FintechZoom simplifies credit card selection with a curated list for diverse spending needs. Their guide empowers informed choices, highlighting key benefits and transparent comparisons.

As tech savvy spenders seek smarter financial management, FintechZoom’s recommendations optimize strategies for maximizing rewards, reducing fees, and securing low interest rates.

Introduction To Fintechzoom

FintechZoom is a trusted platform offering financial news and insights. It simplifies complex financial concepts for consumers.

FintechZoom empowers individuals to make informed decisions about their money. It focuses on innovation and consumer empowerment in finance.

The platform provides valuable analysis and recommendations in the finance and technology sectors. It aims to simplify complex financial concepts for better understanding.

Discover Fintechzoom: Your Gateway To Tailored Credit Card Recommendations

Discover FintechZoom, your go-to source for tailored credit card recommendations, simplifies the process of finding the right credit card for your needs. With comprehensive research and analysis, FintechZoom identifies top-tier credit cards that align with your spending habits and financial goals.

By emphasizing key benefits and transparent comparisons, FintechZoom empowers you to make informed decisions about credit cards. Whether you’re looking to maximize rewards, minimize fees, or secure low-interest rates, FintechZoom provides valuable insights to optimize your financial strategies.

Critical Factors For Credit Card Comparison

Annual Fee: Consider the annual cost of owning a credit card, as it varies widely and can impact your overall expenses.

Rewards Program: Evaluate the rewards offered by the credit card, such as cashback, points, or miles, to maximize benefits based on your spending habits.

Interest Rates: Pay attention to the Annual Percentage Rate (APR) charged by the credit card issuer, especially if you plan to carry a balance.

Introductory Offers: Look for cards with attractive introductory offers, such as 0% APR periods or bonus rewards, to take advantage of initial benefits.

Credit Limit: Assess the credit limit offered by the card to ensure it meets your spending needs without affecting your credit utilization ratio negatively.

Additional Benefits: Consider extra perks like travel insurance, purchase protection, and fraud detection services that add value to the credit card.

Personalized Advice, At Your Fingertips

Get personalized financial advice instantly with FintechZoom, covering credit cards, loans, and investment options. Expert insights catered to your specific needs empower you to make informed financial decisions.

Access FintechZoom’s user friendly platform anytime, anywhere, for comprehensive guidance on managing your finances effectively. Simplify your financial journey with personalized recommendations tailored to your unique financial situation.

Innovations In Fintech You Shouldn’t Miss

- Contactless Payments: Revolutionizing transactions with a simple tap or wave, offering convenience, speed, and security.

- Robo-Advisors: Utilizing automated algorithms for personalized investment strategies, providing cost-effective portfolio management.

- Blockchain Technology: Transforming transactions with secure, decentralized digital ledgers, expanding beyond cryptocurrencies.

- Artificial Intelligence (AI) in Banking: Enhancing customer service with AI-powered chatbots and virtual assistants, improving fraud detection.

- Peer-to-Peer (P2P) Lending Platforms: Connecting borrowers and investors online for competitive rates and flexible loan options.

- Digital Identity Verification: Simplifying online identity verification processes, reducing fraud risks and accelerating transactions.

Importance Of Credit Cards

Credit cards play a crucial role in today’s financial landscape by offering convenience, security, and flexibility in managing transactions. They allow individuals to make purchases online, in-store, or internationally without carrying large amounts of cash, enhancing convenience and safety.

Moreover, credit cards provide valuable benefits such as cashback rewards, travel insurance, and purchase protection, adding value to everyday spending. These perks not only save money but also offer peace of mind, especially during unexpected situations like travel mishaps or fraudulent activities.

Additionally, responsible credit card use can help build and improve credit scores, which are essential for obtaining loans, mortgages, or favorable interest rates in the future. By making timely payments and managing credit utilization wisely, individuals can establish a positive credit history and access better financial opportunities.

Why Credit Cards Matter

Credit cards are essential in today’s economy due to their convenience, security, and financial benefits. Here’s why they matter:

- Convenience: Credit cards allow for quick and easy transactions both online and in-store, eliminating the need to carry large amounts of cash.

- Security: Credit cards offer protection against fraud and unauthorized transactions, providing peace of mind to cardholders.

