Sigonfile on your bank statement is an unfamiliar term that may indicate unknown or unauthorized transactions. It often raises concerns about the security of your financial accounts. Understanding and addressing Sigonfile charges promptly is crucial for protecting your financial stability and peace of mind.

Puzzled by the mysterious appearance of “Sigonfile” on your bank statement . This enigmatic term can spark confusion and raise concerns about the security of your financial accounts. understanding what Sigonfile means is the first step to ensuring your financial stability and peace of mind. Let’s delve into the world of Sigonfile charges and equip you with the knowledge to navigate them confidently.

What is a Sigonfile Charge?

A Sigonfile charge is an unfamiliar entry on your bank statement that may indicate unknown or unauthorized transactions. It often raises concerns about the security of your financial accounts. Understanding and addressing Sigonfile charges promptly is crucial for protecting your financial stability and peace of mind.

Sigonfile and Bank Statement Security

Sigonfile on bank statements can signal potential security risks as, it often represents unfamiliar or unauthorized transactions. The presence of Sigonfile entries may raise concerns about the safety of your financial accounts and the possibility of fraudulent activity.

Promptly verifying the legitimacy of these transactions is essential for maintaining financial security and protecting against potential fraud. Understanding the implications of Sigonfile charges can help you safeguard your finances and ensure peace of mind.

Read Also information...https://financenexgen.com/what-is-the-uscc-ivr-charge-on-your-bank-statement/

Action Steps if You Encounter Sigonfile

If you encounter Sigonfile charges on your bank statement, take these immediate actions:

- Inform your bank immediately about the unrecognized Sigonfile charge.

- Request detailed information and initiate an investigation if necessary.

- Thoroughly review your recent transactions for any other unauthorized activities.

- Strengthen your account security by updating online banking credentials.

- Monitor your account closely for any further irregularities or suspicious activity.

- Consider placing a fraud alert on your credit report if identity theft is suspected.

- Stay proactive and communicate openly with your bank to resolve any concerns promptly.

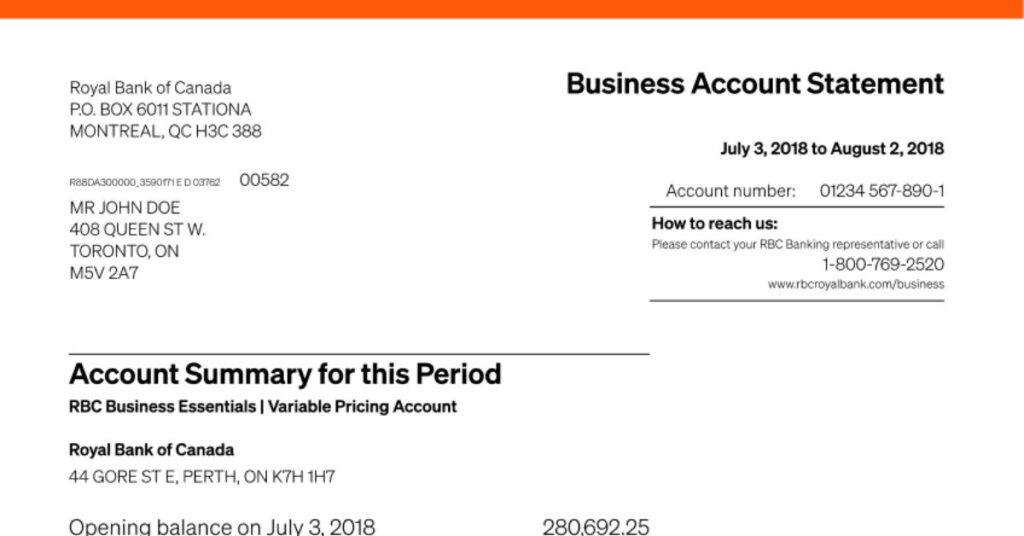

How to Identify Sigonfile Charges?

To identify Sigonfile charges, regularly review your bank statements for unfamiliar entries next to specific transaction amounts. Look out for the term “Sigonfile” as a red flag for further investigation. Conduct these reviews consistently to promptly detect any unusual activity. If you encounter a Sigonfile charge, investigate further to verify the transaction’s legitimacy.

Preventing Unauthorized Sigonfile Charges

To prevent unauthorized Sigonfile charges, regularly monitor your bank statements for any unrecognized transactions. Avoid conducting banking activities over unsecured networks and ensure your online banking password is strong and unique.

Set up real time transaction alerts to stay informed of any suspicious activity, and exercise caution when sharing sensitive banking information. Keeping your banking app and device software up to date also enhances security.

what is sigonfile bank verify

Sigonfile Bank Verify is a service offered by Sigonfile to help verify transactions and ensure the security of your financial accounts. It aids in confirming the legitimacy of transactions appearing on your bank statements, providing peace of mind and protection against fraudulent activity.

