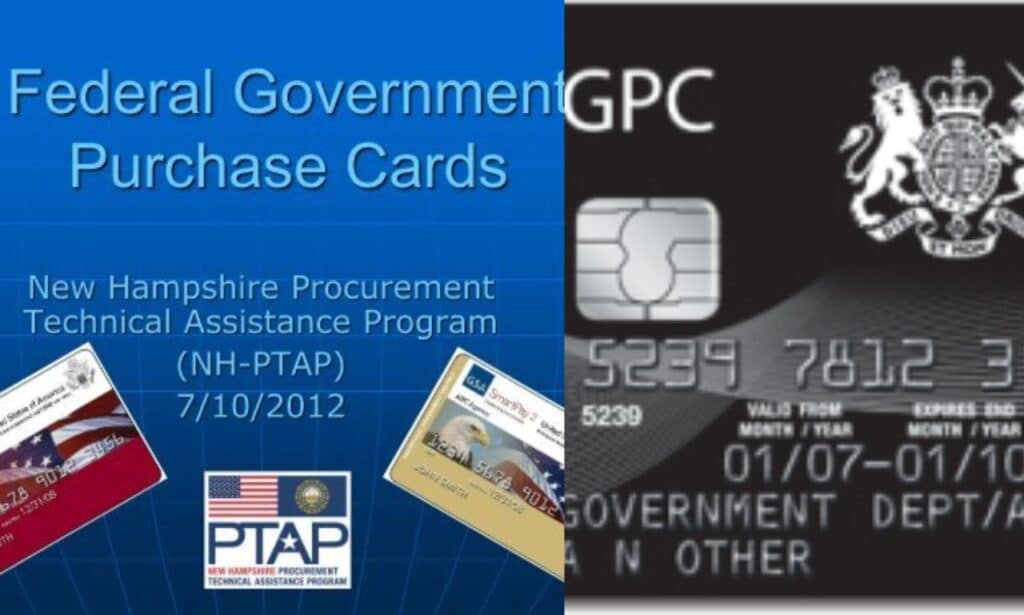

Ever wondered about the mysterious “GPC EFT” on your bank statement It simply stands for Government Procurement Card Electronic Fund Transfer. This term represents a secure and efficient way for government employees and authorized contractors to make payments on behalf of the government, ensuring streamlined transactions and enhanced financial management.

It is simply a government card payment method, making transactions smoother for officials and contractors. No more waiting GPC EFT ensures quick, secure payments, improving cash flow. Digital records mean organized finances at your fingertips. Boost vendor relationships with timely payments. Handle it like a pro: check vendor compatibility and keep neat transaction records. GPC EFT demystified now you are in control of your money.

What Is GPC EFT?

GPC EFT, or Government Purchase Card Electronic Fund Transfer, is a hassle free payment method used by government employees and contractors. It ensures quick and secure transactions, improving cash flow and promoting better relationships with vendors. With GPC EFT, your financial transactions are simplified and efficient.

