The “Quick Card Charge” on your credit card statement typically refers to a fast and convenient payment made using your card. It could represent a purchase made online, in store, or through a mobile payment platform. This charge appears swiftly on your statement, reflecting the immediacy of the transaction.

Curious about that “Quick Card Charge” on your credit card statement, It is simply a transaction related to prepaid cards, like gift cards or reloadable payment options. These charges usually reflect purchases made using such cards or services associated with them. If you are unsure about a specific charge, contacting your credit card issuer can provide clarity and peace of mind.

What is QuickCard?

QuickCard is a convenient tool for making digital payments swiftly. It enables users to complete transactions with ease using a simple tap or scan. With QuickCard, you can securely store your payment information for seamless purchases online or in stores. It’s a time-saving solution that simplifies the payment process for busy individuals.

Disputing Unfamiliar Quick Card Charges

If you spot an unfamiliar Quick Card Charge on your statement, it is crucial to act swiftly. First, review your recent transactions and receipts to see if the charge can be identified. If it still doesn’t ring a bell, contacting your credit card issuer is the next step.

Your credit card provider can offer insights into the charge details and assist in disputing it if it is fraudulent. They will guide you through the process, which may involve filling out a dispute form and providing any relevant information to support your claim. This way, you can ensure your finances are protected.

Also Read This Blog: https://financenexgen.com/what-is-the-quick-card-charge-on-your-credit-card-statement/(opens in a new tab)

How Does QuickCard Work?

QuickCard works by securely storing your payment information, such as credit or debit card details, in a digital format. When making a purchase online or in store, you simply need to tap or scan your Quick Card enabled device at the point of sale. This action initiates the transaction process, sending your payment information securely to the merchant’s payment system.

Once the payment information is transmitted, QuickCard processes the transaction swiftly, deducting the amount from your linked account. This streamlined process eliminates the need for manual entry of card details, reducing the risk of errors and enhancing convenience for users. Overall, QuickCard simplifies the payment experience, making it faster and more efficient for both consumers and merchants alike.

Why Does This Charge Appear?

This charge appears because it reflects a transaction made using your payment method. It could be for a purchase you made online or in store, subscription renewal, or a service fee.

Reviewing your recent transactions can help identify the source of the charge and ensure it aligns with your purchases and subscriptions. If you notice any discrepancies or unauthorized charges, contacting your bank or card issuer promptly is recommended for further assistance.

How to Identify Legitimate Charges

To identify legitimate charges, start by reviewing your recent purchases and subscriptions. Look for familiar merchants and services that you have used or signed up for.

Check your email for purchase confirmations or receipts that match the charges appearing on your statement. If uncertain, contact the merchant directly to verify the transaction details and ensure its legitimacy.

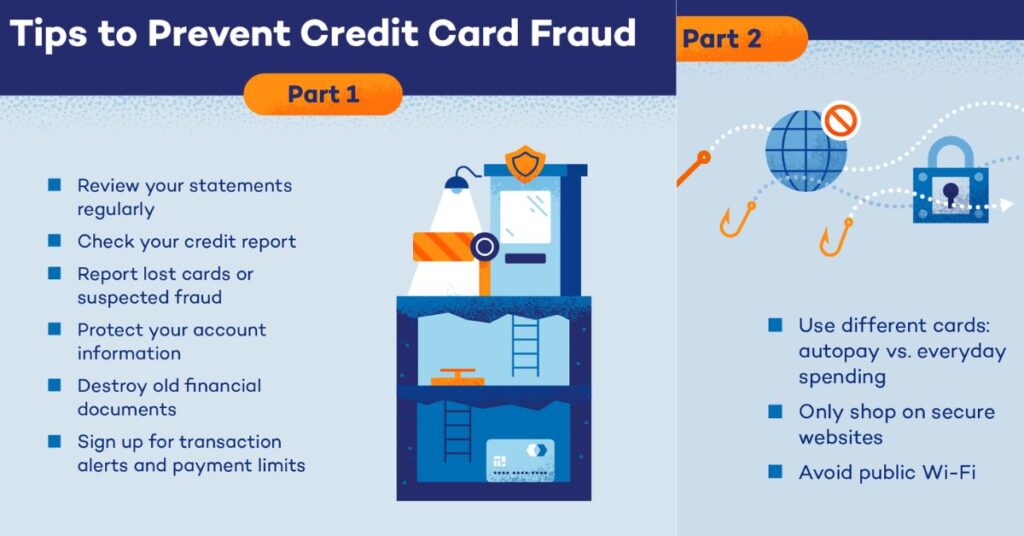

Preventing Fraudulent Quick Card Charges

To prevent fraudulent Quick Card Charges, keep a close eye on your credit card transactions. Regular monitoring allows you to quickly identify and address any unauthorized charges. Consider using secure payment methods, such as contactless payments, which often require verification for added security.