- Financial Benefits: Credit cards often come with rewards programs such as cashback, points, or miles, enabling users to earn rewards on their everyday spending.

- Building Credit: Responsible credit card use can help individuals build and improve their credit scores, which is crucial for accessing loans and favorable interest rates.

- Emergency Use: Credit cards serve as a financial safety net during emergencies, providing immediate access to funds when needed.

In summary, credit cards matter because they offer convenience, security, financial benefits, help build credit, and provide a safety net for emergencies.

Maximizing Financial Flexibility

Maximizing financial flexibility is crucial for managing your finances effectively. Here are some key strategies to achieve this:

Budgeting Wisely: Create a detailed budget to track your income and expenses, allowing you to allocate funds efficiently.

Emergency Fund: Build an emergency savings fund to cover unexpected expenses or financial setbacks without relying on credit.

Debt Management: Prioritize paying off high-interest debts to reduce financial strain and free up funds for other priorities.

Diversify Income: Explore additional sources of income, such as freelancing or passive income streams, to increase financial stability.

Invest Strategically: Consider investing in diversified assets like stocks, bonds, or real estate to grow your wealth over time.

By implementing these strategies, you can enhance your financial flexibility and better navigate various financial situations.

Building A Robust Financial Future

Building a robust financial future is essential for long-term financial stability. Here are some key steps to help you achieve this goal:

Financial Planning: Create a comprehensive financial plan outlining your goals, budget, savings, and investment strategies.

Emergency Fund: Build an emergency savings fund with at least three to six months’ worth of living expenses to cover unexpected costs.

Debt Management: Pay off high interest debts strategically and avoid accumulating new debt whenever possible.

Diversified Investments: Invest in a diversified portfolio of assets, such as stocks, bonds, mutual funds, and real estate, to spread risk and maximize returns.

Continuous Learning: Stay informed about personal finance topics, seek advice from financial experts, and regularly review and adjust your financial plan as needed.

By following these steps and maintaining discipline in your financial habits, you can build a strong foundation for a secure and prosperous financial future.

Criteria For Selecting The Best Credit Cards

When choosing the best credit card, consider factors like the rewards program, annual fees, and interest rates. Look for a rewards program that matches your spending habits to maximize benefits.

Compare annual fees to ensure they are justified by the card’s benefits, and aim for competitive interest rates to save on finance charges. Additionally, take advantage of introductory offers and consider extra benefits like travel insurance and purchase protection.

Credit Card Rewards And Benefits

Credit card rewards and benefits can significantly enhance your financial experience and provide valuable perks. Here’s how they work:

Rewards Programs: Many credit cards offer rewards programs where you earn points, miles, or cashback on your purchases, which can be redeemed for various rewards.

Travel Benefits: Some credit cards provide travel-related benefits such as airline miles, airport lounge access, and travel insurance coverage.

Cashback Offers: Certain cards offer cashback rewards on specific categories like groceries, gas, or dining, allowing you to earn money back on everyday purchases.

Purchase Protection: Credit cards often come with purchase protection benefits, including extended warranties, price protection, and fraud liability protection, offering peace of mind when shopping.

By understanding these credit card rewards and benefits, you can choose a card that aligns with your spending habits and financial goals, maximizing the advantages it offers.

Interest Rates And Fees

Interest rates and fees play a crucial role in determining the cost of using a credit card. Here’s what you need to know about them:

Interest Rates:

- Credit cards typically have variable APRs (Annual Percentage Rates) based on the cardholder’s creditworthiness.

- Higher credit scores may qualify for lower interest rates, while lower scores may lead to higher rates.

- Understanding the APR helps you calculate potential interest charges if you carry a balance month-to-month.

- Some credit cards offer introductory 0% APR periods, providing a temporary reprieve from interest charges.

Fees:

- Credit cards may have annual fees, which can vary widely depending on the card’s benefits and features.

- Common fees include late payment fees, cash advance fees, and foreign transaction fees.

- Being aware of these fees helps you make informed decisions and avoid unnecessary charges.

- Many credit cards waive the annual fee for the first year or offer fee credits as part of their rewards program.

Credit Building Potential

- Using credit cards responsibly by making timely payments can help build a positive credit history.

