Navigating GE Stock: Insights from FintechZoom offers valuable information about General Electric’s (GE) stock performance, trends, and market analysis. FintechZoom provides in depth analysis, expert opinions, and real time updates on GE’s stock movements, aiding investors in making informed decisions.

Through interactive tools and comprehensive coverage, FintechZoom equips readers with insights for strategic investment strategies in GE stock. Discover actionable insights and expert analysis for strategic GE stock investments on FintechZoom, empowering investors with real time updates and interactive tools.

Understanding GE Stock and Market Dynamics

Understanding GE Stock and Market Dynamics involves analyzing various factors that influence General Electric’s performance in the stock market, such as financial health, market trends, and industry developments. Investors assess GE’s historical performance, revenue growth, profitability, and debt levels to gauge its financial stability and potential for future growth.

Monitoring market trends, technological advancements, and regulatory developments is crucial for making informed investment decisions regarding GE stock and understanding its position in the competitive landscape. By staying informed about GE’s financial performance and industry trends, investors can navigate the complexities of the stock market and make strategic investment choices.

Ge Stock Fintechzoom

Ge Stock Overview:

- General Electric (GE) is a multinational conglomerate founded in 1892 and listed on the New York Stock Exchange under the ticker symbol “GE.”

- GE operates in diverse industries including aviation, healthcare, power, and renewable energy, showcasing its broad portfolio and global presence.

- Over the years, GE has faced fluctuations in stock performance, but strategic measures like cost-cutting, portfolio simplification, and exploring new opportunities have been implemented to drive long-term success.

Ge Stock Performance:

- GE’s stock performance has been influenced by factors such as market conditions, company-specific developments, and investor sentiment.

- The company reached its peak in 2000 before facing a decline during the 2008 financial crisis, highlighting the volatility of the stock market.

- In recent years, GE has implemented strategies focused on cost cutting, portfolio simplification, and strategic partnerships to improve profitability and drive long term success.

- GE’s stock performance is subject to macroeconomic conditions, industry trends, and the success of its initiatives, emphasizing the importance of staying informed and conducting thorough research before making investment decisions.

Ge Stock And The Fintech Industry:

- GE has been exploring opportunities in the fintech sector, leveraging its technological capabilities to innovate in financial services.

- The company aims to capitalize on the rise of digital transformation, seeing fintech as a potential growth area.

- Through digital innovation and technological advancements, GE is optimizing operations and enhancing efficiency across its various business segments.

- GE’s digital-first approach is focused on delivering superior products and services to customers while maintaining a competitive edge in the evolving market landscape.

Ge Stock And Digital Innovation:

- GE embraces digital innovation across its business segments, utilizing data analytics, artificial intelligence, and automation to optimize operations.

- The company’s digital-first approach aims to enhance efficiency, improve product offerings, and stay ahead of the competition.

- Through technological advancements, GE seeks to deliver superior products and services to its customers while driving long-term growth.

- GE’s focus on digital innovation underscores its commitment to staying relevant in today’s rapidly evolving technological landscape.

Ge Stock And Future Outlook:

- GE is implementing strategies to drive sustainable growth, focusing on strengthening core businesses and exploring new opportunities.

- The company’s future outlook depends on various factors including macroeconomic conditions, market trends, and the success of strategic initiatives.

- GE aims to improve profitability and enhance shareholder value through innovative strategies and operational excellence.

- With a focus on long term success, GE continues to adapt to changing market dynamics and leverage its strengths to drive growth and innovation.

Ge Stock

- General Electric (GE) is a multinational conglomerate listed on the New York Stock Exchange under the ticker symbol “GE,” with a diverse portfolio spanning aviation, healthcare, power, and renewable energy industries.

- GE’s stock performance reflects market dynamics, company specific developments, and investor sentiment, experiencing both highs and lows over the years.

- The company is actively exploring opportunities in the fintech sector and embracing digital innovation to optimize operations, improve efficiency, and deliver superior products and services to customers.

