As a trailblazer in the streaming realm, Netflix has carved out a dominant position through its ever-evolving business model and adaptability to the dynamic entertainment landscape. Despite intense competition, the company has managed to maintain a substantial subscriber base by investing heavily in captivating original content, differentiating itself from rivals.

Investors keen on staying abreast of Netflix’s stock performance and financial insights turn to FintechZoom, a cutting-edge platform that provides real-time data, expert analyses, and market predictions. FintechZoom’s comprehensive coverage encompasses in-depth financial analysis, up-to-the-minute stock prices, and invaluable insights into stock movements, earnings reports, and industry trends affecting Netflix shares.

With streaming services rapidly expanding their global footprint, Netflix’s stock remains a topic of intense interest in the fintech world. Platforms like FintechZoom have emerged as indispensable resources, empowering investors with the tools and knowledge necessary to make informed investment decisions and devise strategic financial planning for their Netflix holdings.

Netflix’s Roller Coaster On Wall Street

Netflix’s journey on Wall Street has been nothing short of a rollercoaster ride. Since its initial public offering (IPO) in 2002, the streaming giant’s stock (NFLX) has experienced both meteoric highs and precipitous lows, leaving investors on the edge of their seats. As we delve into 2024, the company’s stock performance remains a captivating topic for market analysts and investors alike.

A Tale Of Highs And Lows

In its early days, Netflix’s disruptive business model and innovative approach to movie rentals propelled its stock to unprecedented heights. However, the company’s journey has been marked by challenges, including intense competition from rivals like Amazon Prime Video, Disney+, and Hulu, as well as concerns over content costs and subscriber growth.

The stock reached its all-time high in 2021, fueled by the surge in streaming demand during the COVID-19 pandemic. However, the subsequent years have been a mixed bag, with Netflix’s stock experiencing significant volatility as the company navigated changing consumer behaviors, content saturation, and global economic headwinds.

Recent Performance Snapshot

As of May 2024, Netflix’s stock price hovers around $350, reflecting a relatively stable performance in the face of mounting competition and macroeconomic uncertainties. The company’s Q2 2024 earnings report, released in July, showcased resilient revenue growth and a slight uptick in subscriber numbers, providing a much-needed boost to investor confidence.

Keys To Understanding Netflix Stock Movements

To navigate the complex world of Netflix’s stock, investors must stay attuned to a multitude of factors that can influence its price movements. These include:

Market Trends And Their Impact

The streaming industry is highly sensitive to market trends, consumer behavior, and competitor moves. Industry news, regulatory changes, and technological advancements can significantly impact Netflix’s stock performance. For instance, the rise of ad-supported streaming models and the ongoing battle for content exclusivity have prompted shifts in investor sentiment.

Key Financial Metrics For Shareholders

As with any publicly traded company, Netflix’s financial health is closely scrutinized by shareholders. Key metrics such as revenue growth, earnings per share (EPS), debt-to-equity ratio, and subscriber growth are closely monitored to gauge the company’s financial stability and future prospects.

Fintechzoom: Your Ally In Market Analysis

In the ever-evolving world of stock trading, having access to real-time data, expert analysis, and market insights is crucial. This is where Fintechzoom comes into play, offering investors a comprehensive platform to navigate the complexities of the stock market, including Netflix’s stock.

How Fintechzoom Guides Investors

Fintechzoom empowers investors with a wealth of tools and resources to make informed decisions about their investments, particularly when it comes to Netflix’s stock. From real-time market data and stock screeners to in-depth analysis and forecasts, Fintechzoom provides a comprehensive suite of features to help investors stay ahead of the curve.

Tools And Resources For Stock Analysis

One of the standout features of Fintechzoom is its advanced stock analysis tools. Investors can access detailed charts, historical data, and financial metrics for Netflix and its competitors, enabling them to spot trends, identify potential entry and exit points, and make data-driven investment decisions.

Reading The Market Signals

Fintechzoom’s platform also excels in interpreting market signals, a crucial aspect of successful stock trading. By analyzing factors such as trading volume, price movements, and technical indicators, Fintechzoom empowers investors to make well-informed decisions about when to buy, sell, or hold their Netflix shares.

Interpreting Buy, Sell, And Hold Signals

Fintechzoom’s algorithms and expert analysts continuously monitor the market, providing investors with clear buy, sell, and hold signals for Netflix’s stock. These signals are based on a comprehensive analysis of market trends, company fundamentals, and investor sentiment, enabling investors to act swiftly and capitalize on opportunities or mitigate potential losses.

