When you’ve used an ATM managed by Payment Alliance International (PAI), you might have noticed an odd “PAI ISO” charge lurking on your latest bank statement. You’re not alone – many folks get stumped by this cryptic line item. But don’t sweat it, this guide will demystify that pesky PAI ISO lingo. Buckle up as we dive into decoding this banking mystery.

What Is Pai Iso?

Let’s start with the basics – PAI ISO is short for “Payment Alliance International ISO.” Payment Alliance International (PAI) is a bigwig in the ATM biz, hooking up banks and retailers with ATM processing, maintenance, and equipment.

The “ISO” part stands for Independent Sales Organization – companies authorized by banks to peddle services like credit card processing to merchants.

So in plain English, PAI ISO is a charge that pops up when you use an ATM or make a purchase with your debit or credit card processed through an Independent Sales Organization working with Payment Alliance International.

Why Is Pai Iso On My Bank Statement?

You’ll spot a PAI ISO charge whenever you tap into an ATM or swipe your plastic at a merchant that’s partnered with PAI for payment processing. That explains the merchant or ATM name plastered next to the charge.

But wait, there’s more! PAI ISO fees can also creep up if you use an out-of-network ATM not affiliated with your bank. In that case, your bank might tack on an extra fee for straying outside their ATM family. Cha-ching!

What Does Pai Iso Mean For My Bank Account?

Seeing PAI ISO on your statement simply means you made a transaction that got processed through Payment Alliance International’s systems – no biggie. The charge usually includes details on where exactly you flashed that cash or credit card.

If it’s from using an out-of-network ATM though, prepare for a potential smidge more in fees from your bank for going off the rails. Those fees can vary based on your bank’s policies and account type.

Why Is It Important To Understand Pai Iso Charges?

Three big reasons to get clued in on PAI ISO fees:

- Keeping tabs on your spending Recognizing PAI ISO lets you track where your hard-earned dough is going. Knowledge is power, after all.

- Dodging pesky fees

Knowing your bank charges for out-of-network ATMs means you can stick to in-network machines and save some coin. - Spotting shady transactions A surprise PAI ISO charge you can’t account for? Could be a red flag for fraudulent activity on your account. Time to give your bank a ring!

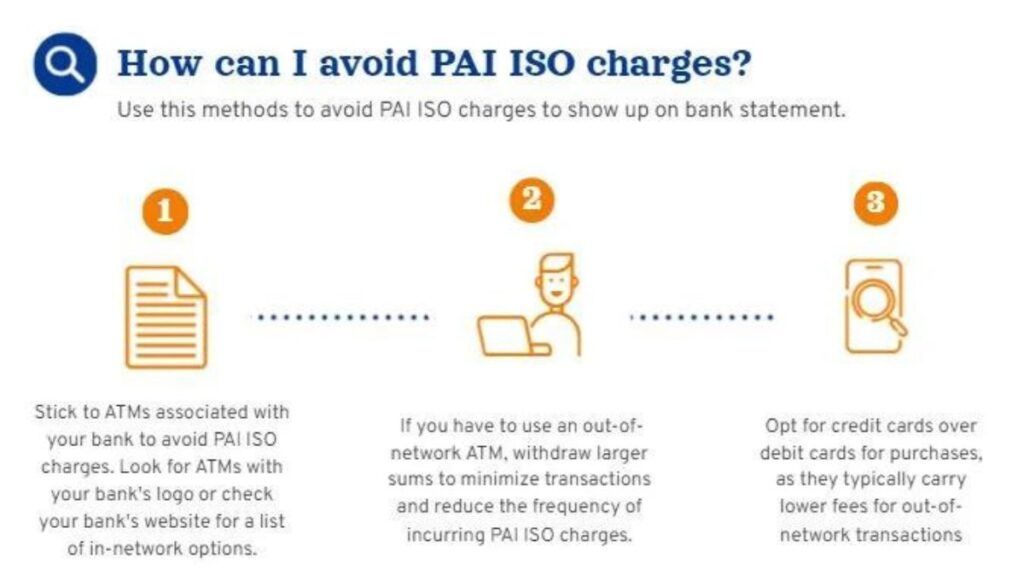

How Can I Avoid Pai Iso Charges?

