Have you ever noticed a charge labeled “ISPA PIMDS” on your bank statement and wondered, It is actually a fee for processing payments through the Internet Service Provider Association’s Payment Intermediary Data Services. This charge often appears when you have subscribed to or purchased services from an internet provider or related online services.

Ever stumbled upon a mysterious “ISPA PIMDS” charge on your bank statement and scratched your head in confusion, This little acronym represents fees from your internet adventures, courtesy of the Internet Service Provider Association. It is like a digital footprint of your online subscriptions or purchases, showing up quietly on your statement

What is ISPA/PIMDS?

ISPA/PIMDS stands for Internet Service Providers’ Association Payment Intermediary Data Services. It is essentially a system that helps manage and process payments for online services. Think of it as a behind the scenes facilitator that ensures your subscription fees or online purchases go through smoothly to your internet service provider or a related online service.

This setup is key for both consumers and service providers, ensuring transactions are handled securely and efficiently. So, when you see “ISPA/PIMDS” on your bank statement, it is a sign that your payment has been processed through this trusted system, keeping your online services up and running without a hitch.

Understanding the Charge Code: ISPA/PIMDS

ISPA/PIMDS stands for Internet Service Providers Association/Payment Intermediary Merchant Data Services. This charge code appears on bank statements when you have used a service that processes payments through this channel. It is essentially a digital handshake for your online transactions, ensuring that your subscriptions or purchases are smoothly processed.

Seeing “ISPA/PIMDS” on your statement means a fee has been applied for using internet services or making online purchases. This charge is the behind the scenes hero, making sure your digital buys are secure and properly managed. So, next time it pops up, you’ll know exactly what it is for keeping your online world running smoothly.

More information: https://financenexgen.com/what-is-the-paddle-net-charge-on-your-bank-statement/

Common Scenarios

There are some common scenarios where this charge has been reported, which can offer clues into its origin.

ATM Withdrawals

ATM withdrawals let you pull cash directly from your bank account through an Automated Teller Machine. It is a quick, convenient way to get your hands on your money when you need it, anywhere and anytime.

keep in mind, some transactions may come with fees, especially if you are using an ATM outside your bank’s network. Always check your bank’s policy to avoid unexpected charges.

Small Businesses

Small businesses utilizing online payment services might notice the ISPA/PIMDS charge on their bank statements. This fee is associated with processing electronic transactions through the Internet Service Providers Association’s framework. It ensures secure and efficient payment handling for services or subscriptions the business uses or offers online.

For small enterprises, this charge is a part of the digital commerce landscape, reflecting the cost of accessing broader markets via the internet. Understanding this fee can help businesses manage their finances better, ensuring transparency in their online transactions.

Rolling Cost for Online Service

The “ISPA PIMDS” charge on your bank statement often includes a rolling cost for online services, reflecting periodic subscription fees. This means the charge is not a one off but recurs, based on the terms of your subscription with an internet service provider or a digital service.

Understanding this rolling cost is crucial to managing your finances, as it ensures you are aware of regular deductions for services you have subscribed to. Keeping an eye on these charges can help avoid surprises and ensure your subscriptions align with your current needs and usage.

How to Deal with ISPA/PIMDS Charges

If you find an “ISPA/PIMDS” charge on your credit card statement and are unsure of its origin, taking immediate action is crucial. Here’s how to deal with it.

Steps to Verify the Charge

Check Your Subscriptions: Review any recent internet service subscriptions or online purchases you’ve made that might explain the ISPA/PIMDS charge.

Examine the Date: Match the charge date on your statement with any of your known transactions or subscription renewals.

Contact Your Bank: Reach out to your bank for detailed information about the charge and ask for the merchant’s contact details.

Verify With the Merchant: Use the merchant information provided by your bank to contact the service provider directly and inquire about the charge.

Review Your Bank’s Policies: Familiarize yourself with your bank’s policies on intermediary charges to understand if the ISPA/PIMDS fee is a standard practice.

Dispute If Necessary: If the charge seems erroneous and you cannot verify its legitimacy with the merchant, consider disputing the charge through your bank.

Importance of Contacting Your Bank

If you spot an “ISPA/PIMDS” charge on your bank statement and it is got you puzzled, reaching out to your bank should be your first step. This proactive approach can clarify any confusion and ensure your finances are in order.

