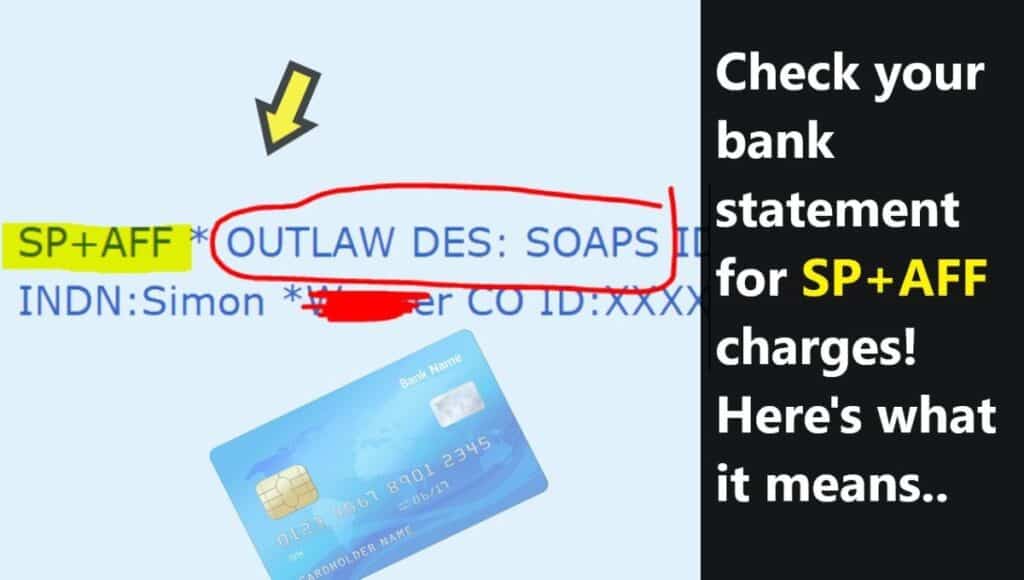

Ever landed on a puzzling “SP AFF*” charge while scrutinizing your bank statement? No need to panic – we’ve got you covered! Let’s unravel this bewildering fee and ensure you’re not getting hoodwinked.

What Does Aff Mean On Bank Statement?

First up, let’s break it down: SP stands for “subscription payment,” while AFF refers to “affiliate.” So an SP AFF* charge indicates you’ve been billed for a subscription or membership service through an affiliate or third-party website.

No shadiness here, folks! It’s a legitimate fee, not some sketchy scam campaign.

What Is This Charge For?

Now, how did this mystifying charge find its way onto your statement? Two likely scenarios:

- You signed up for a free trial or discounted offer through an affiliate site, and buried in the fine print, it stated that after X days/months, the full subscription price would kick in.

Easy to miss those terms and conditions when blinded by the promise of freebies, right?

- You subscribed directly through a company but they use a third-party payment processor, hence the cryptic “SP AFF*” label on your statement.

Is The Sp Aff* Charge A Recurring Charge?

You betcha! This bad boy isn’t a one-time fling – it’s a committed relationship that’ll keep reappearing on your statement monthly/annually (or whatever payment cycle was specified).

If you’re no longer feeling the love, you’ll need to break it off officially by canceling that subscription. More on that shortly!

How Do I Cancel My Subscription Or Membership?

No worries, we’ve all been there – entranced by an irresistible offer only to have regret set in later. Let’s get you out of this mess:

- First, identify which company is behind the SP AFF* charge. A quick Google search for “company name + SP AFF* charge” should point you in the right direction.

- Next, you’ll need to follow that company’s specific cancellation process. This could mean logging into your account on their website or giving their customer support team a ring.

- Note that some companies require advance notice to avoid getting charged for the next billing cycle, so read those terms carefully and mark your calendar.

Read This Blog

What If I Don’t Remember Signing Up For This Subscription Or Membership?

Happens to the best of us! With so many distractions and sign-ups these days, those buried T&Cs can easily slip through the cracks.

No need to panic – simply reach out to the company directly. They should be able to jog your memory and guide you through the cancellation process if needed.

Can I Get A Refund For The Sp Aff* Charge?

This one’s a bit trickier and depends on the company’s refund policy and those pesky terms you hopefully read!

Some companies may offer a courtesy refund if you cancel within a certain timeframe, while others might have an ironclad “no refunds” policy.

Your best bet? Contact the company, put on your sweetest customer service voice, and inquire about their refund protocol for this charge.

How Can I Avoid Future Sp Aff* Charges?

Learn from this experience, friend! The easiest way to steer clear of surprise charges is to:

- Always read the terms and conditions before signing up for any free trials or discounted offers. Know exactly when that trial period ends and when you’ll get charged the full amount.

- Set reminders on your calendar to cancel before the next billing cycle if you don’t wish to continue.