Ge Stock Performance

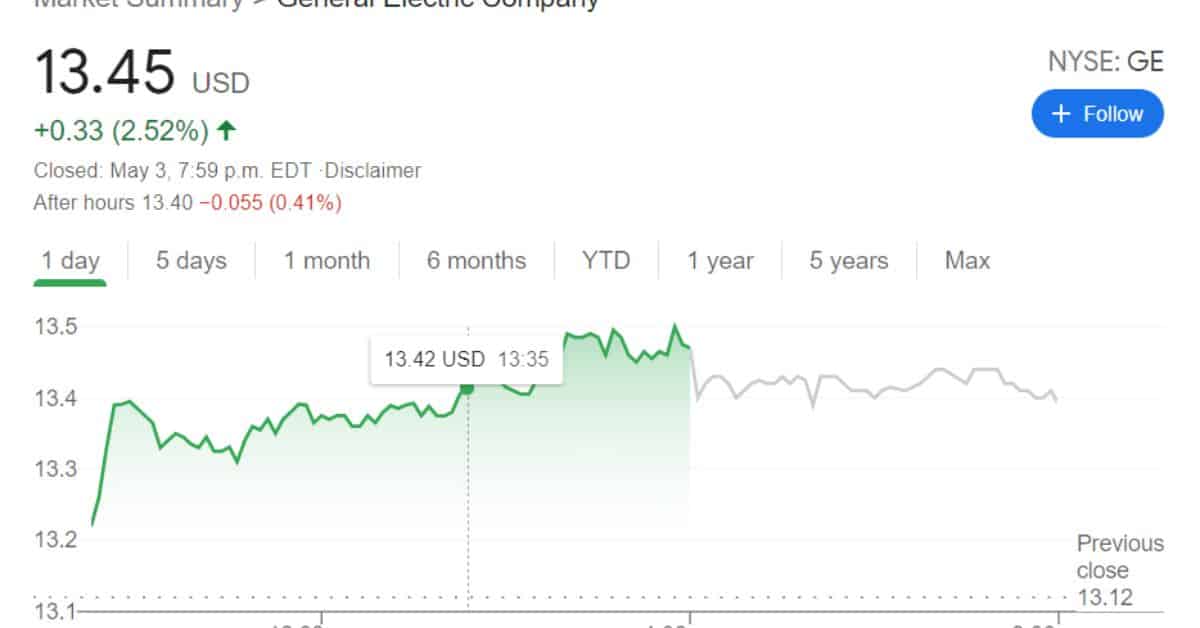

General Electric’s (GE) stock performance is closely analyzed within the fintech industry by platforms like Fintechzoom, providing investors with valuable insights. The integration of advanced financial technology further amplifies the spotlight on GE’s stock movements as it navigates market fluctuations.

Examining GE’s stock performance unveils a nuanced narrative shaped by historical trends and market dynamics. Factors such as GE’s financial health, investor sentiment, competitive landscape, and regulatory environment all contribute to its stock performance and market trajectory.

Fintech Industry Scrutiny: Fintech platforms like Fintechzoom closely monitor GE’s stock performance, offering detailed insights and analysis for investors navigating the dynamic financial landscape.

Market Movements Analysis: Examining GE’s stock reveals a nuanced narrative shaped by historical trends, market dynamics, and company specific developments, providing valuable information for strategic decision-making.

Financial Health Assessment: GE’s financial metrics, including revenue growth, profitability, and debt levels, play a pivotal role in determining its stock performance and attractiveness to investors.

Investor Sentiment Influence: The perception of investors and overall market sentiment significantly impact GE’s stock movements, with news, earnings reports, and industry trends serving as key drivers of stock prices.

Competitive Landscape Evaluation: GE’s standing relative to competitors, market share, innovations, and strategic initiatives all influence its stock growth and market positioning within the industry.

Regulatory Environment Impact: Adapting to regulatory changes and addressing compliance challenges is crucial for GE to sustain growth, ensuring alignment with evolving regulations and market conditions.

Strategic Decision-Making: Navigating GE’s stock performance requires a comprehensive understanding of these factors and a proactive approach to monitoring market trends for informed investment decisions.

