Charter Services 855-707-7328 Mo charges on your bank statement refer to payments made for various services provided by a company named Charter. These services could include cable TV, internet, phone services, charter flights, travel services, financial or consulting services, or membership fees/subscriptions.

Contacting your bank or reviewing associated details can provide clarity on the specific nature of the Charter Services 855-707-7328 Mo” charges.It is essential to review your billing statements regularly to stay informed about your expenses and ensure accuracy in your financial records.

Connection to Spectrum Services

The “Charter Services 855 707 7328 MO” charge on your bank statement is directly related to services provided by Spectrum, a prominent broadband communications company in the United States. Here’s how this charge connects to Spectrum services:

- Spectrum, formerly known as Charter Communications, offers a range of services, including cable TV, internet, and phone services.

- The “Charter Services” descriptor on your statement is a billing representation of payments made for these Spectrum services.

- The phone number 855-707-7328 associated with the charge connects to Spectrum’s customer service, further confirming its link to Spectrum.

Understanding this connection helps you identify the nature of the charge and its relevance to your services with Spectrum.

If you are a Spectrum customer and see this charge, it is likely related to your regular billing for their services. However, if you are unsure or the charge seems unusual, contacting Spectrum or your bank for clarification is advisable.

Additional Information:

- Spectrum is one of the largest cable operators in the United States, providing services to millions of customers nationwide.

- The “MO” in the charge descriptor stands for “Mobile,” indicating that the charge might be related to mobile services or payments processed through mobile devices.

- Spectrum offers various packages and plans for cable TV, internet, and phone services, catering to different customer needs and preferences.

- The billing descriptor “Charter Services” may vary slightly in format or wording on different bank statements but generally refers to payments for Spectrum services.

- Spectrum’s customer service representatives can provide detailed information about your specific charges and help address any billing related inquiries or concerns.

How the Charge Appears on Statements

The “Charter Services 855 707 7328 MO” charge can appear differently on your bank statements, but it generally follows a specific format that indicates the nature of the transaction. Here’s how the charge might appear on statements:

- It may be listed as “CHKCARD Charter Services 855-707-7328 MO” or “CHECKCARD Charter Services 855-707-7328 MO,” indicating a debit card transaction.

- Alternatively, it could appear as “POS Debit Charter Services 855-707-7328 MO” or “POS PUR Charter Services 855-707-7328 MO,” denoting a point of sale debit.

- The charge may also show as “Visa Check Card Charter Services 855-707-7328 MO MC, indicating a Visa branded debit card transaction.

- Sometimes, it might be listed as PRE AUTH Charter Services 855-707-7328 MO, representing a pre authorized transaction.

- If a refund is issued, the charge may appear as “POS REFUND Charter Services 855-707-7328 MO.”

Understanding these variations helps you interpret the charge accurately on your statements and track your financial activity effectively. Here are more details about how the charge can appear:

- The “MO” in the descriptor typically stands for “Mobile,” indicating a mobile related transaction.

- Different banks or financial institutions may use slightly different abbreviations or formats for the same charge.

- The descriptor may include additional information such as the date of the transaction or the merchant’s location.

- It might show as PENDING Charter Services 855-707-7328 MO if the transaction is not yet fully processed.

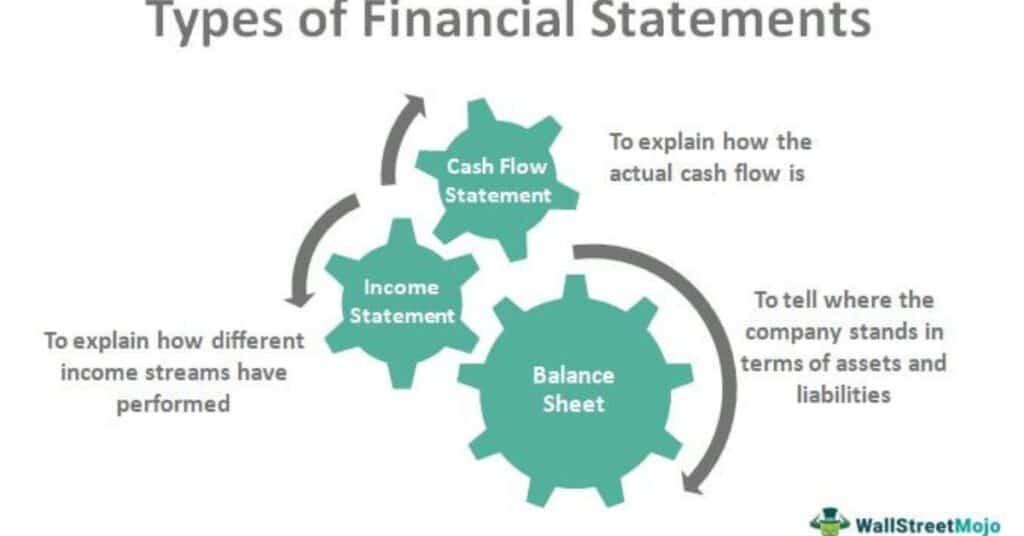

Explanation of Different Statement Types

Different statement types on your bank statements represent various transaction categories and provide insights into your financial activity. Here’s an explanation of different statement types:

CHKCARD and CHECKCARD: These terms indicate transactions made using a check card, equivalent to a debit card.

POS Debit: Represents “Point of Sale” debit transactions, indicating purchases made at physical locations.