The easiest way to sidestep PAI ISO? Simple – only use ATMs decked out with your bank’s logo or branding. A quick peek at your bank’s site or app can point you to all their in-network ATM hot spots.

If you gotta hit up an out-of-network ATM though, try withdrawing bigger bucks in one go to minimize those pricey per-transaction fees. Or go plastic and use a credit card for purchases to cut down on charges.

Keep An Eye On Statements For Funky Fees

Sure, PAI ISO itself isn’t a scam, but shady fees and unauthorized charges are always lurking. Stay frosty by giving your statements a thorough scan each cycle. If anything looks fishy, don’t hesitate to grill your bank on it.

Loyalty Has Its Perks – Ask About Fee Waivers

Okay, so you slipped up and used an out-of-network ATM. Before sulking over the incoming fee, see if your bank will hook you up with a freebie waiver. Long-time loyal customers often get sweet perks like these. It never hurts to ask!

Get Savvy – Check Atm Allegiances

Not sure if that random ATM is in-network or not? Smart move doing your homework! Many ATMs clearly advertise which networks and banks they’re affiliated with. Keep an eagle eye peeled for logos and branding to avoid surprises.

Cash Is King (Sometimes)

In today’s tap-and-go world, carrying a crisp wad of cash feels downright prehistoric. But keeping a modest cash stash on hand can be a real fee-saver when your only ATM options are out-of-network. A little green in your pocket gives you more flexibility.

The Bottom Line

Understanding what PAI ISO really means on statements is half the battle. Now you know it’s just signaling a run-of-the-mill transaction processed by Payment Alliance International – no shadiness here.

But don’t get complacent! Always review statements closely for any unauthorized charges or fees. When in doubt, flex that financial savvy and pick up the phone to get clarity from your bank. Armed with this PAI ISO intel, you’re ready to be the boss of your own banking.

Stay In The Loop On Policy Changes

Banking fees and policies are always shifting, so make it a habit to skim those pesky fine-print updates from your bank. They’ll give you a heads up on any new charges or ATM rules to watch out for. A little prep goes a long way in avoiding sticker shock later!

Go Digital To Track Spending

Statement surprises stressing you out? Sign up for your bank’s online banking and mobile apps to get a real-time view of your transactions and ATM activity. Nipping potential issues in the bud is way easier when you’ve got those deets at your fingertips 24/7.

Also Read This Information

Maximizing Atm Freebies

Some banks and account types include a set number of freebie out-of-network ATM transactions each month or cycle. If that’s you, use those free passes strategically when an in-network ATM is nowhere in sight. Every little bit of savings counts!

The Convenience Factor

Let’s be real – fees suck, but sometimes you just gotta bite the bullet for convenience. If you’re caught in a pinch needing cash ASAP, that random PAI ISO charge might be worth averting a crisis. Just make sure to budget accordingly.

When To Call The Pros

For the average Joe, a stray PAI ISO charge here and there is no biggie. But if you’re seeing them constantly or the amounts seem way off, it’s time to enlist the professionals. Schedule a sit-down with your bank or personal finance advisor to get to the bottom of it.

Embracing The Card Life

Okay, so you despise carrying cash but ATM fees make you cringe. Why not lean into our cashless era and start using credit cards for most purchases? Many have sweet rewards programs and fraud protection to boot. Just be disciplined about paying that balance.

The more you understand the ins-and-outs of banking fees like PAI ISO charges, the easier it’ll be to keep your hard-earned money in your pocket where it belongs. With some planning and vigilance, you’ll be a fee-dodging master in no time.

Conclusion

Seeing “PAI ISO” on your bank statement can be confusing, but it’s no biggie! It just means you used an ATM or made a purchase processed by Payment Alliance International. If it’s an out-of-network ATM, you might get hit with extra fees from your bank.

The key? Use your bank’s ATMs whenever possible to avoid those charges. But don’t freak over the odd PAI ISO line – it’s legit. Just stay vigilant for any unauthorized transactions and fees. With a little know-how, you can be the master of your banking and keep more cash in your pocket. Simple as that.