Gold has long been regarded as a haven asset, a store of value, and a hedge against inflation and economic uncertainty. Its allure as a precious metal has captivated investors for centuries, making it a focal point for those seeking stability and potential returns. In the ever-evolving world of finance, FintechZoom has emerged as a pioneering platform that revolutionizes the way investors approach the gold market.

Gold Price Fintechzoom Overview

FintechZoom is a cutting-edge financial technology platform that provides real-time data, insights, and comprehensive analyses related to the gold market. It empowers investors with a wealth of tools and resources to navigate the intricacies of gold investing, offering a seamless and informed experience.

As a commodity with a finite supply, gold’s price is primarily driven by the intricate interplay of supply and demand dynamics. However, its status as an investment asset sets it apart from other commodities. Gold is widely regarded as a safeguard against inflation and currency devaluation, making it a coveted asset for central banks and investors alike.

Central banks around the world hold substantial gold reserves to diversify their portfolios and hedge against economic uncertainties. This practice stems from gold’s intrinsic value as a finite physical commodity that retains its worth even in times of turmoil.

Gold’s desirability as a store of value led to the establishment of the gold standard, a monetary system where currencies were directly linked to the precious metal. While most countries have abandoned this system, gold’s significance in the global financial landscape remains undiminished.

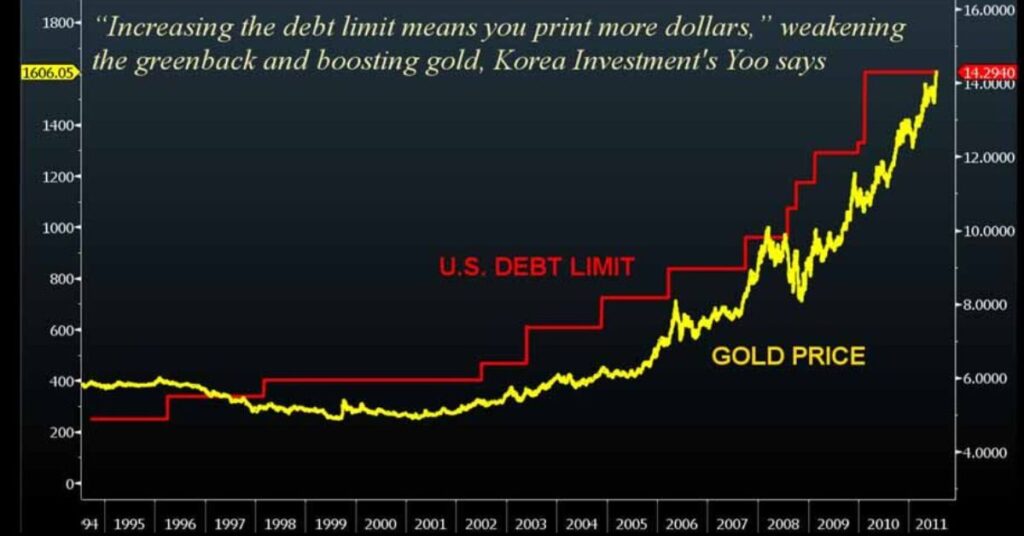

One of the key factors influencing gold prices is currency movements, particularly those of the U.S. dollar. A weaker dollar tends to boost gold prices, as investors seek alternative assets to preserve their purchasing power. Conversely, a stronger dollar can dampen demand for gold, leading to lower prices.

Investors can gain exposure to gold through various avenues, such as physical bullion, gold futures and options contracts, gold-mining stocks, or gold-linked exchange-traded funds (ETFs). FintechZoom provides a comprehensive platform for investors to explore and capitalize on these investment opportunities.

Gold Price Dynamics Over The Past Year

The gold market has witnessed remarkable price movements over the past year, reflecting the ever-changing global economic landscape and investor sentiment.

As of April 2024, the price of gold has decreased by 1.50% since the beginning of the year, currently hovering around $2,030 per ounce. Despite this recent dip, the overall trajectory for the past year has been positive, with gold prices experiencing a change of over 10%.

The precious metal reached an all-time high of $2,150 per ounce in December 2023, fueled by geopolitical tensions, economic uncertainties, and rising inflation concerns. However, as the Federal Reserve initiated aggressive rate hikes in 2022 to combat soaring inflation, gold prices experienced volatility and a downtrend before staging a remarkable recovery in 2023.

The moderation of inflation expectations and the potential easing of monetary policy by central banks have contributed to gold’s resurgence, reinforcing its appeal as a safe-haven asset during turbulent times.