POS PUR, POS PURCH, POS PURCHASE: Abbreviations for “Point of Sale Purchase,” similar to POS Debit.

POS REFUND: Indicates a refund issued for a previous point of sale transaction.

PRE AUTH: Stands for “Pre Authorization,” indicating a hold placed on your account for a future transaction.

PENDING: Denotes transactions that have been initiated but are not yet fully processed by the bank.

Also Read: WHAT IS FFNHELP ON YOUR BANK STATEMENT?

Similar Charges

Similar charges on your bank statement may include transactions related to services or purchases from companies with similar billing descriptors, such as payments for telecommunications services, educational materials, food services, or other business related transactions.

CHARTER COMMUNICATIONS 888-438-2427 CA: Likely related to payments for services provided by Charter Communications, such as cable TV, internet, or phone services.

CHARTERCOMMUNIC CO ENTRY: Another potential billing descriptor for transactions with Charter Communications.

Charthouse Learning Corp: Could relate to services or products purchased from Charthouse Learning Corporation, possibly educational materials or training.

CHART POOL USA PORTAGE IN: May represent charges from Chart Pool USA, a pool services company based in Portage, Indiana.

CHARTWELLS @ I281147 IND: Possibly linked to food service transactions provided by Chartwells at a specific location.

How to Handle Unrecognized Charges

Handling unrecognized charges on your bank statement is crucial for maintaining financial accuracy and security. Here’s how you can effectively deal with such charges:

Review Your Recent Purchases: Start by reviewing your recent transactions to see if the unrecognized charge aligns with any purchases you made. Sometimes, the merchant’s name on the statement may differ from what you remember due to billing descriptors or processing delays.

Contact the Merchant: If the unrecognized charge includes a merchant’s contact information, such as a phone number or email, consider reaching out to the merchant directly. Explain the situation and inquire about the nature of the charge to determine if it is legitimate.

Check with Other Authorized Users: If your credit card or bank account is shared with other family members or authorized users, ask them if they recognize the charge. It is possible that someone else made the transaction and can provide clarification.

Report to Your Bank or Credit Card Company: If the unrecognized charge remains unresolved, contact your bank or credit card company immediately. Inform them about the charge, provide any relevant details, and request further investigation or assistance.

Monitor Your Account: Keep a close eye on your account for any additional unrecognized charges or suspicious activity. Regularly checking your statements and account activity helps detect and address potential issues promptly.

By following these steps, you can effectively handle unrecognized charges on your bank statement, ensuring your financial records are accurate and secure.

Also Read: WHAT IS THE FACEBOOKTEC TRANSACTION ON YOUR BANK STATEMENT?

Contacting Your Bank or Credit Card Company

When reaching out to your bank or credit card company, ensure you have your account details and any relevant documentation ready to provide accurate information and expedite the resolution process.

Choose the most convenient communication channel, such as phone, email, or online chat, based on your preferences and the urgency of your inquiry, to effectively convey your concerns and receive timely assistance.

Clearly explain your issue or inquiry to the customer service representative, providing specific details and any supporting evidence, to facilitate a swift and satisfactory resolution to your financial query or concern.

charter services income tax

Charter services income tax refers to the taxation related to income earned from providing charter services. Here’s a breakdown of what this entails:

Income Tax: This is the tax levied on the income earned by an individual or entity, including income derived from providing charter services.

Charter Services: These are services provided under a charter agreement, such as charter flights, charter boats, or charter bus services.

Taxation of Charter Services Income: The income generated from providing charter services is subject to income tax, similar to other sources of income.

Tax Reporting: Individuals or businesses offering charter services are required to report their income from these services accurately and pay the applicable income taxes based on the tax laws and regulations in their jurisdiction.

Tax Deductions: Depending on the tax laws, there may be deductions or exemptions available for expenses related to providing charter services, which can impact the taxable income.

It is important for individuals or businesses involved in charter services to understand their tax obligations, maintain proper records, and comply with tax laws to avoid any penalties or issues related to income tax reporting.

Consulting with a tax professional or accountant can provide further guidance on managing charter services income tax effectively.

Frequently asked question:

What is a charter services charge on a bank statement?

A charter services charge on a bank statement typically refers to payments made for services provided under a charter agreement, such as charter flights, boats, or buses.

What is spectrum on my bank statement?

Spectrum on your bank statement refers to charges related to services provided by Spectrum, a leading broadband communications company offering cable TV, internet, and phone services.

How can I verify if the Charter Services charge is legitimate and not a fraudulent transaction?

To verify if a Charter Services charge is legitimate, check your records for any corresponding transactions or services provided by the company. Contacting your bank or the service provider directly can also help confirm the legitimacy of the charge.

How often do Charter Services charges appear on bank statements, and are they recurring or one-time transactions?

Charter Services charges can appear on bank statements either as recurring fees for ongoing services like cable or internet subscriptions, or as one time transactions for specific charter services such as flights or boat rentals.

Summary

Charter Services 855-707-7328 Mo charges on your bank statement typically pertain to payments made for services offered by Charter Communications. These services can range from cable TV subscriptions to internet and phone services.

The charges may appear as recurring monthly fees for ongoing subscriptions or as one time transactions for specific services like pay per view events or equipment upgrades.

It is important to carefully review your bank statements to verify the legitimacy of these charges and ensure they align with the services you have subscribed to or availed from Charter Communications. If you spot any unfamiliar or unauthorized charges, promptly contact your bank or the service provider to investigate and resolve any discrepancies.