- A longer credit history with diverse types of credit, including credit cards, can improve credit scores.

- Keeping credit card balances low relative to credit limits demonstrates responsible credit management.

- Regularly checking credit reports and monitoring credit scores can track progress in credit building efforts.

User Experience And Customer Support

User Experience and Customer Support play a crucial role in credit card satisfaction and usability:

Ease of Use: Credit cards with intuitive interfaces and straightforward processes enhance user experience.

Accessibility: Efficient customer support via multiple channels such as phone, email, and chat ensures prompt assistance.

Issue Resolution: Quick resolution of queries, disputes, and concerns contributes to a positive customer experience.

Feedback Mechanism: Credit cards with feedback systems allow users to provide input, leading to continuous improvement in services.

Security Features

Security Features are paramount in credit cards to protect against fraud and unauthorized transactions:

EMV Chip Technology: Cards equipped with EMV chips offer enhanced security by generating unique transaction codes.

Tokenization: Tokenization replaces sensitive card details with tokens, reducing the risk of data breaches.

Fraud Monitoring: Robust fraud monitoring systems detect suspicious activities and alert cardholders promptly.

Zero Liability Policy: Many cards provide a zero liability policy, protecting users from fraudulent charges when reported promptly.

Acceptance And Accessibility

Credit cards offer wide acceptance and accessibility, making them convenient for various transactions:

Accepted Globally: Credit cards are widely accepted at millions of locations worldwide, including online stores and physical establishments.

ATM Access: Most credit cards allow users to withdraw cash from ATMs, providing additional flexibility.

Contactless Payments: Many cards support contactless payments, enabling quick and secure transactions with a simple tap.

Fintechzoom’s Top 10 Credit Card Picks For 2024

FintechZoom’s top 10 credit card picks for 2024 cater to a range of financial needs and lifestyles, ensuring that users can maximize benefits and rewards.

These cards are selected based on factors such as rewards programs, annual fees, interest rates, and introductory offers, providing consumers with valuable options to suit their preferences and spending habits.

Whether it’s travel rewards, cashback benefits, or premium perks, FintechZoom’s recommendations aim to help individuals make informed decisions and optimize their credit card experience in the digital age.

Ultimate Rewards Mastercard

The Ultimate Rewards Mastercard is renowned for its versatile rewards program, allowing cardholders to earn points on various purchases.

Key benefits include cashback rewards on everyday spending, travel perks such as airline credits and hotel discounts, and flexible redemption options for points earned.

Additionally, the card offers robust security features, including fraud protection and zero liability for unauthorized transactions, ensuring peace of mind for users.

Cashback Champion Visa

Cashback Champion Visa is a rewarding credit card option known for its cashback benefits and user-friendly features. It offers various perks that make it appealing to many consumers seeking value from their credit card usage.

- Cashback Rewards: Earn cashback on eligible purchases, providing savings with every transaction.

- User-Friendly Features: Accessible online account management and convenient payment options enhance the cardholder experience.

- Wide Acceptance: Visa’s global network ensures widespread acceptance, making it convenient for both domestic and international transactions.

3.Traveler’s Platinum Card

The Traveler’s Platinum Card is designed for frequent travelers, offering exclusive perks and benefits tailored to enhance the travel experience.

Travel Rewards: Earn points or miles for travel-related purchases, including flights, hotels, and car rentals.

Premium Benefits: Access to airport lounges, travel insurance coverage, and concierge services add value to the cardholder experience.

Global Acceptance: Enjoy worldwide acceptance and convenience with Visa or Mastercard branding, ensuring hassle-free transactions during international travel.

4.Zero-fee Entrepreneur Card

The Zero fee Entrepreneur Card is ideal for business owners, providing essential financial tools without annual fees or hidden charges.

No Annual Fee: Enjoy cost savings with no annual fee, allowing business owners to manage expenses efficiently.

Tailored Rewards: Earn rewards or cashback on business related purchases such as office supplies, advertising, and travel.

Expense Tracking: Access detailed expense reports and monitoring tools to track business spending and streamline financial management.

5.Student Saver Card

The Student Saver Card is designed to meet the financial needs of students, offering benefits tailored to their lifestyle and budget.

- Student Discounts: Enjoy exclusive discounts and offers at participating retailers and service providers, helping students save on everyday expenses.

