CCB Madison Tampa Florida on your bank statement refers to a banking transaction code where “CCB” represents the banking entity, and “Madison Tampa Florida” serves as a location identifier. It signifies financial activities tied to this specific branch or region. Understanding this entry is crucial for effective financial management and ensuring the accuracy of your transactions.

Ever spotted “CCB Madison Tampa Florida” on your bank statement, Wonder no more. Uncover the meaning behind this puzzling entry and explore its connection to your financial transactions. Take charge of your money by delving into the significance of “CCB Madison Tampa Florida” on your bank statement. Let’s demystify it together.

What Does ‘CCB Madison Tampa Florida’ Mean?

Have you ever glanced at your bank statement and wondered about the cryptic entry “CCB Madison Tampa Florida” Fear not, as it is a straightforward combination of abbreviations. “CCB” typically stands for a banking entity, while “Madison Tampa Florida” serves as a geographical identifier, pinpointing the location associated with the transaction.

when you see ‘CCB Madison Tampa Florida’ on your bank statement, it is simply indicating a transaction linked to a bank situated in the Madison area of Tampa, Florida.we have demystified the acronyms, let’s delve into why this information matters. Recognizing ‘CCB Madison Tampa Florida’ on your bank statement allows you to track and understand your financial activities more efficiently.

Whether it is a deposit, withdrawal, or other transaction, having this clarity enhances your financial literacy. So, next time you spot ‘CCB Madison Tampa Florida, rest assured that it is a key to unlocking the details of a transaction associated with a bank in the vibrant city of Tampa, Florida.

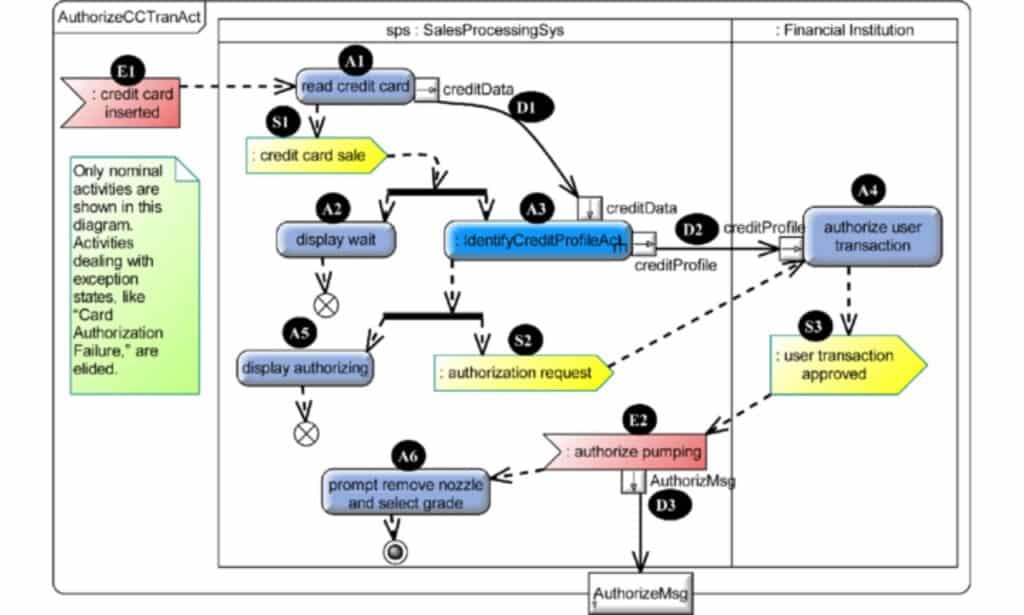

Understanding Authorization Holds in Card Transactions

Ever noticed a pending charge on your card statement that’s not the actual purchase amount. These are authorization holds, temporary deductions initiated by merchants to ensure funds are available before completing a transaction. While the actual purchase amount might differ, authorization holds play a crucial role in preventing overspending and verifying account validity.

When you use your card for a transaction, the merchant contacts your bank to confirm if you have sufficient funds. To secure the funds, your bank places a temporary hold on the specified amount, reducing your available balance.

This hold ensures that the money needed for the transaction is set aside. Once the transaction is finalized, the actual purchase amount replaces the hold, and any remaining funds are released. Understanding authorization holds empowers you to manage your finances more effectively and avoid potential overdrafts.

Also Read More:https://financenexgen.com/what-is-equinox-moto-on-your-bank-statement/

Why Does This Charge Appear on Your Statement?

Encountered a mysterious charge on your statement. It may stem from various sources like subscription renewals, online purchases, or even automatic bill payments. Identifying the nature of the charge is essential for financial awareness and preventing unauthorized transactions.

If the charge seems unfamiliar or incorrect, act promptly. Contact the merchant for clarification, scrutinize your receipts, and review your online accounts. Reporting unauthorized charges to your bank or credit card company is crucial to dispute and resolve the issue promptly, ensuring the security of your finances. Stay vigilant and take control of your financial well being.

How to Monitor and Verify These Charges?

Keep a close eye on your transactions by regularly checking your bank or credit card statements online, ensuring accuracy and promptly identifying any unfamiliar or unauthorized charges.

Here are some practical tips on how to monitor and verify these charges:

Regularly Review Bank Statements:

Regularly reviewing your bank statements is crucial to ensure accurate financial records, spot any unauthorized transactions, and maintain control over your spending. Take a few minutes each month to scrutinize your statements, confirming that all entries align with your financial activities, promoting financial security and awareness.