Fintechzoom Gold Investment Strategies

Investing in gold can offer a unique balance between safety and potential returns. While gold is considered a safe-haven asset, capable of maintaining its value during economic downturns, it also possesses the potential to appreciate, making it an attractive investment proposition.

When embarking on a gold investment journey, it is essential to have clearly defined objectives and a well-crafted strategy. FintechZoom’s platform revolutionizes gold investment strategies by offering a modern approach that provides investors with a fresh perspective and streamlined access to gold investments.

Despite gold’s historical stability, it is not immune to market fluctuations. Therefore, understanding one’s risk tolerance and having an exit strategy is crucial for successfully navigating the often-volatile waters of gold investment.

One effective strategy is to diversify investments across various asset classes, including gold, to mitigate exposure to market volatility. Another tactic, known as “dollar-cost averaging,” involves investing a fixed amount at regular intervals, thus averaging out the impact of price fluctuations over time.

FintechZoom’s advanced tools and analytics empower investors to develop and implement tailored strategies that align with their investment goals and risk profiles. By leveraging the platform’s real-time data and insights, investors can make informed decisions and capitalize on emerging opportunities in the gold market.

What Moves Gold Price On Fintechzoom?

The price of gold on FintechZoom is influenced by a multitude of factors, each playing a crucial role in shaping the global gold market. Understanding these drivers is essential for investors seeking to navigate the complexities of gold investing successfully.

London Bullion Market Association (Lbma) Gold Price

The LBMA Gold Price serves as a central reference point for the physical gold market, established through an electronic auction held twice daily. This benchmark price is widely accepted globally for valuing significant gold transactions and is a key determinant of gold prices on FintechZoom.

Key aspects of the LBMA Gold Price include:

- An electronic auction platform managed by ICE Benchmark Administration Limited.

- Participants consisted of major banks and trading houses.

- Auctions are held twice daily, once in the morning and once in the afternoon.

- The opening price is set based on an equilibrium point where supply and demand bids balance out.

- Widely accepted as a benchmark for valuing large gold transactions across the globe.

Gold Futures Market

Gold futures contracts, traded on prominent exchanges like COMEX in New York or the Multi Commodity Exchange (MCX) in India, play a pivotal role in price discovery and influence gold prices on FintechZoom. These contracts provide insights into future price expectations based on factors such as inflation, interest rates, and currency rates.

Key features of the gold futures market include:

- A standard contract size of 100 troy ounces, with additional smaller contracts available.

- Trading times spanning from 6:00 p.m. U.S. ET until 5:00 p.m. U.S. ET, Sunday through Friday.

- Prices influenced by supply and demand dynamics, as well as speculative trading activities.

Supply And Demand Dynamics

The fundamental principle of supply and demand is a cornerstone in determining gold prices on FintechZoom. Mine production and recycled gold contribute to the overall supply, while demand stems from various sectors, including jewelry making, investment, and central bank reserves.

Imbalances between supply and demand exert significant pressure on gold prices. Several factors influence these dynamics:

- Gold’s use in jewelry and electronics impacts its demand, with rising consumer spending often driving prices higher.

- Monetary policy and interest rates can influence gold prices through the concept of “opportunity cost,” where higher interest rates make gold investments less appealing compared to interest-bearing securities.

- Economic indicators such as employment figures, wages, and GDP growth can indirectly impact gold prices through their influence on the Federal Reserve’s monetary policy decisions.

- Gold is priced internationally in U.S. dollars, making currency fluctuations a critical factor influencing its price. A weaker dollar typically increases demand for gold as an alternative asset, while a stronger dollar can dampen demand and lower gold prices.

Gold Price Fintechzoom Vs. Traditional Gold Investment

FintechZoom has revolutionized the way investors approach gold, bringing convenience, accessibility, and transparency to the forefront. The traditional methods of physically holding gold or navigating convoluted investment channels are giving way to a new era of streamlined and user-friendly platforms like FintechZoom.

One of the key advantages of FintechZoom is its ability to provide a safe and open platform, enabling investors to monitor their holdings and the market’s performance with ease. The platform’s user-friendly interface and advanced tools empower even those with limited financial expertise to confidently engage in gold transactions.

In contrast to traditional investment methods, FintechZoom offers a comprehensive suite of features that cater to the needs of modern investors. Tools for comparing gold prices with other market indicators, currencies, or commodities provide a broader perspective on the relationship between gold and various economic factors.