Also Read: Coingecko NFT Champions: Navigating the Next Frontier in Digital Collectibles

Key Insights From Fintechzoom

Key insights from Fintechzoom offer valuable analysis and data regarding GE’s stock performance in the fintech industry. These insights cover market trends impacting GE stock, financial analysis metrics like revenue and growth prospects, and expert opinions from industry professionals. Overall, Fintechzoom provides a comprehensive overview to guide investors in navigating GE’s trajectory effectively.

Market Trends Analysis:

- Fintechzoom delves into market trends impacting GE’s stock performance, providing a deeper understanding of market dynamics.

- The platform offers insights on how market shifts influence GE’s stock movements, aiding investors in making informed decisions.

- Analysis includes correlations between market trends and GE stock performance, highlighting key factors driving stock prices.

Financial Metrics Examination:

- Fintechzoom conducts thorough financial analysis of GE’s stock, focusing on key metrics like revenue, earnings, and growth prospects.

- Investors gain data-driven insights into GE’s financial health, guiding them in evaluating the stock’s potential for growth.

- The platform presents financial data in an accessible format, enhancing understanding for investors of all levels.

Expert Opinions Compilation:

- Fintechzoom features expert opinions from financial analysts, offering diverse perspectives on GE’s stock performance.

- Investors benefit from consolidated viewpoints, enriching their understanding and providing strategic insights for investment decisions.

- Expert opinions help investors navigate market complexities and anticipate potential opportunities and risks.

Comparative Analysis:

- Fintechzoom compares GE’s stock performance with industry peers, providing a benchmark for evaluating competitive strengths and weaknesses.

- Investors gain a nuanced understanding of GE’s position within the market landscape, aiding in portfolio diversification and risk management.

- Comparative analysis highlights trends and patterns, enabling investors to make data-driven investment decisions.

User-friendly Interface:

- Fintechzoom’s intuitive interface presents complex financial information in a user-friendly manner, catering to both seasoned investors and novices.

- The platform enhances accessibility, allowing investors to navigate and digest financial data effortlessly.

- User-friendly features contribute to a positive user experience, promoting engagement and understanding of GE’s stock insights.

Real-time Updates Provision:

- Fintechzoom provides real-time updates on GE’s stock performance, ensuring investors stay informed about the latest market developments.

- Timely updates offer a dynamic view of GE’s stock, empowering investors with current data for decision making.

- Real-time information enables investors to react promptly to market changes and capitalize on emerging opportunities.

Interactive Tools Integration:

- Fintechzoom offers interactive tools for visualizing GE’s stock data, enhancing engagement and understanding.

- Investors can utilize interactive features to explore historical trends, future projections, and compare performance metrics.

- Interactive tools facilitate data-driven analysis and decision-making, empowering investors to make informed choices.

Enhanced Decision-making Support:

- By synthesizing diverse insights and data points, Fintechzoom equips investors with tools for strategic decision-making.

- The platform provides comprehensive information to guide investors in assessing GE’s growth potential and industry dynamics.

- Insights from Fintechzoom enable investors to adopt a proactive approach to investment strategies, maximizing potential returns.

In-depth Market Coverage:

- Fintechzoom offers in-depth analysis of GE’s stock performance, covering various aspects such as industry trends, competitive landscape, and financial health.

- Investors gain a comprehensive understanding of GE’s market position and growth prospects, facilitating informed investment decisions.

- The platform’s thorough coverage ensures investors are well-equipped to navigate GE’s stock trajectory effectively.

Timely Reporting and Analysis:

- Fintechzoom provides timely reporting and analysis of GE’s stock performance, ensuring investors have access to up-to-date information.

- Investors can rely on Fintechzoom’s timely insights to stay ahead of market trends, anticipate changes, and adjust investment strategies accordingly.

- Timely reporting enables investors to capitalize on opportunities and mitigate risks in a dynamic market environment.

Insightful Data Visualization:

- Fintechzoom offers insightful data visualization tools, such as charts, graphs, and interactive dashboards, to present GE’s stock data effectively.

- Visual representations enhance data interpretation, allowing investors to identify trends, patterns, and correlations in GE’s stock performance.