Keep Track of Your Purchases:

Keeping track of your purchases is essential for effective budgeting and financial management. By regularly monitoring your transactions and categorizing expenses, you can identify spending patterns, avoid overspending, and make informed decisions about your finances. Stay in control and achieve your financial goals by staying vigilant about your purchase history.

Act on Prolonged Authorization Holds:

If you notice prolonged authorization holds on your card, contact the merchant or your bank promptly to ensure a smooth resolution. Taking action on extended holds helps prevent unnecessary freezes on your funds and maintains the accuracy of your available balance.

Use Banking Apps and Alerts:

Optimize your financial management by utilizing banking apps and alerts, allowing real time tracking of transactions and providing instant notifications for any unusual or unauthorized activities. Stay informed and in control of your accounts for enhanced financial security.

Contact the Merchant if Necessary:

If you encounter unfamiliar charges, reach out to the merchant directly for clarification, ensuring a swift resolution and understanding the nature of the transaction. Proactive communication with the merchant can help resolve issues related to billing discrepancies or unauthorized charges on your account.

Deciphering Your Bank Statement

Deciphering your bank statement is like unlocking a financial puzzle each entry holds key information about your transactions. Take a closer look at the details, including merchant names, dates, and transaction amounts, to understand your spending patterns better.

Recognizing common abbreviations and codes can demystify entries like “CCB Madison Tampa Florida,” giving you clarity on your financial activities. Regularly decoding your bank statement ensures accurate records and empowers you to make informed financial decisions.

Possible Transactions under CCB Madison Tampa Florida

various transaction types under “CCB Madison Tampa Florida” on your bank statement. From routine payments and withdrawals to online purchases, understanding these transactions enhances your financial literacy.

Dive deeper into examples of transactions associated with “CCB Madison Tampa Florida.” These may include utility payments, retail purchases, or ATM withdrawals, each reflecting specific financial activities tied to Clearwater Community Bank in Madison, Tampa, Florida. Familiarizing yourself with these examples ensures you stay informed about your expenditures.

Why CCB Madison Tampa Florida Appears on Your Statement

Wondering why “CCB Madison Tampa Florida” appears on your bank statement, This abbreviation signifies transactions with Clearwater Community Bank, located in Madison, Tampa, Florida. Understanding banking abbreviations ensures transparency in your financial records.

Madison Tampa Florida serves as a location identifier, pinpointing the specific branch or area associated with the transactions. This detail aids in tracking your financial activities and reinforces the importance of recognizing geographic indicators on your bank statement for accurate record keeping.

How to Investigate Unrecognized Transactions

If you find a transaction on your bank statement that leaves you scratching your head, do not panic, Start by carefully examining the details of the unfamiliar entry. Take note of the transaction amount, date, and any accompanying descriptions. Next, contact your bank promptly to inquire about the specific transaction. They can provide valuable insights and help identify whether it is a legitimate charge or potentially fraudulent activity.

Staying vigilant and promptly investigating unrecognized transactions is crucial for maintaining the security of your financial accounts. Harness the power of online banking platforms to investigate unrecognized transactions swiftly. Many banks offer detailed transaction histories and real time updates, allowing you to verify recent activities.

consider setting up alerts for unusual account activities to receive immediate notifications. If the transaction appears suspicious or unauthorized, take swift action by notifying your bank and freezing your account if necessary. Proactive investigation and timely reporting are key steps to protect yourself against potential fraud and ensure the security of your financial assets.

Also Read More:https://financenexgen.com/what-is-gpc-eft-transactions-on-my-bank-statement/

Frequently Asked Questions:

How do I recognize common transactions under “CCB Madison Tampa Florida”?

Look for familiar amounts, dates, and merchant names associated with your routine expenditures when deciphering transactions under “CCB Madison Tampa Florida” on your bank statement. Consistent recognition of these details enhances your understanding of common and regular financial activities.

Why does this abbreviation appear on my statement?

The abbreviation “CCB Madison Tampa Florida” appears on your statement to signify various transactions with Clearwater Community Bank in that specific location.

Why is financial literacy important in understanding these entries?

Financial literacy is crucial in understanding entries like “CCB Madison Tampa Florida” as it empowers you to manage your finances effectively and make informed decisions about your transactions.

Why do I need to review my receipts alongside my bank statement?

Reviewing receipts alongside your bank statement is essential to verify the legitimacy of transactions and ensure accurate record-keeping, enhancing your overall financial awareness.

How do I stay in control of my financial records?

To stay in control of your financial records, regularly review your bank statements, utilize banking apps, and promptly address any discrepancies or unauthorized activities for enhanced financial security.

Conclusion

Have you ever questioned the meaning behind “CCB Madison Tampa Florida” on your bank statement, This mysterious abbreviation represents transactions with Clearwater Community Bank in Madison, Tampa, Florida. Unraveling this code is key to financial literacy. Decoding your bank statement involves recognizing the abbreviation “CCB” for Clearwater Community Bank and understanding the location marker “Madison Tampa Florida.

These details highlight the importance of acknowledging both the financial institution and the specific branch or area associated with each transaction. By demystifying “CCB Madison Tampa Florida,” you gain valuable insights into your financial activities and maintain control over your records.

Alexander, our distinguished author, boasts 6 years of rich experience in finance. His profound insights and adeptness in navigating financial intricacies make him a valuable asset, ensuring content that resonates with expertise.