Placing buy and sell orders on FintechZoom is a seamless process, further enhancing the platform’s appeal. Potential investors can sign up for an account, undergo necessary verification processes for safety and legality, and gain access to a wide range of gold investment vehicles, including physical gold and ETFs that track gold prices.

FintechZoom’s commitment to transparency and investor protection sets it apart from traditional investment channels. By providing real-time data, in-depth analysis, and educational resources, the platform equips investors with the tools they need to make informed decisions and navigate the complexities of the gold market with confidence.

Fintechzoom Features For The Gold Market

FintechZoom offers a comprehensive suite of features that cater to investors seeking real-time updates, historical trends, and in-depth analyses of the gold market. By leveraging these powerful tools, investors can gain a competitive edge and make informed decisions in the dynamic world of gold investing.

Real-Time Updates: At the core of FintechZoom’s offering is its ability to provide users with up-to-the-minute updates on gold prices. This real-time data ensures that investors have access to the latest market information, enabling them to react swiftly and seize opportunities as they arise.

Investment Vehicles: FintechZoom’s platform offers a diverse range of gold investment vehicles, including physical gold, gold-backed exchange-traded funds (ETFs), and gold futures contracts. This versatility allows investors to choose the investment option that best aligns with their risk tolerance, investment horizon, and overall financial goals.

Historical Trends: By offering access to comprehensive historical data on gold prices, FintechZoom enables users to track and analyze past trends, identify patterns, and gain a deeper understanding of how gold prices have evolved over time. This historical perspective is invaluable for developing effective investment strategies and making well-informed decisions.

In-Depth Analyses: FintechZoom goes beyond merely providing raw data by offering in-depth analyses of the gold market. Users can access expert insights, market commentary, and trend analyses, empowering them to interpret the data effectively and stay ahead of market shifts.

Market Indicator Comparison: One of the standout features of FintechZoom is its ability to compare gold prices with various market indicators, such as stock indices, currency exchange rates, or commodity prices. This comparative analysis allows traders to understand the interplay between different asset classes and make more informed investment decisions.

Performance Metrics: FintechZoom’s gold price charts provide performance metrics that allow users to assess how gold prices stack up against other assets over different time frames. This feature aids in evaluating the relative strength of gold as an investment option and identifying potential opportunities for diversification.

Customizable Tools: The platform offers customizable tools for comparative analysis, allowing users to tailor their comparisons based on specific parameters or preferences. Additionally, the personalized alerts feature keeps users updated on critical price movements and events that could impact their investments, even when they are not actively monitoring the platform.

Educational Resources: FintechZoom recognizes the importance of investor education and provides a wealth of educational resources, including tutorials, webinars, and market insights. These resources are designed to help investors develop a deeper understanding of the gold market, enabling them to make more informed and confident investment decisions.

By leveraging these powerful features, FintechZoom empowers investors to navigate the complexities of the gold market with ease, positioning themselves for success in an ever-changing financial landscape.

Also Read This Blog: Fintechzoom Boeing Stock In 2063

S&P 500 Vs. Gold: Which Is The Better Investment?

When it comes to investing, comparing the performance of different asset classes is crucial for making informed decisions. In the realm of gold and equities, the age-old debate of S&P 500 versus gold often arises. While both assets have their unique characteristics and appeal, their performance over various time frames can provide valuable insights for investors.

Recent Performance:

- Gold: In the wake of global uncertainties and economic turmoil, gold reached an all-time high of nearly $2,150 per ounce in December 2023 and spiked above $2,000 per ounce during the Russia-Ukraine conflict in early 2022.

- S&P 500: The S&P 500, a widely followed benchmark for the U.S. stock market, is up 7.6% in 2023, reflecting the resilience of the equity markets despite ongoing challenges.

One-Year Performance:

- Gold: The SPDR Gold Shares ETF (GLD), which tracks the price of gold bullion, is up 8.6% so far in 2023, showcasing gold’s appeal as a safe-haven asset during periods of uncertainty.

- S&P 500: The S&P 500 has also delivered a respectable 7.6% return in 2023, highlighting the continued strength of the U.S. equity markets.

Five-Year Performance:

- Gold: According to FintechZoom’s gold price charts, from 1990 to 2020, the price of gold increased by around 360%, reflecting its long-term value as a store of wealth.

- S&P 500: Over the same period, the Dow Jones Industrial Average (DJIA) gained an impressive 991%, demonstrating the potential for substantial growth in equities over an extended time frame.

Ten-Year Performance:

- Gold: For the last decade, gold prices have risen by 55%, showcasing its resilience and ability to preserve value during periods of economic turmoil.

