Lean in finance refers to the application of lean management principles to financial processes and operations. It aims to optimize efficiency, reduce waste, and improve overall performance within financial functions.

Lean in finance involves streamlining financial activities, eliminating non value adding tasks, and fostering continuous improvement to enhance value for both customers and stakeholders. It emphasizes the removal of waste within financial processes to achieve greater efficiency and effectiveness.

Benefits of Lean Finance

Implementing Lean Finance practices offers numerous advantages:

- Reduced operational costs.

- Enhanced financial reporting accuracy.

- Improved decision making efficiency.

- Boosted overall financial performance.

Adopting Lean Finance principles can lead to streamlined processes and improved performance across the organization.

Who Leads Lean Finance?

Lean Finance is typically led by CFOs, financial controllers, and financial analysts within organizations, spearheading the implementation of lean principles.

These finance professionals play a crucial role in ensuring alignment with lean principles, driving efficiency improvements and value creation.

Scope of Lean Finance

The scope of Lean Finance includes optimizing financial processes and activities to enhance efficiency and effectiveness.

It covers various areas such as budgeting, forecasting, financial analysis, cost control, corporate finance, and lean accounting.

These efforts aim to streamline operations, eliminate waste, and drive continuous improvement throughout the financial function of an organization.

Empowering Decision-Making

Empowering decision-making involves providing individuals at all levels with the information and tools needed to make informed choices.

By simplifying financial reporting and analysis, lean finance enables quicker and more effective decision-making processes.

Focus on the Future

Focusing on the future in lean finance entails shifting from past-oriented reporting to forward-looking activities.

It involves dedicating time to tasks like identifying cost savings, evaluating investments, and implementing new systems for long-term success.

Also Read: what are public finances

Process Re-Engineering and Continuous Improvement

In Lean Finance, streamlining processes through re engineering enables efficiency gains and fosters ongoing improvement. Key steps include:

- Defining customer value

- Mapping value streams

- Identifying bottlenecks

- Applying continuous improvement methods

- Embracing automation and IT solutions

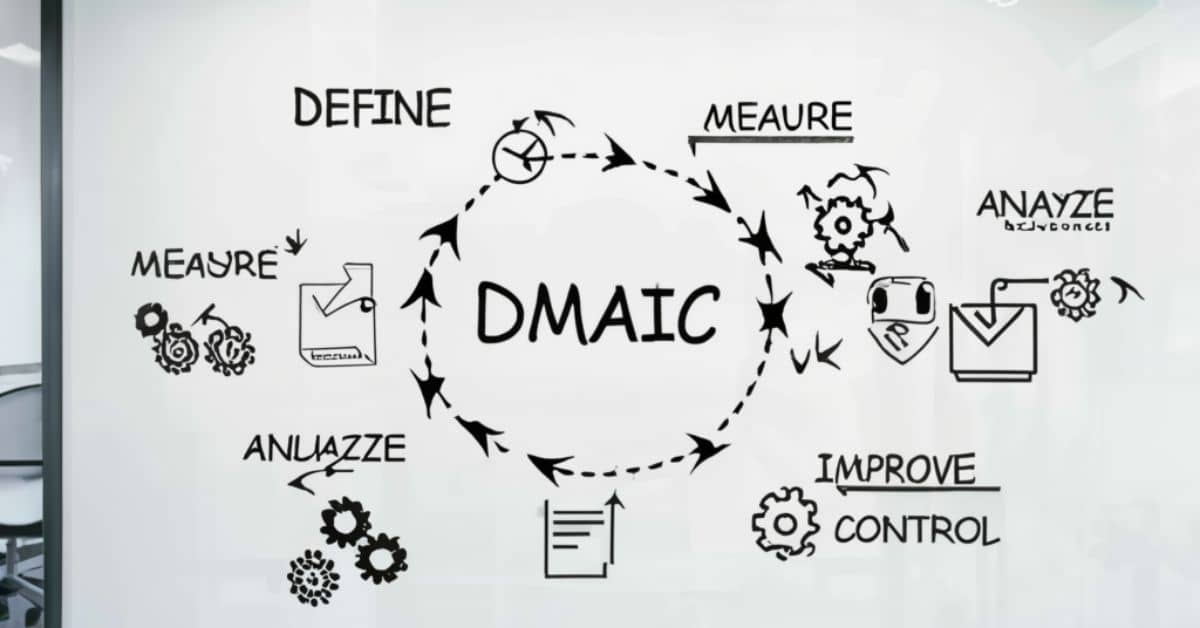

Using Six Sigma DMAIC in Lean Finance

Six Sigma DMAIC, a method derived from Lean Finance, aims to enhance efficiency and reduce errors in financial processes.

- Define project goals

- Measure current process performance

- Analyze process data

- Improve processes based on analysis

- Control and monitor improved processes

Lean Accounting: A Major Focus Area

Lean Accounting focuses on streamlining financial processes and aligning them with operational goals to eliminate waste and improve efficiency. It emphasizes delivering value and facilitating decision making through accurate and timely financial reporting.

One major aspect of Lean Accounting is the integration of financial metrics with operational performance indicators. This ensures that financial reporting reflects the organization’s value stream and supports continuous improvement efforts.

Further Learning Resources

For those interested in delving deeper into Lean Finance, numerous resources are available to enhance understanding and application. Online courses, books, and webinars offer valuable insights into Lean Finance principles and practices.

Leading authors such as Nicholas Katko and David Parmenter provide comprehensive guides on Lean Finance implementation and optimization strategies. Additionally, platforms like Gemba Academy offer interactive courses and interviews with industry experts to support ongoing learning.