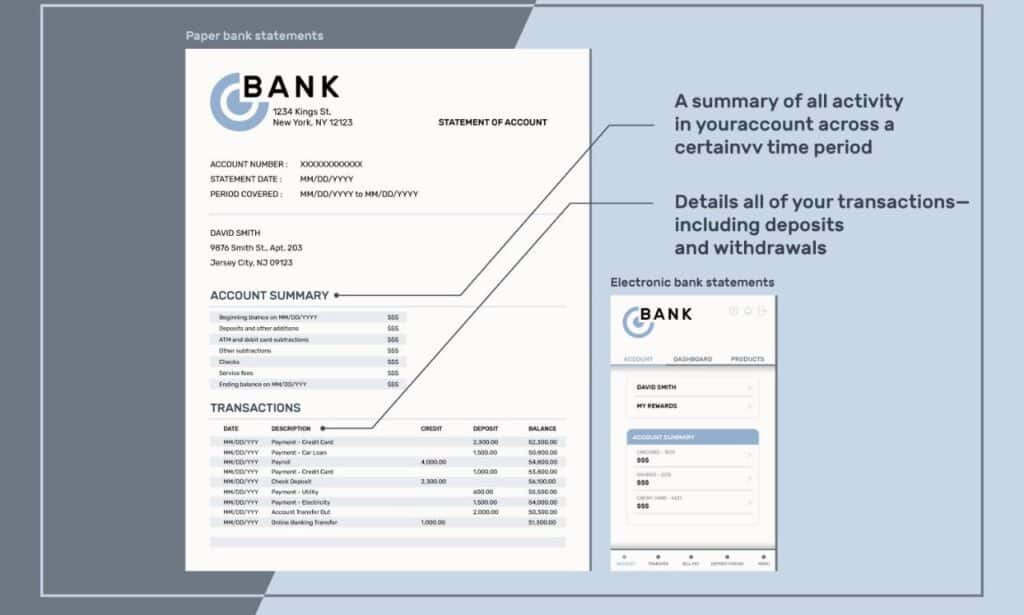

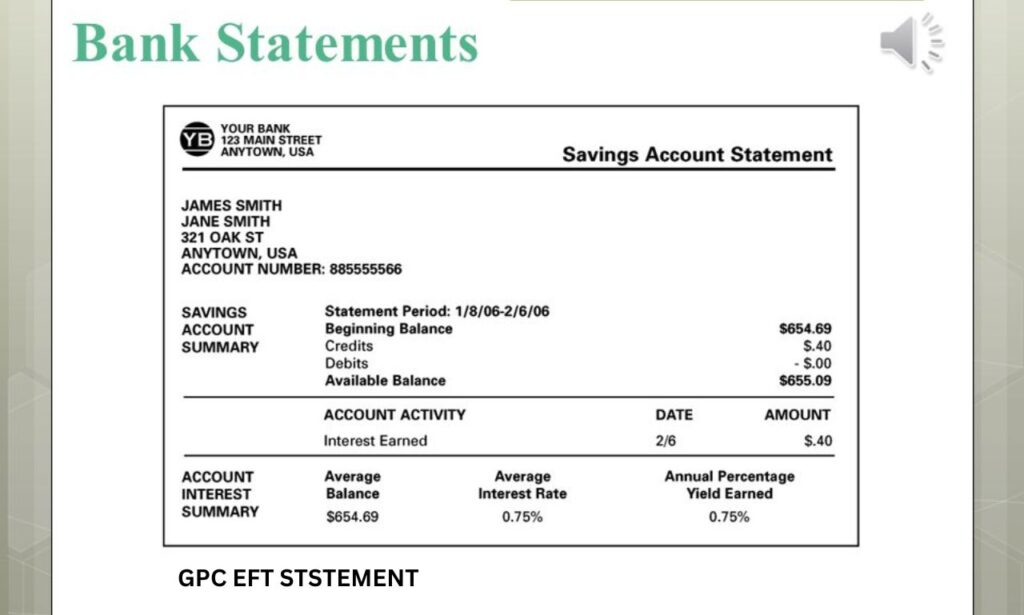

Spotting GPC Charges on Bank Statements

Spotting GPC charges on your bank statement It is simply your government purchase card in action, making transactions a breeze. Check for “GPC EFT” or “GPC transaction,” confirming a smooth payment process. Keep an eye out for these friendly indicators on your statement!

Why Do I Have a GPC EFT Charge?

It is just your government purchase card making efficient payments. Your GPC EFT charge means quick and secure transactions for approved expenses. It Is a savvy financial move, streamlining the way you handle official purchases. Rest easy your GPC EFT charge is your ticket to hassle free transactions,

There are a few potential reasons:

Government Employee Cardholder

The VIP of efficient spending, wielding the power of a specialized purchase card. With this card, government employees effortlessly handle approved expenses, ensuring quick and secure transactions. It is the key to a streamlined procurement process, putting convenience in the hands of those serving the public. Say hello to easy and accountable government spending with the Government Employee Cardholder.