- Financial Education: Access resources and tools to improve financial literacy, helping students learn about budgeting, credit management, and responsible spending.

- Building Credit: Start building a positive credit history with responsible card use, which can be beneficial for future financial endeavors such as renting an apartment or applying for loans.

6.Unlimited Adventure Card

The Unlimited Adventure Card is ideal for individuals who enjoy travel and outdoor activities, offering rewards and benefits that enhance their adventures.

Travel Rewards: Earn points or miles on travel-related purchases such as flights, hotels, car rentals, and dining, allowing cardholders to accumulate rewards for future trips.

Adventure Perks: Access exclusive benefits like travel insurance, airport lounge access, concierge services, and discounts on adventure tours and outdoor gear.

Flexible Redemption: Enjoy flexibility in redeeming rewards for various travel expenses, including flights, hotel stays, vacation packages, and adventure activities.

7.Grocery Guru Gold Card

The Grocery Guru Gold Card is a top choice for those who frequently shop for groceries, offering tailored rewards and perks for their spending habits.

With bonus points or cashback on grocery purchases, cardholders can save money on essential expenses and earn rewards for their everyday spending. Additionally, the card provides benefits like extended warranty protection, purchase protection, and access to exclusive discounts or promotions with partner merchants.

8.Auto Enthusiast’s Edge Card

The Auto Enthusiast’s Edge Card offers rewards and benefits tailored to automotive spending, including fuel purchases and vehicle maintenance. Cardholders also enjoy perks like roadside assistance and rental car insurance, making it a valuable choice for auto enthusiasts. This card provides convenience and savings for those passionate about cars.

9.Metropolitan Luxe Card

The Metropolitan Luxe Card is a premium credit card tailored for individuals seeking luxury perks and exclusive benefits. With features like concierge services, travel rewards, and access to VIP events,

it caters to a sophisticated lifestyle. Cardholders enjoy a range of privileges designed to enhance their experiences and elevate their status.

10.Health & Wellness Rewards Card

The Health & Wellness Rewards Card is designed for individuals focused on maintaining a healthy lifestyle. With benefits such as gym membership discounts, cashback on wellness purchases, and rewards for health-related spending, it supports your well-being goals.

Fitness Benefits:

- Discounts on gym memberships and fitness classes.

- Rewards for purchasing health supplements and wellness products.

- Cashback on purchases at health-conscious retailers.

Wellness Rewards:

- Earn points for medical appointments and preventive care services.

- Redeem rewards for spa treatments, yoga classes, and wellness retreats.

- Access exclusive offers on health-related subscriptions and services.

Comparison With Other Leading Credit Cards

When comparing credit cards, it’s essential to focus on key factors such as rewards, fees, and customer service. Each credit card offers different benefits and features, so evaluating these aspects can help you make an informed decision.

Also Read:High Risk Merchant Account At highriskpay.com – All You Need To Know About It

Credit Card Rewards Schemes: A Comparative Look

Credit card rewards schemes vary significantly among different cards, offering diverse benefits tailored to various spending habits and preferences. These schemes often include cashback, travel rewards, points for purchases, and exclusive perks to attract different types of cardholders.

- Cashback programs typically refund a percentage of the total amount spent on the card, providing instant savings on everyday purchases.

- Travel rewards schemes offer points or miles for travel-related spending, which can be redeemed for flights, hotel stays, rental cars, and other travel expenses.

- Points-based rewards allow cardholders to earn points for every dollar spent, which can be redeemed for merchandise, gift cards, statement credits, or experiences.

Interest Rates And Fees: Understanding The Costs

Understanding the costs associated with credit cards involves considering both interest rates and fees, which can significantly impact your financial decisions.

Interest Rates: Credit cards may have variable or fixed interest rates, affecting the cost of carrying a balance from month to month.

Annual Fees: Some credit cards charge an annual fee for access to rewards and benefits, while others offer no-fee options.

Other Fees: Additional fees like late payment fees, foreign transaction fees, and balance transfer fees can add to the overall cost of using a credit card.

User Experience And Customer Service

User experience and customer service are crucial aspects to consider when choosing a credit card provider, as they directly impact your satisfaction and convenience.

