Equinox Moto on your bank statement refers to transactions associated with the upscale Equinox fitness center. It is a label encompassing charges like membership fees or service costs. Understanding these entries helps demystify financial statements and clarifies their connection to your fitness expenses.

Have you ever spotted a puzzling “Equinox Moto” charge on your bank statement Fear not, This mysterious term is linked to transactions from the upscale Equinox fitness center, covering membership fees and related costs. Discover the connection between Equinox Moto and the American Express Platinum Card’s exclusive Equinox Credit, offering cardholders a $300 annual benefit.

What Is The Equinox Moto?

If you are scratching your head over an “Equinox Moto” charge on your bank statement, This term simply represents transactions related to the high end Equinox fitness center, encompassing membership fees and associated costs. It is not a mysterious entity but a label for various Equinox related expenses. Dive into the details and demystify the “Equinox Moto” enigma effortlessly.

Equinox Moto charges

Equinox Moto charges on your bank statement signify transactions tied to the upscale Equinox fitness center, covering membership fees and related expenses. It is a straightforward label for various Equinox related costs.

Here are some of the common ways these charges may be listed:

- Equinox Moto charges represent various transactions related to Equinox fitness centers, such as membership fees and service costs.

- These charges can appear on bank statements in different forms, including “CHKCARDEQUINOX MOTO” or “POS PUR EQUINOX MOTO.

- Demographic considerations reveal that individuals with higher disposable incomes, valuing luxury fitness amenities, benefit most from the Equinox Credit.

- Addressing Equinox Moto concerns involves verifying the accuracy of charges, recognizing potential fraud, and taking prompt action to dispute unauthorized transactions with Equinox and your bank.

The Equinox Credit and American Express Platinum Card

The Equinox Credit is a unique perk for American Express Platinum Cardholders, offering a $300 annual benefit. Cardholders can enroll through the American Express website, receiving $25 monthly credits towards specific Equinox memberships. This exclusive feature eases the financial burden for those enjoying the upscale amenities of Equinox fitness centers.

More information: https://financenexgen.com/what-is-gpc-eft-transactions-on-my-bank-statement/

How the Equinox Credit Works:

The Equinox Credit, a perk for American Express Platinum Cardholders, works by providing a $300 annual benefit dispersed as $25 monthly credits. To enjoy this financial relief, cardholders need to actively enroll through the American Express website, where the credits are applied towards specific Equinox memberships. This user friendly process helps reduce the overall cost of maintaining an Equinox membership.

Enrollment and Utilization Process:

Equinox Moto charges signify transactions linked to the upscale Equinox fitness center, covering membership fees and related expenses.

These charges can appear in various forms on your bank statement, such as “CHKCARDEQUINOX MOTO” or “POS PURCHASE EQUINOX MOTO.”

Enrollment in the Equinox Credit is not automatic, cardholders must actively enroll through the American Express website to take advantage of this financial perk.

Understanding the Equinox Moto entries involves recognizing common forms on bank statements and unraveling the connection between these charges and Equinox related financial activities.

Common Forms of Equinox Moto Charges

Equinox Moto charges on your bank statement may appear in various forms, such as “CHKCARDEQUINOX MOTO” or “POS PUR EQUINOX MOTO,” indicating different transaction types.

These entries can signify check card transactions, in person point of sale purchases, or even pre authorization charges related to Equinox services. Recognizing these common forms helps decipher the nature of the transactions associated with your Equinox membership.

Cost Analysis and Demographic Considerations

Equinox memberships feature varied costs, and the Equinox Credit from the American Express Platinum Card offers a monthly rebate, making it advantageous for those prioritizing upscale fitness experiences with a higher disposable income.

The value of this benefit is based on individual financial and lifestyle circumstances.

Cost Breakdown of Equinox Memberships:

- Equinox memberships have diverse costs, varying based on the type and location.

- Monthly fees for an Equinox All Access Membership can be around $275.

- Other options like the Equinox Destination or E by Equinox Memberships may have different pricing structures.

- The Equinox Credit from the American Express Platinum Card provides a monthly rebate on these fees.

- The value of this benefit depends on an individual’s financial circumstances and lifestyle preferences.

Demographic and Lifestyle Considerations:

- The Equinox Credit caters to individuals prioritizing high end fitness experiences.

- This demographic typically includes professionals with a higher disposable income.

- Equinox memberships offer substantial annual savings of $300 for regular patrons.

- The credit may hold less value for those not frequently using upscale fitness amenities.

- Considering lifestyle preferences and budget helps determine the suitability of the Equinox Credit for each individual.