The Role Of Analyst Ratings

Analyst ratings play a crucial role in shaping investor confidence and stock popularity. Fintechzoom aggregates ratings from leading financial analysts, providing investors with a holistic view of the market’s sentiment towards Netflix. These ratings, combined with Fintechzoom’s own analysis, offer investors a comprehensive perspective on the stock’s potential performance.

Behind The Scenes Of Stock Trading

While Fintechzoom equips investors with powerful tools and insights, understanding the psychology and dynamics of stock trading is equally important. The stock market is not just about numbers and charts; it’s a complex interplay of human behavior, emotion, and market forces.

The Psychology Of Trading

Fear and greed are two powerful emotions that can significantly influence trading decisions. Fintechzoom’s platform offers educational resources and expert guidance to help investors navigate the psychological aspects of trading, enabling them to make rational and informed decisions, even in the face of market volatility.

Institutional Investors Vs. Retail Traders

The stock market is a battleground where institutional investors, with their vast resources and deep pockets, often have a significant advantage over retail traders. However, Fintechzoom levels the playing field by providing retail investors with the same level of data, analysis, and insights as their institutional counterparts, empowering them to make informed decisions and potentially reap substantial rewards.

Netflix’s Strategy And Market Position

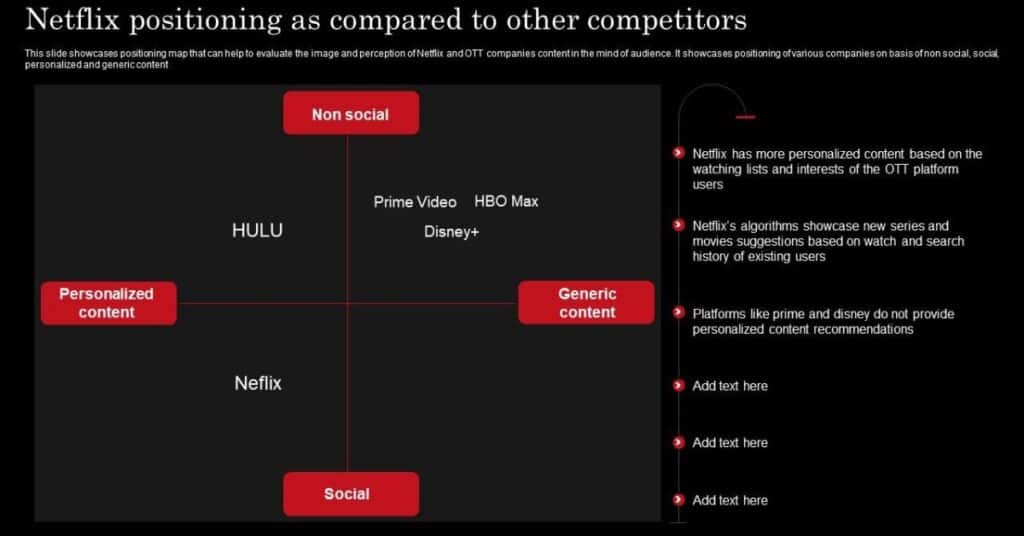

Understanding Netflix’s strategy and market position is crucial for investors seeking to make informed decisions about the company’s stock. Despite facing fierce competition from industry giants like Disney+, Amazon Prime Video, and Hulu, Netflix has managed to maintain its dominance in the streaming realm through a combination of innovative content strategies, strategic partnerships, and global expansion.

Competitive Landscape In Streaming

The streaming industry is a highly competitive and rapidly evolving space. Netflix’s ability to adapt to changing consumer preferences, embrace new technologies, and differentiate its offerings has been a key factor in its success. The company’s focus on producing high-quality original content, such as hit shows like “Stranger Things” and critically acclaimed films like “The Irishman,” has helped it maintain a loyal subscriber base and attract new viewers.

Netflix’s Content And Subscriber Growth

Content is the lifeblood of Netflix’s business model, and the company has consistently invested heavily in acquiring and producing compelling content to fuel subscriber growth. In 2024, Netflix announced ambitious plans to expand its content library, partnering with renowned creators and exploring new genres and formats to cater to diverse audiences worldwide.

Making Sense Of Fintechzoom Data

While Fintechzoom provides a wealth of data and analysis, making sense of this information and translating it into actionable investment decisions can be a daunting task. Fortunately, Fintechzoom offers a range of tools and resources to help investors navigate the complexities of the data.