Accessibility: Look for credit card issuers that offer easy access to customer service through multiple channels like phone, chat, or email.

Responsiveness: Evaluate how quickly and effectively the credit card company responds to inquiries, resolves issues, and addresses concerns.

Online Tools: Consider the availability and functionality of online tools, such as account management portals and mobile apps, for a seamless user experience.

Security Measures And Fraud Protection

Security measures and fraud protection are paramount when selecting a credit card, ensuring your financial transactions are secure and protected from unauthorized access.

- Encryption: Look for credit cards that use strong encryption methods to protect your personal and financial information when making online purchases or transactions.

- Fraud Alerts: Opt for credit card providers that offer real-time fraud alerts and monitoring services to detect and prevent unauthorized transactions promptly.

- Liability Protection: Consider credit cards that offer zero-liability protection, ensuring you are not held responsible for fraudulent charges made on your account.

Credit Building And Reporting

Credit building and reporting are crucial aspects of managing your finances and improving your credit score over time.

- Timely Payments: Make sure to pay your credit card bills on time each month to build a positive payment history, which is a key factor in determining your credit score.

- Credit Utilization: Keep your credit utilization ratio low by using only a small portion of your available credit limit, as this can positively impact your credit score.

- Monitor Your Credit Report: Regularly check your credit report for accuracy and address any errors promptly to maintain a healthy credit profile.

How To Apply For Fintechzoom’s Recommended Credit Cards

You can apply for Fintechzoom’s recommended credit cards online by visiting their website or through their platform. Simply fill out the required personal and financial information to complete the application process.

Alternatively, you can apply for these credit cards over the phone by calling the issuer’s customer service number and providing the necessary details to a representative. Make sure to review the terms, benefits, and eligibility criteria before applying to ensure the card aligns with your financial goals.

To get started, let’s look at the straightforward process of applying for these top-tier financial tools.

Research And Select The Right Card For You

When researching and selecting a credit card, consider your spending habits, financial goals, and lifestyle to find the right fit.

- Analyze your spending patterns to determine which rewards program aligns best with your needs.

- Compare interest rates, annual fees, and other charges to ensure they fit within your budget.

- Read customer reviews and research the issuer’s reputation for customer service and support to make an informed decision.

Gather Essential Information

Gathering essential information involves collecting key details about credit cards to make an informed decision.

- Identify your financial goals and spending habits to determine the type of rewards or benefits you prefer.

- Research interest rates, annual fees, and other costs associated with different credit cards.

- Compare rewards programs, perks, and terms of service from various issuers to find the best match for your needs.

Apply Through The Official Website

Applying for a credit card through the official website is a straightforward process that ensures accuracy and security.

- Visit the Issuer’s Website: Navigate to the official website of the credit card issuer.

- Explore Available Options: Browse through the available credit card options to find one that suits your needs.

- Fill Out the Online Application: Complete the online application form with accurate personal and financial information.

- Submit Your Application: Electronically submit your application through the website for processing.

- Wait for Approval: After submission, wait for the issuer to review your application, conduct a credit check, and provide an approval decision.

- Receive Your Card: Once approved, you’ll receive your credit card by mail, usually within a few business days.

Follow Up On Your Application

After submitting your credit card application, it’s essential to stay informed about the status and take necessary follow-up actions.

Check Application Status: Visit the issuer’s website or contact customer service to inquire about the status of your application.

Review Communication: Keep an eye on emails, messages, or mail for any updates or requests for additional information.

Provide Additional Documentation:If required, promptly submit any requested documents or information to expedite the processing of your application.

Follow Up Regularly: If you haven’t received a response within the expected timeframe, follow up with the issuer to ensure your application is being processed.

Receive Approval Notification: Once approved, you’ll receive notification along with details about your credit limit, interest rate, and card features.

Activate Your Card: Upon receiving your card, activate it as per the instructions provided and start using it responsibly.