Vendor Who Accepts GPC Payments

Those who accept GPC payments join a seamless financial revolution. Unlocking convenience, these savvy businesses welcome quick, secure transactions from government purchase cardholders. It is not just a payment; it is a nod to efficiency, as GPC transactions ensure vendors receive timely and reliable payments. Join the GPC friendly crew and elevate your business transactions.

Government Contractor

Government contractors, the power players in streamlined spending, using GPCs for authorized expenses. It is not just a card, it is the key to efficient, hassle free transactions for work related costs. Government contractors wielding GPCs ensure payments align seamlessly with regulations, making financial processes a breeze. Elevate your government dealings with the efficiency of a government contractor armed with a GPC.

Also Read this Blog: https://financenexgen.com/what-is-the-sp-aff-charge-on-bank-statement-is-it-a-scam-or-legit/(opens in a new tab)

Next Steps for GPC EFT Transactions

If an unknown GPC EFT charge appears or you simply want to verify a particular transaction, take these steps

Decoding the Debits: Unraveling the mysteries of GPC EFT transactions for confident financial navigation.

Navigating the GPC Trail: Next steps to ensure your GPC EFT charges align seamlessly with your records and expectations.

Secure Transactions 101: A guide on verifying and handling GPC EFT charges for peace of mind and financial security.

Swift Solutions for Unknown Charges: Proactive steps to take when faced with unrecognized GPC EFT transactions on your bank statement.

Overview of Government Procurement Cards

Government Procurement Cards (GPCs) are like magic wands for officials and contractors, streamlining purchases hassle free. These special cards work like regular credit cards but exclusively for authorized government transactions.

GPCs cut through bureaucracy, ensuring swift and efficient procurement of essential goods and services. Say goodbye to paper checks GPCs enhance vendor relationships by allowing electronic bill payments. Simplifying government finances, GPCs are the secret sauce for seamless transactions.

The Benefits GPC EFT Transactions

The financial game changer offering quick, secure payments and improved cash flow for government agencies and contractors.

Digital records, enhanced security, and better vendor relationships GPC EFT delivers a trifecta of benefits for streamlined financial success! Some of these are:

Smooth Sailing Finances: Discovering the ease and convenience of GPC EFT transactions for seamless financial management.

Cash Flow Upgrade: Boosting your money flow with GPC EFT quick, secure, and always on time.

Fraud Proof Payments: GPC EFT transactions: where safety meets simplicity, ensuring your money stays where it belongs.

Digital Dollars, Digital Sense: Embracing the digital revolution with GPC EFT for organized and paperless financial records.

Vendor Harmony: How GPC EFT transactions foster better relationships with vendors, making everyone a winner in the payment game.

What To Do If You Receive A GPC EFT Charge?

Received a surprise GPC EFT charge, Do not fret first, scrutinize the details, cross checking dates and amounts for accuracy. If it seems fishy, contact the merchant, a missed detail might be the culprit.

For unresolved issues, reach out to your bank promptly, and notify the issuing government agency to ensure a thorough investigation. Stay proactive, and your financial ship will sail smoothly through unexpected GPC EFT waves!

How To Handle GPC EFT Transactions

Check vendor compatibility to ensure smooth transactions. Keep digital records organized, creating a reliable trail for hassle free accounting. Remember, GPC EFT is not just a payment method it is a savvy financial move, streamlining official purchases. Stay in control, and watch your GPC EFT transactions unfold effortlessly.

Common GPC EFT Scams and Fraud Methods:

Guard Against GPC EFT Tricks: Unveiling common scams and frauds targeting your Government Purchase Card Electronic Fund Transfer.

Navigating GPC EFT Safely: Stay ahead of the game with insights into prevalent scams and fraud methods associated with GPC transactions.