- S&P 500: However, the S&P 500 Index has outperformed gold significantly over the long term, with an average annual total return of around 164% over the last 10 years.

While gold can outperform the S&P 500 for short periods, over extended periods like the last decade, the S&P 500 has consistently outperformed gold. This trend is also reflected in the performance of other major equity indices, as shown by the promising trends in the Dow Jones FintechZoom over the 5-year range.

For long-term investors, it is advisable to consider this performance difference when making investment decisions. Many financial advisors recommend allocating a majority of investments to broad-based equity index funds or exchange-traded funds (ETFs) like the S&P 500 ETF Vanguard (VOO), while reserving a smaller portion for alternative assets like precious metals such as gold.

Gold Price (5-Year Forecast) By Fintechzoom

As investors seek to navigate the ever-changing landscape of the gold market, FintechZoom’s analysts have provided a 5-year forecast for gold prices. This forecast offers valuable insights into the potential trajectory of this precious metal, enabling investors to make informed decisions and plan their investment strategies accordingly.

| Year | Average Price | Year-End Price | High Price |

| 2024 | $2,017.05 | $2,073.05 | $2,084 |

| 2025 | $2,156 | $2,264 | $2,317 |

| 2026 | $2,395 | $2,481 | $2,705 |

| 2027 | $2,553 | $2,681 | $2,707 |

| 2028 | $2,553 | $2,681 | $2,707 |

Disclaimer: This table is based on the analysts’ opinions and should not be considered financial advice. Please remember that past performance is not indicative of future results.

According to the forecast, gold prices are expected to maintain an upward trajectory over the next five years, potentially reaching new highs. The analysts predict that by 2028, the average price of gold could reach $2,553 per ounce, with a year-end price of $2,681 and a potential high of $2,707.

However, it is crucial to note that these projections are subject to change based on various economic and geopolitical factors, including global economic growth, inflation rates, currency fluctuations, and central bank policies.

Investors interested in exploring other market indices can also check out FintechZoom’s Nasdaq charts for additional insights and analysis.

Conclusion

Gold’s role as a haven asset and store of value makes it a crucial portfolio diversifier. While a hedge against inflation, investors must evaluate their risk tolerance before investing. FintechZoom empowers investors by providing real-time gold data, in-depth analysis and forecasting tools.

Overall, the article emphasizes making informed gold investment decisions using platforms like FintechZoom in 2024. It underscores gold’s potential in a balanced portfolio but stresses carefully considering individual financial goals and economic conditions. Ultimately, an understanding of gold market dynamics using cutting-edge fintech resources can optimize investment strategies.

FAQ’s

Is It Smart To Invest In Gold?

Investing in gold can be a prudent diversification strategy, offering stability during economic uncertainty, but it’s not without risks. Consider factors like market conditions and your investment goals before deciding.

How Do You Invest In Gold?

Gold can be invested in through various means, including purchasing physical gold, investing in gold ETFs or mutual funds, trading gold futures, or buying gold mining stocks. Each method carries its own set of risks and benefits, so research thoroughly before choosing.

What Is The Prediction For Gold Investments?

Predicting gold investments is challenging due to various factors influencing its price, such as economic conditions, geopolitical events, and investor sentiment. While some analysts may offer forecasts, they’re inherently uncertain and subject to change.

How Do You Analyze Gold Prices?

Gold prices can be analyzed through technical analysis, examining historical price data and chart patterns, or fundamental analysis, considering factors like supply and demand, inflation, and currency movements. Both approaches provide insights into potential price movements.

What Is The Best Indicator For Gold Price?

The best indicator for gold price varies depending on your investment strategy and preferences. Some commonly used indicators include moving averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence), but no single indicator guarantees accuracy.

What Are The Methods Of Gold Analysis?

Methods of gold analysis include chemical assays to determine purity, spectroscopy techniques for trace element analysis, and X-ray fluorescence for non-destructive testing. Each method serves different purposes, from assessing the quality of bullion to analyzing geological samples.

What Are The Two Methods Of Finding Gold?

Prospecting involves physically searching for gold deposits in rivers, streams, or geological formations, often using tools like metal detectors or panning equipment. Geological exploration utilizes scientific methods such as sampling, mapping, and drilling to identify potential gold-rich areas underground.

What Are The Two Ways To Find Gold?

Gold can be found through placer mining, where gold particles are extracted from loose sediments in rivers and streams, or through hard rock mining, which involves extracting gold from solid rock formations deep underground using machinery and explosives. Both methods require careful planning and investment.