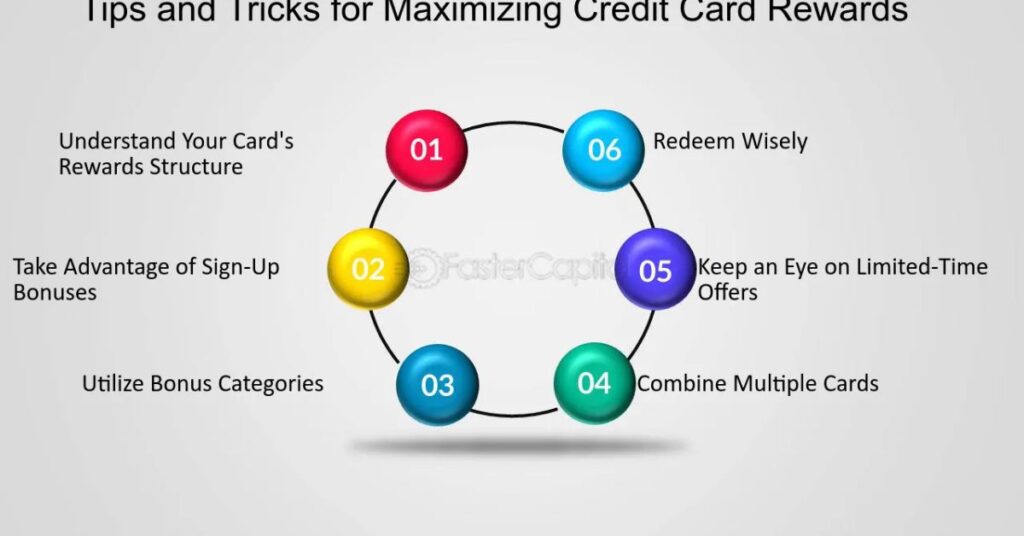

Tips For Maximizing Credit Card Benefits

To maximize credit card benefits, consider paying your balance in full each month and utilizing rewards strategically based on your spending habits and lifestyle.

Understand Your Credit Card Rewards

Understanding your credit card rewards is crucial for maximizing benefits. Familiarize yourself with the types of rewards offered, such as points, miles, or cashback, and their redemption options. Regularly review your rewards balance and redemption options to make the most out of your credit card perks.

Set Up Automatic Payments

Automating your credit card payments offers convenience and helps avoid late fees. Here are key points to consider:

- Log in to your bank account or credit card issuer’s website to set up automatic payments.

- Choose the payment amount and frequency that align with your budget and due dates.

- Ensure sufficient funds are available in your account to cover the automatic payments on time.

Take Advantage Of Sign-up Bonuses

When applying for a new credit card, capitalize on sign-up bonuses for added benefits:

- Research credit cards offering lucrative sign-up bonuses, such as bonus points or cash rewards.

- Meet the spending requirements within the specified timeframe to qualify for the sign-up bonus.

- Utilize the sign-up bonus wisely, either redeeming it for rewards or offsetting your card’s annual

Leverage Category Spending

To maximize your rewards and benefits, it’s essential to understand your spending habits and choose a credit card that aligns with them. Identify the categories where you spend the most, such as groceries, dining, or travel, and select a card that offers bonus rewards or cashback in these areas.

By strategically using your card for purchases in these categories, you can optimize your rewards earning potential and make the most out of your credit card benefits.

Regularly Review Your Rewards Balance

Regularly reviewing your rewards balance on credit cards is essential for maximizing benefits and staying informed about your financial situation. It helps you track your progress towards earning rewards and ensures you don’t miss out on any opportunities to redeem valuable perks.

- Regular reviews of rewards balance help you identify any discrepancies or unauthorized transactions promptly, leading to timely resolution and enhanced security.

- By staying updated on your rewards balance, you can plan your spending strategically to take advantage of bonus categories or promotional offers and earn more rewards.

Redeem Rewards Wisely

Redeeming rewards wisely is crucial to maximizing the benefits of your credit card. It involves understanding the redemption options available and using them strategically to get the most value out of your rewards.

- Prioritize high-value redemptions such as travel or statement credits to maximize the value of your rewards.

- Take advantage of bonus offers or promotions for redeeming rewards, which can often provide extra value.

- Consider saving up rewards for larger purchases or experiences to make the most significant impact on your finances.

Utilize Additional Perks

- Take advantage of additional perks offered by your credit card to enhance your overall experience.

- Explore benefits like travel insurance, extended warranties, or purchase protection for added peace of mind.

- Maximize rewards by utilizing perks such as airport lounge access, concierge services, or complimentary upgrades when available.