Equinox Moto as a Potential Scam

Be cautious if Equinox Moto charges on your bank statement seem unfamiliar, as instances of potential scams have been reported. While generally associated with legitimate Equinox transactions, discrepancies may indicate unauthorized charges.

Fraud prevention organizations suggest monitoring for unrecognized charges, differentiating between valid entries and possible scams. If in doubt, verifying transactions with Equinox or your bank ensures swift resolution and safeguards against fraudulent activities.

How to Cancel Equinox Memberships?

If you decide to cancel your Equinox membership, start by reviewing the membership terms for notice periods and cancellation fees. Contact your local Equinox club, either in person or through their provided contact information, and follow their cancellation procedure.

If visiting in person, request a written confirmation of your cancellation. Ensure your cancellation letter includes your full name, address, membership number, and a clear statement expressing your desire to cancel. Monitor your bank statements afterward to confirm the cancellation and avoid any additional charges.

Contact Your Local Equinox Club:

To cancel your Equinox membership, reach out to your local Equinox club directly using the contact information provided on their website or in your membership agreement. Whether in person or by mail, contacting the club ensures a smooth and straightforward cancellation process.

Visit the Club in Person (Recommended):

For the most effective cancellation process, visiting your local Equinox club in person is recommended. This allows for direct communication and immediate confirmation of your membership cancellation.

How to Resolve Equinox Moto Issues

If you encounter unfamiliar Equinox Moto charges on your bank statement, start by verifying the accuracy of the transactions. Double check your Equinox usage and compare it with the listed charges. If discrepancies persist, promptly contact Equinox customer service to seek clarification on the nature of the charges.

In case the Equinox Moto issues persist or remain unclear, consider initiating a dispute with your bank. Provide them with details about the disputed charges and any communication with Equinox.

Simultaneously, closely monitor your bank statements for updates on the dispute resolution and to ensure that no further unauthorized charges occur. Taking swift action and staying vigilant will help address and resolve Equinox Moto issues efficiently.

How Can I Understand Equinox Moto Entries?

Understanding Equinox Moto entries starts with recognizing common forms on your bank statements, such as “CHKCARDEQUINOX MOTO” or “POS PUR EQUINOX MOTO.” These abbreviations represent different transaction types related to Equinox services, providing clues about the nature of each charge. Familiarizing yourself with these forms helps in deciphering your financial activities associated with Equinox memberships.

Unraveling the mystery further involves establishing the link between these entries and your specific Equinox related financial activities. Whether it is a direct purchase at an Equinox location or a pre authorization charge for membership setup, understanding the context of each entry is crucial.

By connecting the dots between the listed forms and your interactions with Equinox, you gain a clearer understanding of the purpose behind each Equinox Moto entry on your bank statement.

Potential for Equinox Moto as a Scam

If you spot unfamiliar Equinox Moto charges on your bank statement, exercise caution, as there is a potential for scams. While these charges are typically legitimate and linked to Equinox fitness center transactions, instances of fraudulent activities have been reported.

Stay vigilant and thoroughly review your bank statements to ensure all Equinox Moto charges align with your actual usage of Equinox services. Instances of scams often involve unauthorized charges under the guise of Equinox Moto, catching those without an Equinox membership off guard.

To safeguard against potential fraud, closely monitor your bank statements and cross reference the charges with your Equinox activities. If discrepancies arise or charges seem unfamiliar, take immediate action by contacting Equinox and your bank to investigate and address any potential fraudulent Equinox Moto charges.

HOW DOES WORK Equinox Moto

Equinox Moto charges on your bank statement aren’t a mysterious entity but a label for transactions tied to Equinox fitness centers. Whether it is a check card transaction, point of sale purchase, or pre authorization charge, Equinox Moto encompasses various financial activities associated with your Equinox membership, such as membership fees, service charges, and refunds.

The connection between Equinox Moto charges and the American Express Platinum Card lies in the exclusive Equinox Credit. This unique perk offers cardholders an annual benefit, dispersed as monthly credits. To take advantage of this, cardholders need to actively enroll through the American Express website, reducing the financial burden of Equinox memberships by applying these monthly credits to certain membership fees.