By utilizing Sigonfile Bank Verify, you can promptly identify and address any unauthorized charges, safeguarding your financial stability.

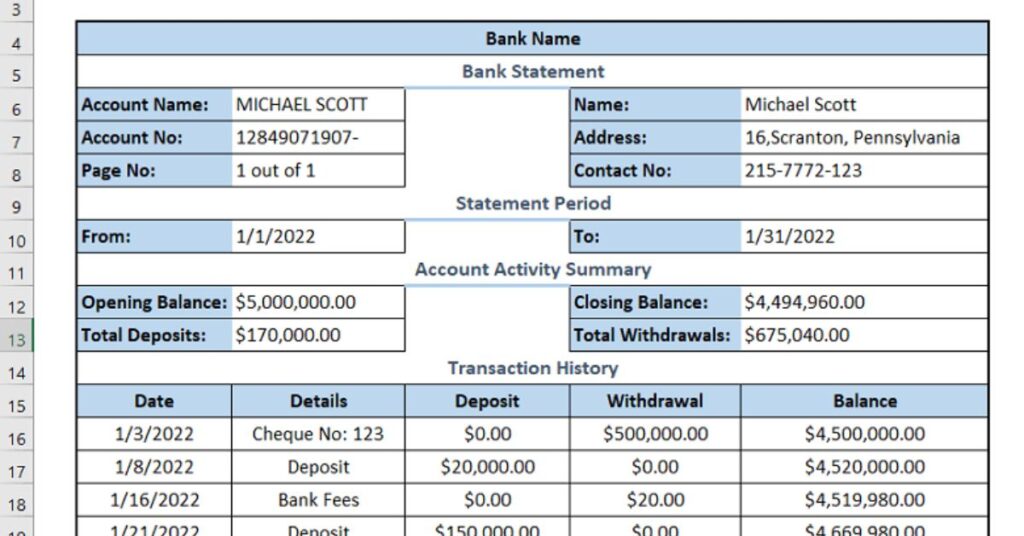

sigonfile withdrawal on bank statement

A Sigonfile withdrawal on a bank statement indicates a transaction processed by Sigonfile. Here,

- Sigonfile withdrawal on a bank statement indicates a transaction processed by Sigonfile.

- It may represent various types of withdrawals, such as ATM withdrawals, online transfers, or direct debits.

- Reviewing the details of the withdrawal can help determine its legitimacy and purpose.

- If the Sigonfile withdrawal appears unfamiliar or unauthorized, contacting your bank promptly is advised.

- Taking prompt action can help resolve any issues and ensure the security of your financial accounts.

sigonfile deposit

A Sigonfile deposit on your bank statement signifies a transaction processed by Sigonfile. It could represent various types of deposits, including transfers, payments, or refunds. Reviewing the details of the deposit can help verify its legitimacy and source. If the Sigonfile deposit appears unfamiliar or unexpected, contacting your bank for clarification is recommended.

Read Also information..https://financenexgen.com/what-is-google-wm-max-llc-charge-on-your-bank-statement/(opens in a new tab)

Frequently asked question

How do you identify an unknown transaction?

To identify an unknown transaction, review your bank statement for unfamiliar entries and compare them to your recent financial activity. If the transaction remains unclear, contact your bank for further clarification and verification.

How long do you have to report unauthorized transactions?

You typically have up to 60 days to report unauthorized transactions to your bank to protect yourself from liability. It is important to notify your bank promptly upon discovering any unauthorized activity on your account.

Why would Sigonfile appear on my bank statement?

Sigonfile may appear on your bank statement to denote transactions processed by a third party service provider or as a descriptor for certain types of transactions. Its presence could indicate various financial activities, including withdrawals, deposits, or payments.

Can I dispute a Sigonfile charge with my bank?

Yes, you can dispute a Sigonfile charge with your bank if you believe it to be unauthorized or erroneous. Contact your bank promptly to initiate the dispute process and provide any relevant information or evidence to support your claim.

Conclusion

If you spot “Sigonfile” on your bank statement, it is likely an unfamiliar term that can cause confusion and concern. This mysterious entry often indicates transactions processed by Sigonfile, but its appearance may raise questions about the security of your financial accounts. Understanding what Sigonfile means is essential for protecting your finances and ensuring peace of mind.

Sigonfile charges can vary in nature, ranging from withdrawals to deposits, and may encompass various types of transactions. Regularly reviewing your bank statements and promptly addressing any unfamiliar Sigonfile entries can help safeguard against unauthorized activity. By staying vigilant and proactive, you can maintain control over your finances and mitigate potential risks associated with Sigonfile charges.