Leveraging Data For Investment Decisions

Fintechzoom’s platform allows investors to customize their data views, create personalized watchlists, and set alerts for specific stock movements or news events related to Netflix. Additionally, Fintechzoom’s sentiment analysis tools provide valuable insights into market sentiment, helping investors gauge the overall mood towards Netflix’s stock and make informed decisions accordingly.

Case Studies: Successful Trades And Warnings

To illustrate the power of Fintechzoom’s platform, the company regularly publishes case studies showcasing successful trades and timely warnings. These case studies not only highlight the platform’s capabilities but also serve as valuable learning resources for investors, allowing them to gain insights into real-world trading scenarios and strategies.

Also Read This Blog

Future Projections And Market Speculation

As we look ahead, the future of Netflix’s stock remains a topic of intense speculation and debate among market analysts and investors. While the company’s dominance in the streaming industry is undeniable, it faces several challenges and uncertainties that could shape its stock performance in the coming years.

Investor Sentiment And Future Outlook

Investor sentiment plays a crucial role in determining a stock’s future performance, and Netflix is no exception. Positive sentiment, fueled by factors such as strong subscriber growth, successful content launches, and favorable market conditions, could drive the stock higher. Conversely, negative sentiment, stemming from concerns over competition, content saturation, or macroeconomic headwinds, could lead to a decline in stock price.

Emerging Trends And Netflix’s Adaptability

The streaming industry is constantly evolving, with new trends and technologies emerging at a rapid pace. Netflix’s ability to adapt and stay ahead of these trends will be a key determinant of its long-term success. For instance, the rise of interactive and immersive streaming experiences, as well as the integration of artificial intelligence and machine learning into content recommendation systems, could present both opportunities and challenges for the company.

Global Growth Opportunities

As the world becomes increasingly interconnected, Netflix’s ability to expand its global footprint will be crucial for sustaining long-term growth. The company has already made significant strides in this regard, with its content available in over 190 countries and a growing emphasis on producing localized content that resonates with diverse audiences worldwide.

However, navigating the complexities of different markets, cultural nuances, and regulatory environments presents a formidable challenge. Fintechzoom’s platform provides investors with valuable insights into Netflix’s global expansion strategies, market penetration, and potential growth opportunities in emerging markets.

Competitive Challenges

While Netflix has maintained its dominance in the streaming industry, the competitive landscape is constantly evolving. Established players like Disney+, Amazon Prime Video, and Hulu continue to invest heavily in content and technology, while new entrants with deep pockets and innovative business models threaten to disrupt the status quo.

Moreover, the rise of ad-supported streaming models and the ongoing battle for content exclusivity have added another layer of complexity to the industry. Fintechzoom’s competitive analysis tools enable investors to stay abreast of these developments, monitor Netflix’s competitive positioning, and assess the potential impact on the company’s stock performance.

Investor Sentiment And Market Speculation

Investor sentiment plays a pivotal role in shaping stock performance, and Netflix is no exception. Positive sentiment, driven by factors such as strong subscriber growth, successful content launches, and favorable market conditions, can propel the stock higher. Conversely, negative sentiment, stemming from concerns over competition, content saturation, or macroeconomic headwinds, can lead to a decline in stock price.

Fintechzoom’s sentiment analysis tools provide investors with a comprehensive view of the market’s sentiment towards Netflix, enabling them to make informed decisions based on real-time data and expert analysis.

The Way Forward: Adapting To Change

As the streaming industry continues to evolve rapidly, Netflix’s ability to adapt and stay ahead of emerging trends will be crucial for its long-term success. The company’s willingness to embrace new technologies, experiment with innovative content formats, and cater to changing consumer preferences will play a pivotal role in shaping its future stock performance.

Investors who stay informed, leverage the power of Fintechzoom’s platform, and remain agile in their investment strategies will be well-positioned to navigate the complexities of the Netflix stock and capitalize on the opportunities that arise in this dynamic industry.

Conclusion

The article delves into the rollercoaster journey of Netflix’s stock, exploring its highs and lows, recent performance snapshots, and keys to understanding market trends impacting its movements.

It highlights FintechZoom as an indispensable ally, offering real-time data, expert analysis, and tools for interpreting buy/sell signals and navigating the market’s complexities. The article examines Netflix’s strategies, competitive landscape, content and subscriber growth, and the psychology behind stock trading.

Leveraging FintechZoom’s data and case studies, it provides insights into making informed investment decisions while speculating on future projections and trends shaping Netflix’s adaptability.

In summary, the article provides a comprehensive overview of Netflix’s stock performance, the factors influencing its movements, and the role of FintechZoom in guiding investment decisions through data-driven insights and analysis.