Enhance your card’s safety by setting up alerts for transactions and keeping your card in a secure location. Never share your card details over unsecured platforms. These simple habits can significantly reduce the risk of fraudulent charges on your account.

How use quick card ?

Using Quick Card is simple and convenient. First, add your payment information to the Quick Card app or device, securely storing your credit or debit card details. Then, when making a purchase online or in store, select Quick Card as your payment method or present your Quick Card-enabled device at the point of sale.

Next, follow the prompts to complete the transaction by tapping or scanning your Quick Card device, securely transmitting your payment details to the merchant’s payment system. Finally, confirm the transaction, and you’re done! Quick Card streamlines the payment process, offering a seamless and efficient experience for users.

What is Quick Credit Card Charge on Credit Card ?

A Quick Credit Card Charge on your credit card statement refers to a transaction processed through Quick Credit Card, a payment service provider. This charge represents purchases made using your credit card, processed swiftly and securely through Quick Credit Card’s platform.

These transactions could include online purchases, subscription renewals, or payments made at participating merchants. Reviewing your statement can help you identify and verify these charges to ensure they align with your purchases and subscriptions. If you have any concerns about a specific charge, contacting your credit card issuer for clarification is recommended.

Quick Card A Business Payment Processor!

Quick Card serves as a reliable business payment processor, facilitating swift and secure transactions for merchants. By integrating Quick Card into their payment systems, businesses can streamline their payment processes and provide a seamless checkout experience for customers.

With Quick Card, businesses can accept various payment methods, including credit cards, debit cards, and mobile payments, expanding their customer base and enhancing convenience. Quick Card offers robust security features to protect sensitive payment information and mitigate the risk of fraud, providing peace of mind for both businesses and customers alike.

Who are the investors in QuickCard?

QuickCard boasts a diverse group of investors, including prominent venture capital firms and strategic partners. These investors provide financial backing and expertise to support QuickCard’s growth and development initiatives, ensuring its continued success in the competitive payment industry.

With the support of these investors, Quick Card can innovate and expand its services, offering cutting edge solutions that meet the evolving needs of consumers and businesses. the strategic partnerships forged with investors enable Quick Card to access valuable resources and networks, further enhancing its market presence and competitiveness.

Also Read This Blog: https://financenexgen.com/what-is-the-sp-aff-charge-on-bank-statement-is-it-a-scam-or-legit/(opens in a new tab)

Benefits of Quick Card’s Payment

Quick Card’s payment system offers numerous benefits to both consumers and businesses alike. For consumers, Quick Card provides convenience by allowing swift and hassle free transactions online and in-store, saving valuable time during checkout processes.

Quick Card enhances security, utilizing advanced encryption technology to safeguard sensitive payment information and protect against fraud.Furthermore, Quick Card offers flexibility, allowing users to link multiple payment methods, including credit cards, debit cards, and mobile wallets, for added convenience and choice.

Quick Card’s seamless integration with various merchants and service providers ensures widespread acceptance, enabling users to make purchases across a diverse range of platforms and industries. Overall, Quick Card’s payment system streamlines the payment process, offering a user friendly experience that prioritizes efficiency, security, and flexibility for all parties involved.

frequently asked question

How to read your credit card statement

To read your credit card statement, review transactions, ensuring they match your purchases. Check for fees, interest charges, and due dates to manage your finances effectively.

Who pays credit card transaction fees?

Merchants usually pay credit card transaction fees, covering the cost of processing payments, while cardholders are not directly charged for these fees.

How to Manage Quick Card Charges

To manage Quick Card charges, review your transactions regularly and ensure they align with your purchases. Monitor your account balance and set up alerts for any unusual activity to stay on top of your finances.

How are Quick Card charges categorized on credit card statements?

Quick Card charges are typically categorized on credit card statements under the merchant’s name or as online transactions, providing clarity for users when reviewing their statements.

How quickly are Quick Card charges processed?

Quick Card charges are processed swiftly, usually reflecting on your credit card statement shortly after the transaction, ensuring timely and efficient payment processing.

summary

When you spot a Quick Card charge on your credit card statement, it typically signifies a transaction processed through Quick Card, a versatile payment service renowned for its convenience and security. These charges encompass various purchases, ranging from online shopping sprees to in store transactions, providing users with a seamless payment experience at their fingertips.

While initially puzzling, understanding the nature of Quick Card charges unveils their role in simplifying financial transactions and ensuring hassle-free payments. Quick Card charges are processed swiftly, often appearing on your statement shortly after the transaction takes place.

This prompt processing not only facilitates efficient payment management but also offers users real-time insights into their spending habits. By promptly identifying and tracking Quick Card charges, individuals can maintain better control over their finances, making informed decisions and staying on top of their budget with ease.