a more inclusive approach. By considering factors such as income and banking history, they aim to provide access to financing for individuals who may have been overlooked by other lenders. So, if you’re looking for a hassle free way to finance your needs, Snap Finance could be the answer.

Why Snap Finance Approval Matters

Securing approval from Snap Finance holds substantial importance in your financial journey. It’s the gateway to accessing tailored financing solutions that cater to your specific needs and circumstances, offering a path to financial empowerment.

With Snap Finance approval, you unlock the door to flexible funding options, empowering you to address essential purchases or unexpected expenses with ease. This approval opens up avenues for financial stability and flexibility, allowing you to navigate your financial journey with confidence and convenience.

Understanding Snap Finance

Snap Finance is a modern financial solution that offers flexible payment plans to individuals. It evaluates eligibility based on factors like income and banking history, providing opportunities to those with limited or no credit history.

With Snap Finance, individuals can access funds to fulfill their needs and aspirations, regardless of their credit score. Its inclusive approach ensures that more people have access to financial assistance, promoting financial empowerment and flexibility.

Assessing Eligibility

To increase your approval chances with Snap Finance, assessing your eligibility is key. While credit history isn’t the main factor, understanding the minimum requirements is crucial.

Steady Income: Demonstrating consistent earnings assures lenders of your repayment ability.

Active Bank Account: A stable banking history showcases financial responsibility.

Identification and Age: You must be at least 18 years old with valid ID.

Understanding the minimum requirements helps in planning and preparing for the application process.

Also Read: what happens if you crash a financed car with insurance

Preparing for Application

Preparing for a Snap Finance application is crucial for a smooth process and higher approval chances. Follow these steps to ensure you’re ready:

Gather Necessary Documents: Compile proof of income, bank statements, and IDs beforehand for quick submission.

Check Credit Report: Review it for errors or discrepancies, correcting any issues to present an accurate financial profile.

Assess Financial Picture: Provide detailed information on income, expenses, and existing obligations to showcase your repayment capacity.

Prepare Explanation: If there are past credit problems, offer a clear and concise explanation to demonstrate responsibility and growth.

Stay Organized: Keep all documents and information readily accessible during the application process for easy reference and submission.

The Application Process

Navigating the Snap Finance application process is straightforward when you follow these steps:

- Begin Online: Visit the Snap Finance website and fill out the application accurately and honestly.

- Submit Required Documents: Along with the application, provide necessary documents like pay stubs and IDs promptly.

- Respond Promptly: Be ready to reply to any additional requests for information from Snap Finance.

- Wait for Review: The application and documents undergo a thorough review process by Snap Finance.

- Be Patient: It may take a few business days for Snap Finance to reach a decision.

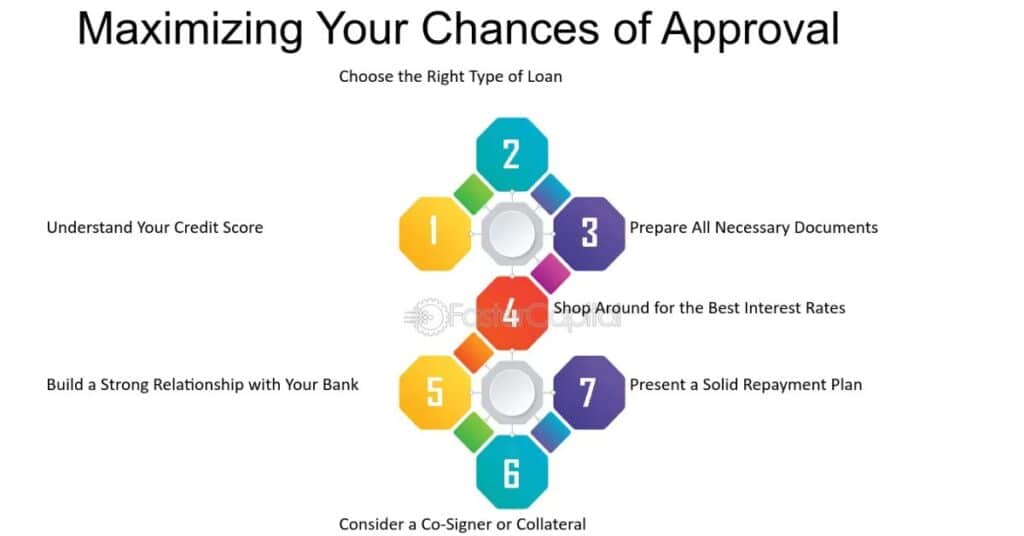

Maximizing Approval Chances

Maximizing your approval chances with Snap Finance involves strategic actions that showcase your financial stability and responsibility:

- Strengthen Income: Consider increasing your earnings temporarily to demonstrate higher repayment capacity.

- Manage Debts Wisely: Focus on paying off outstanding debts, especially high-interest ones, to improve your overall financial standing.

- Build Positive Banking History: Maintain a healthy banking relationship by avoiding overdrafts and responsibly managing your accounts.

- Communicate Effectively: Respond promptly to any requests for additional information from Snap Finance to show your commitment and reliability.

How Does Snap! Finance Work?

Finance operates as an accessible financing solution for individuals without established credit histories. Here’s a simplified breakdown of how it works:

Eligibility Criteria: To qualify, you must be 18 years or older, have an active checking account, and earn a steady income of at least $750 per month.

Application Process:

· Apply Online: Submit your application, which typically takes just minutes.

·Approval Decision: Receive an instant decision on your application status.

· Funding: If approved, access funds instantly, often up to $5,000.

Payment Method: Use the provided card number for purchases at participating retailers.

Repayment: Repay the loan in installments over an agreed-upon period, as outlined during the application process.

Snap Finance’s streamlined process and flexibility make it an accessible option for those in need of financing without the stringent credit requirements of traditional lenders.

Also Read: what is a lean in finance

Conclusion

To secure approval from Snap Finance, focus on meeting their eligibility criteria and presenting a clear financial picture during the application process. Firstly, ensure you’re at least 18 years old, possess an active checking account, and have a consistent income of $750 per month or more. Gather all necessary documentation, including proof of income, bank statements, and identification, to streamline the application process.

Review your credit report for any discrepancies and provide a compelling explanation for any past credit issues. Secondly, during the application, be accurate and transparent about your financial situation, including income, expenses, and existing debts. Snap Finance looks beyond traditional credit scores and assesses your ability to repay based on income and banking history.

Respond promptly to any requests for additional information and maintain open communication throughout the process. By demonstrating financial responsibility, providing thorough documentation, and communicating effectively, you can enhance your chances of approval with Snap Finance.

Frequently asked question

how to get approved for snap finance in Texas

To get approved for Snap Finance in Texas, you need to be 18 or older, have an active checking account, and earn a steady income of $750 or more monthly. Apply online, submit required documents, and await an instant decision.

how to get approved for snap finance online

To get approved for Snap Finance online, follow the same eligibility criteria regardless of your location. Apply through their website, provide necessary documents, and await an instant decision on your application status.

Does snap finance run a credit check?

Snap Finance does not conduct traditional credit checks but may review other financial information to assess eligibility, making it accessible for those with less-than-perfect credit histories.

Does snap Finance accept bad credit?

Snap Finance accepts applicants with varying credit backgrounds, making it possible to be approved even with bad credit.

Does snap Finance lend money?

Snap Finance provides financing rather than lending money directly, allowing eligible applicants access to funds for purchases.

Does snap finance check your bank account?

Snap Finance may check your bank account as part of their evaluation process to verify income and financial stability.