Cracking the Code: GPC EFT Edition: Be scam smart by learning about the deceptive tactics targeting GPC EFT transactions.

Safety First in GPC EFT World: Identifying and avoiding potential frauds to ensure your financial peace of mind in the GPC EFT realm.

How Does GPC EFT Appear on a Bank Statement?

Look for a clear entry with the vendor’s name, payment amount, and date. It Is not a secret code but a straightforward debit, indicating money was securely taken for the transaction. GPC EFT transactions are your financial superhero, ensuring quick and efficient payments. Your bank statement just got friendlier with GPC EFT easy to read, easy to manage!

Benefits of Using GPC EFT for Bill Payments

No more check writing hassles, just easy transactions at your fingertips. Boost your cash flow by sidestepping the waiting game GPC EFT ensures swift payments without delays.

Say goodbye to fraud concerns GPC EFT payments are secure, safeguarding your financial peace of mind. With digital records and timely payments, GPC EFT not only simplifies your life but also fosters better vendor relationships.

Tips to Guard Against GPC EFT Fraud:

Essential tips to safeguard your GPC EFT transactions from potential frauds.

Smart Banking Moves: Stay one step ahead with these foolproof tips to guard against GPC EFT fraud.

Safety First in GPC EFT Realm: Top notch strategies to protect your financial turf from any GPC EFT fraud attempts.

Secure Spending 101: Elevate your financial security with these practical tips to shield your GPC EFT transactions.

Fraud Busters for GPC EFT Users: A comprehensive guide to empower you against any fraudulent activities in the GPC EFT world.

Also Read this Blog: https://financenexgen.com/what-is-google-wm-max-llc-charge-on-your-bank-statement/(opens in a new tab)

Handling GPC EFT Transactions

Mastering GPC EFT transactions like a pro is a piece of cake, verify vendor compatibility, keep digital records organized, and sail through hassle free accounting. It is not just a payment method, it is your ticket to efficient and streamlined official purchases. Take control of your financial ship, and let GPC EFT transactions navigate smoothly. Stay savvy, stay in control.

Frequently asked question

What information does a GPC EFT transaction include?

It typically includes the vendor’s name, transaction amount, date, and occasionally a reference number, providing clarity on the payment.

How do I handle an unrecognized GPC EFT charge?

Review the transaction details, contact the merchant for clarification, and if needed, report the issue to your bank for resolution.

What does GCP stand for?

GCP stands for Government Purchase Card, a specialized credit card used by government employees and authorized contractors for official purchases.

What steps should I take if I suspect GPC EFT fraud?

Contact your bank immediately, report the suspected fraud, and notify the issuing government agency for investigation.

How do I navigate GPC EFT transactions with confidence?

Understand vendor compatibility, keep meticulous records, and embrace the digital benefits of GPC EFT for streamlined financial management.

How can I decipher GPC EFT on my bank statement easily?

Understand the vendor, transaction amount, and date, embrace the benefits of GPC EFT for efficient financial management.

Summary

Ever noticed a puzzling entry labeled GPC EFT on your bank statement. Fear not GPC EFT translates to Government Purchase Card Electronic Fund Transfer, indicating a payment made with a specialized credit card for government related transactions. This transaction, appearing as a debit, includes vital details like the vendor’s name, amount, and date, simplifying identification and offering a transparent view of your financial activity.

It is not just a code, I is a smart and secure way for government employees and authorized contractors to manage official purchases efficiently. Delving into the world of GPC EFT unveils a host of advantages. This streamlined payment method ensures easy, secure transactions, eliminating the need for cumbersome check writing.

Experience improved cash flow with swift payments, fortified security measures to thwart fraud attempts, and the luxury of digital record keeping for organized financial management. GPC EFT is not just about transactions; it is about fostering better relationships with vendors, ensuring timely payments, and ultimately creating a hassle free financial experience for all involved.