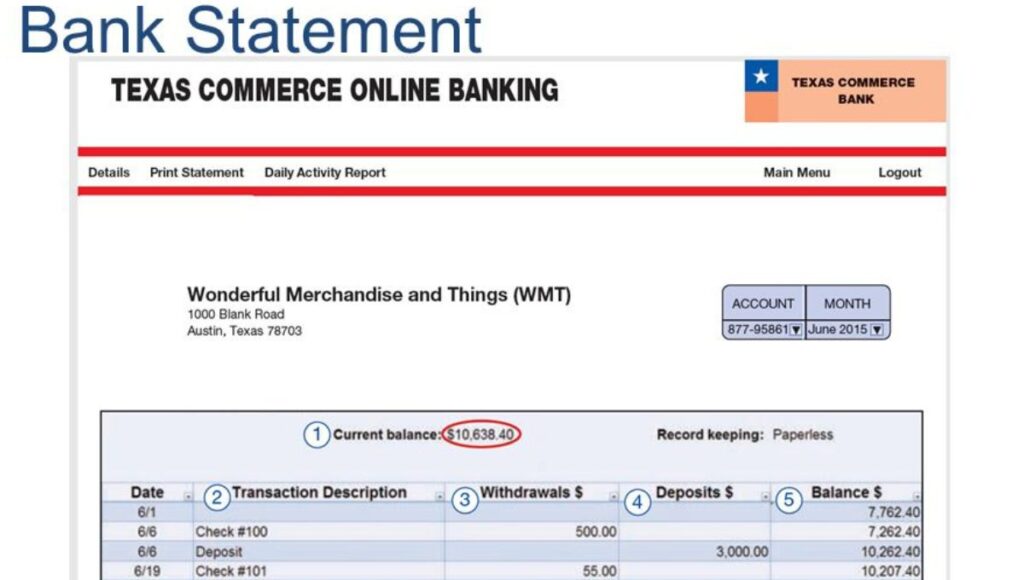

- Regularly review your bank statements with a fine-tooth comb to catch any unfamiliar charges early on.

How To Avoid Getting Tripped Up By Subscriptions You Don’t Need

While subscriptions can be supremely convenient, they can also drain your wallet faster than a kid gobbling up Halloween candy.

To keep those recurring charges from piling up:

- Do a monthly subscription audit – chances are there are some you’ve forgotten about or no longer need

- Check if you’re being double-charged for overlapping services (e.g. multiple streaming platforms)

- See if you can cut costs by downgrading, bundling services, or taking advantage of any loyalty discounts

- Get savvy about sharing accounts, logins, and familial plans for greater cost-splitting

The bottom line? A little diligence goes a long way in swerving those head-scratching “SP AFF*” charges and keeping your finances in tiptop shape!

What To Do If You Suspect Fraudulent Activity

In the rare case that you come across suspicious charges that seem completely out of left field, don’t hesitate to reach out to your bank immediately.

The sooner you report any potential fraud, the better your chances of getting the situation resolved and receiving any warranted refunds or credits.

Your bank will likely require you to submit a claim and may issue you a new debit or credit card number as a preventative measure.

While frustrating, it’s a small price to pay for protecting your hard-earned money from scammers.

Stay vigilant, folks! Knowing what to look for on your statements empowers you to catch any shenanigans early.

Wrapping It Up

There you have it, friends – everything you need to know about decoding those cryptic “SP AFF*” charges on your bank statements.

At the end of the day, a little know-how coupled with some dilligence in reading the fine print can go a long way in avoiding surprises.

So keep an eye out for any unexpected charges, don’t hesitate to query suspect fees, and remember: you’re the boss when it comes to what subscriptions you want to keep or terminate.

Money mindfulness for the win! Drop any other burning questions below, and let’s continue the conversation.

The Subscription Economy: A Double-Edged Sword

The rise of the subscription model has been a game-changer for businesses and consumers alike. Companies love the recurring revenue stream, while we enjoy the convenience of automatic renewals.

But every rose has its thorns, and the subscription economy is no exception. Keeping track of all your subscriptions can quickly become a tangled web of charges hitting your accounts.

From streaming services to meal kits, software licenses to beauty boxes – it’s all too easy to lose track and let those fees accumulate unchecked.

Avoiding Subscription Fatigue

Nobody wants to be nickel-and-dimed into oblivion, so here are some pro tips for taming the subscription beast:

- Conduct quarterly subscription audits to weed out any you no longer need or use

- Set up a dedicated email folder for ALL subscription communications to stay organized

- Leverage tools like Truebill or Trim to monitor and manage your subscriptions in one place

- Get ruthless about sharing accounts with family/friends to minimize overlap

A little subscription hygiene goes a long way in keeping your finances tidy!

The Fine Print Strikes Back

We’ve all been there – excitedly signing up for a freebie or discount without reading the fine print. But that’s where companies often sneak in the “we’ll start charging you after X days” clause.

To avoid getting burned by those automatic renewals:

- Always read terms/conditions thoroughly before signing up

- Set calendar reminders for when free trials expire

- Be very intentional about what boxes you check during signup flows

An ounce of diligence is worth a pound of cure when it comes to thwarting those “gotcha” subscription traps.

When To Dispute A Charge

While many SP AFF* charges are legitimate (albeit confusing), sometimes a statement review reveals something more nefarious afoot.

If you come across charges you definitively did not authorize or sign up for, it’s time to summon your inner Karen and:

- Contact the company immediately to dispute the charges and cancel any associated subscriptions

- Follow up with your bank about the unauthorized charges and request a refund

- Monitor future statements closely and consider requesting a new card number

Don’t let fraudsters take you for a ride! Staying vigilant is key to protecting your money.

Conclusion

Seeing a weird “SP AFF*” charge on your bank statement can be confusing, but don’t sweat it! It simply means you signed up for a subscription or membership through an affiliate site. While legit, these recurring charges can easily pile up unnoticed.

To avoid surprises, always read the fine print before signing up for free trials or discounts. Set reminders to cancel unwanted subscriptions before they auto-renew. Regularly review your statements and dispute any unauthorized charges right away.

A little diligence goes a long way in keeping your finances tidy and avoiding those head-scratching fees. Stay on top of your subscriptions, and you’ll be one savvy money-minding pro!