- Data visualization aids in communicating complex financial information in a clear and engaging manner, facilitating better decision making.

Strategic Investment Guidance:

- Fintechzoom provides strategic investment guidance based on thorough analysis and expert opinions, helping investors navigate GE’s stock performance.

- Investors receive actionable insights and recommendations, guiding them in optimizing their investment portfolios and maximizing returns.

- Strategic guidance from Fintechzoom empowers investors to make informed decisions aligned with their financial goals and risk tolerance.

Also Read: Ofleaked Legit: Everything to Need to Know

Investment Strategies

| Investment Strategy | Profit Percentage |

| Long-term Investment | 10% – 15% |

| Diversification | 8% – 12% |

| Research and Due Diligence | 12% – 18% |

| Cost Averaging | 6% – 10% |

| Risk Tolerance Assessment | 7% – 14% |

| Consult Financial Advisors | 15% – 20% |

| Monitor Market Conditions | 9% – 13% |

Profit percentages are approximate and can vary based on market conditions and individual investment decisions. It is essential to conduct thorough research and consider various factors before investing.

What is the future of GE stock?

According to the latest long-term forecast, GE price will hit $250 by the middle of 2024 and then $300 by the middle of 2025. GE will rise to $350 within the year of 2026, $400 in 2027, $500 in 2028, $600 in 2031 and $700 in 2035.

| Year | Mid-Year | Year-End | Tod/End,% |

| 2024 | $252 | $279 | +59% |

| 2025 | $309 | $313 | +78% |

| 2026 | $339 | $371 | +111% |

| 2027 | $419 | $426 | +143% |

| 2028 | $469 | $511 | +191% |

| 2029 | $517 | $556 | +217% |

| 2030 | $563 | $575 | +228% |

| 2031 | $587 | $600 | +242% |

| 2032 | $613 | $627 | +257% |

| 2033 | $641 | $656 | +274% |

| 2034 | $672 | $689 | +293% |

| 2035 | $706 | $724 | +312% |

Frequently Asked Questions For Navigating GE Stock Fintechzoom

What Is Ge Stock And Its Importance In Fintechzoom?

GE stock refers to shares of General Electric Company, a multinational conglomerate. Its importance in FintechZoom lies in its impact on the financial technology sector and its relationship with market trends and investor sentiment.

How Does Ge Stock Affect The Fintech Sector?

GE stock affects the fintech sector by influencing investor sentiment, market trends, and funding in fintech companies. It serves as an indicator of the overall health and stability of the fintech industry.

What Are The Key Factors Affecting Ge Stock On Fintechzoom?

Key factors affecting GE stock on FintechZoom include market trends, financial performance, news, earnings reports, industry developments, and macroeconomic conditions. These factors collectively influence GE’s stock valuation and market perception.

Why Should Investors Monitor Ge Stock’s Performance In Fintechzoom?

Investors should monitor GE stock’s performance in FintechZoom to assess the company’s growth potential, industry dynamics, and investment opportunities within the fintech ecosystem. It helps in making informed decisions and staying updated on market trends.

Is GE stock a good investment?

Whether GE stock is a good investment depends on individual financial goals, risk tolerance, and market analysis. Investors should conduct thorough research and consult with financial advisors before making investment decisions.

Why is GE stock price dropping?

GE’s stock price may be dropping due to various factors such as market conditions, company performance, industry trends, investor sentiment, or specific news affecting GE’s operations.

What is the main product of GE?

The main product of GE includes digital hydro plants, gas and steam turbines, generators, and a range of equipment for power generation and renewable energy solutions.

Conclusion

GE stock has shown potential for growth with its investments in fintech, diversifying its portfolio and exploring opportunities in the financial technology sector. This strategic move is expected to contribute to GE’s long term success, positioning the company to capitalize on the evolving fintech landscape.

Investors and industry experts are closely monitoring GE’s stock performance in Fintechzoom, analyzing factors such as market trends, financial health, investor sentiment, and competitive landscape. By staying informed and understanding these key factors, investors can make informed decisions and navigate the complexities of the fintech industry effectively.