Stay Abreast Of Special Offers And Updates

Stay updated with special offers and updates from your credit card issuer to maximize benefits.

- Regularly check for new rewards programs, bonus points promotions, and discounts to make the most of your card.

- Take advantage of limited-time offers, cashback deals, and exclusive perks tailored to cardholders’ preferences.

Keeping Your Account In Good Standing

Maintaining a good standing with your credit card account is essential for financial health.

Pay your bills on time each month to avoid late fees and negative impacts on your credit score.

Monitor your account regularly for any unauthorized charges or suspicious activities and report them promptly to your card issuer.

Keep your credit utilization low by using only a small portion of your available credit limit, which can positively impact your credit score.

Educate Yourself Continuously

Continuous education is key to understanding the intricacies of credit cards and managing them effectively.

- Stay updated with the latest financial news and credit card trends.

- Take advantage of online resources, articles, and tutorials to enhance your knowledge.

- Engage with financial experts or attend workshops/webinars to deepen your understanding of credit card management strategies.

Also Read: What Is The 7700 Eastport Park Charge On Your Bank Statement: How to Spot It and Protect Yourself

What are the 7 classes of credit?

The seven classes of credit are:

Revolving Credit: This type of credit allows you to borrow up to a certain limit and make payments based on the amount borrowed.

Open-End Credit: Similar to revolving credit, open end credit provides flexibility in borrowing and repayment terms.

Installment Credit: With installment credit, you borrow a specific amount and repay it in fixed installments over time.

Charge Cards: These cards require you to pay off the balance in full each month, offering no revolving credit option.

Service Credit: This type of credit applies to services like utility bills or memberships where you pay after using the service.

Mortgage Loans: Mortgage loans are installment credits specifically for purchasing or refinancing real estate.

Consumer Loans: These loans cover various personal expenses like car loans, student loans, or home improvement loans.

Frequently Asked Questions

What Are The Best Credit Cards For 2024?

The best credit cards for 2024 vary based on individual needs but may include options like Chase Sapphire Preferred, Capital One Venture X, or American Express Gold, each offering unique rewards and benefits tailored to different spending habits.

How To Choose A Fintech Credit Card?

Choosing a fintech credit card involves considering factors such as rewards program, annual fees, interest rates, and additional perks like travel insurance or cashback rewards, ensuring the card aligns with your financial goals and lifestyle.

What is credit card reward rate?

Credit card reward rate refers to the percentage of rewards or cashback you earn on your spending, typically ranging from 1% to 5% depending on the card and spending categories, providing an incentive for cardholders to use the card for purchases.

How can I improve my chances of approval for a credit card with specific credit score requirements?

Improving your chances of approval for a credit card with specific credit score requirements involves maintaining a good credit history by paying bills on time, reducing debt, and checking your credit report for errors or discrepancies.

Are Cashback Cards Worth It?

Cashback cards can be worth it for individuals who regularly use credit cards for purchases and can maximize cashback rewards, providing a valuable way to earn money back on everyday spending.

Can I Get A Credit Card With Bad Credit?

It is possible to get a credit card with bad credit, although options may be limited and may come with higher interest rates or fees. Secured credit cards or cards designed for rebuilding credit are common choices for those with less than perfect credit.

How do you classify credit card rewards?

Credit card rewards are classified into categories like cashback, travel rewards, points based rewards, or co branded rewards, each offering different ways to earn and redeem rewards based on spending habits and preferences.

How to check credit score?

You can check your credit score online through various credit bureaus or by using free credit score services. It is important to monitor your credit score regularly to track your financial health and identify any potential issues or discrepancies.

Conclusion

In 2024, FintechZoom has curated a list of the best credit cards designed to cater to diverse financial needs and lifestyles. These cards offer competitive rewards programs, valuable perks, and user friendly features that make managing finances more convenient and rewarding.

From travel rewards to cashback options, FintechZoom’s top credit card picks for 2024 provide various benefits such as flexible redemption options, welcome bonuses, and bonus rewards on specific categories like dining, groceries, or travel.

By carefully selecting a credit card from FintechZoom’s recommendations, users can maximize their rewards potential and enjoy financial perks that align with their spending habits and preferences.