The Importance of Lean Finance

Lean Finance is crucial for organizations aiming to enhance operational efficiency, reduce waste, and maximize value creation across financial activities.

Benefits of Lean Finance:

Cost Reduction: Lean principles help minimize unnecessary expenses, leading to significant cost savings.

Enhanced Efficiency: By streamlining processes, Lean Finance optimizes resource utilization, saving time and effort.

Improved Decision-Making: Access to accurate and timely financial data empowers informed decision-making at all levels.

Greater Agility: Lean Finance enables organizations to adapt quickly to changing market conditions and customer needs.

Strategic Alignment: Aligning financial activities with organizational goals fosters better strategic planning and execution.

What are the Lean Finance Principles?

The Lean Finance Principles are based on the core tenets of lean management and include:

Specify Customer Value: Identifying and understanding the value desired by the customer.

Map the Value Stream: Analyzing and optimizing the process flow to eliminate waste and inefficiencies.

Create Continuous Flow: Ensuring a smooth and uninterrupted flow of work to deliver value efficiently.

Implement Pull Systems: Establishing systems where work is pulled based on demand, reducing overproduction.

Pursue Perfection: Striving for continuous improvement to achieve higher levels of efficiency and effectiveness.

Why is Lean Finance Effective?

Lean Finance is effective because it optimizes processes, reduces waste, and enhances efficiency in financial operations, leading to cost savings and better resource utilization. By streamlining workflows, it enables quicker decision-making and strategic support for business objectives.

The methodology’s focus on eliminating non value added tasks and improving workflows results in faster analysis, better reporting, and ultimately, improved financial performance for organizations. This approach also fosters a culture of continuous improvement, ensuring ongoing efficiency gains over time.

How to Adopt Lean Finance Practices

To adopt Lean Finance practices, start by identifying stakeholders and their value expectations. Streamline processes, automate where possible, and introduce pull based workflows to enhance efficiency and reduce waste.

Encourage a culture of continuous improvement and provide training to ensure team members understand and embrace Lean Finance principles. Regularly review and refine processes to maintain efficiency and adapt to changing business needs.

Specify the value desired by the customer

Specify the value desired by the customer by understanding their needs and expectations. Tailor products and services to meet these requirements effectively.

Identify the value stream and challenge wasted steps currently utilized to provide it

Identify the value stream to understand the sequence of activities needed to deliver value to the customer. Challenge wasteful steps to streamline processes and improve efficiency in value delivery.

Make the value flow continuously through the remaining steps

Ensure the smooth flow of value through each step of the process without interruptions or delays. This involves optimizing workflow and eliminating bottlenecks to maintain a steady value stream.

Introduce pull between steps

Implement a system where each step in the process pulls resources only when needed from the preceding step. This ensures a more efficient and responsive workflow, reducing waste and improving productivity.

Manage towards a process where time needed to move through until the time declines between steps

Strive to continuously reduce the time required to move through each step of the process, promoting greater efficiency and faster delivery of value to the customer. This ongoing improvement helps streamline operations and enhances overall productivity.

Should We Adopt Lean Finance in Our Work Habits?

Considering adopting Lean Finance in work habits involves weighing efficiency gains against potential drawbacks. While Lean principles can streamline processes and reduce waste, they may overshadow core principles if not aligned properly with company values.

However, adopting a mindset of continual improvement can benefit accounting teams, promoting smarter resource utilization and long lasting organizational change. It is essential to balance Lean Finance with maintaining the integrity of your company’s core principles and objectives.

FREQUENTLY ASKED QUESTION?

What does lean mean in banking?

In banking, lean refers to optimizing processes to eliminate waste, enhance efficiency, and deliver high-quality services to customers.

What is the concept of lean?

Lean is a management philosophy focused on minimizing waste and maximizing value by continuously improving processes and eliminating non-value-added activities.

What does lean mean in business?

In business, lean means adopting practices to streamline operations, reduce costs, and improve productivity by eliminating waste and inefficiencies.

Why is lean important?

Lean is important because it helps businesses improve efficiency, reduce costs, enhance quality, and respond quickly to customer needs, ultimately leading to increased competitiveness and profitability.

What is lean SDLC?

Lean SDLC, or Lean Software Development Life Cycle, applies lean principles to software development, aiming to deliver high-quality products efficiently by eliminating waste and focusing on customer value.

Why is a lean business important?

A lean business is important because it can reduce waste, increase efficiency, improve customer satisfaction, and drive innovation, leading to sustainable growth and competitive advantage.

Summary

Lean Finance is a pivotal concept originating from the 1990s, emphasizing efficiency and waste reduction to enhance customer value, applicable across various industries. Its principles, derived from the manufacturing sector, include specifying customer value, optimizing workflows, and pursuing continuous improvement.

While initially associated with manufacturing, these principles are adaptable to finance, fostering streamlined processes, improved reporting, and better strategic support.The effectiveness of Lean Finance lies in its ability to save time, reduce costs, and enhance workflows, akin to its impact in manufacturing.

By adopting Lean Finance practices, teams can become more responsive, save money, and provide better support to leadership and investors. Through the lens of Lean Finance principles, stakeholders can identify value, challenge inefficiencies, and manage processes towards continual improvement, fostering a culture of efficiency and adaptability.

Alexander, our distinguished author, boasts 6 years of rich experience in finance. His profound insights and adeptness in navigating financial intricacies make him a valuable asset, ensuring content that resonates with expertise.