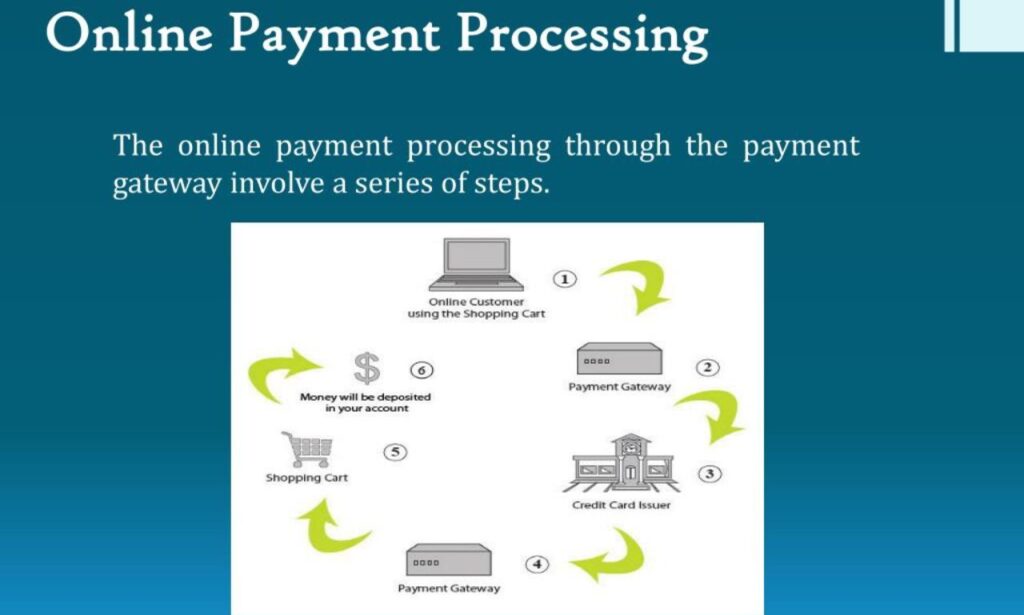

Equinox MOTO Payment Processing

Equinox Moto payment processing involves various methods, including check card transactions, point of sale purchases, and pre authorization charges, reflecting different aspects of Equinox fitness center services on your bank statement.

These entries encapsulate membership fees, service charges, and refunds, offering a comprehensive overview of your financial interactions with Equinox. Understanding the nuances of Equinox Moto payment processing helps demystify the nature of these transactions and ensures clarity in your financial records.

Also Read This Blog:https://financenexgen.com/what-is-google-wm-max-llc-charge-on-your-bank-statement/(opens in a new tab)

How do I dispute unauthorized Equinox Moto charges?

If you discover unauthorized Equinox Moto charges on your bank statement, the first step is to contact your bank and initiate a dispute. Provide them with detailed information about the specific charges in question and any relevant communication you have had with Equinox regarding the matter. Promptly addressing these unauthorized charges ensures a swift resolution and protects your financial well being.

Once the dispute process is initiated, closely monitor your bank statements for updates on the resolution. If the unauthorized charges persist or if you encounter any challenges, follow up with your bank promptly. Additionally, keeping Equinox informed about the dispute ensures open communication channels and enhances the likelihood of a successful resolution. Taking proactive steps in disputing unauthorized charges safeguards your financial security and helps maintain the integrity of your bank statements.

Frequently Asked Questions

What information do I need to cancel my Equinox membership?

Have your membership details, including ID, personal information, and relevant billing details, ready for a streamlined process.

Can Equinox Moto entries be a result of system errors?

While rare, system errors can occur, and contacting Equinox for clarification is recommended.

What steps can I take to prevent Equinox Moto scams?

Regularly monitor your accounts, cross reference charges with Equinox activities, and report any discrepancies promptly.

Can Equinox Moto charges be fraudulent?

In some cases, yes. Monitor your bank statements and take immediate action if charges seem unfamiliar or unauthorized.

Why do I see Equinox Moto if I haven’t visited Equinox?

Review your bank statement for unauthorized or incorrect charges, and verify with Equinox if needed.

Conclusion

Equinox Moto on your bank statement is not a standalone service but a label for transactions linked to Equinox fitness centers. These transactions include membership fees, service charges, and refunds, and the appearance of Equinox Moto can take various forms on your statement, like “CHKCARDEQUINOX MOTO” or “POS PUR EQUINOX MOTO.

The connection between Equinox Moto charges and the American Express Platinum Card is through the exclusive Equinox Credit. This unique benefit offers cardholders a $300 annual credit dispersed as $25 monthly credits, reducing the financial burden of Equinox memberships.

Understanding the relationship between Equinox Moto charges, your bank statement, and the Equinox Credit provides clarity on the financial dynamics associated with your upscale fitness experiences.

Alexander, our distinguished author, boasts 6 years of rich experience in finance. His profound insights and adeptness in navigating financial intricacies make him a valuable asset, ensuring content that resonates with expertise.