Inquire about the charge: Get a clear explanation directly from the source.

Verify transaction legitimacy: Confirm that the charge is for a service you have actually used.

Understand your statement: Learn how to spot and understand various charges in the future.

Ensure account security: Make sure no unauthorized transactions are happening under your radar.

Possibility of Refunds

If an “ISPA/PIMDS” charge on your bank statement was unexpected or unauthorized, you might be eligible for a refund. Contacting your bank or the service provider directly is the best first step to address the issue.

Banks and service providers often have policies in place for handling disputed charges. They can guide you through the process to potentially reverse the charge and secure your refund.

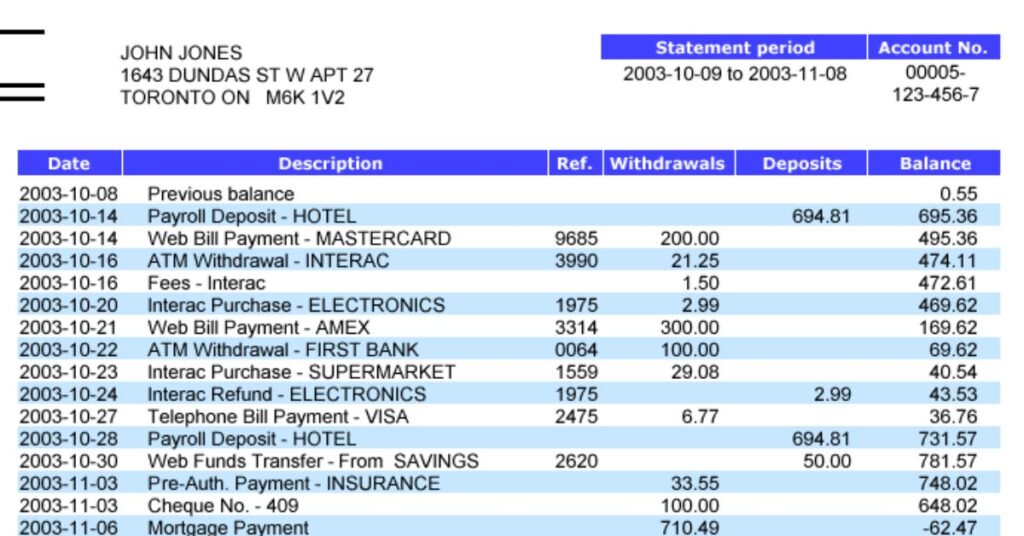

Potential Charges Noticed on Your Bank Statements

Spotting unexpected charges on your bank statement can be alarming. These could range from subscription renewals to ATM withdrawal fees, highlighting the need for regular account reviews.

To manage these surprises, familiarize yourself with common fees and maintain open communication with your bank. This proactive approach helps avoid misunderstandings and keeps your finances in check.

What is the deadline for disputing an ISPA PIMDS charge?

The deadline for disputing an ISPA/PIMDS charge on your bank statement typically falls within 60 days from the statement date. This window allows you to review and question any unfamiliar transactions you might find.

Acting promptly ensures your bank can investigate and address the dispute effectively. Missing this deadline could limit your options for resolution, so keeping an eye on your statements is crucial.

Why did an ISPA PIMDS charge appear on my bank statement?

An ISPA/PIMDS charge appears on your bank statement when you have made a transaction that involves an Internet Service Provider or a digital service. This code signifies that a payment intermediary facilitated the transaction, ensuring a secure exchange of funds for online services.

Such charges are common for subscriptions, online purchases, or memberships processed through the Internet Service Providers Association’s payment system. It is a digital footprint of your active engagement with online services, marking the completion of a transaction.

Navigating Bank Statement Charges

Navigating bank statement charges requires a keen eye and a bit of know how. Firstly, familiarize yourself with common charges, like monthly maintenance fees, ATM withdrawal fees, or unexpected ones like the ISPA/PIMDS charge for online transactions.

To keep surprises at bay, regularly review your statement and set up alerts for transactions. If something looks off, do not hesitate to reach out to your bank. This proactive approach can help you manage your finances more effectively and avoid unnecessary expenses.

More Information: https://financenexgen.com/what-is-sigonfile-on-your-bank-statement/

How do I recognize if the ISPA PIMDS charge is authorized?

To recognize if an ISPA/PIMDS charge is authorized, start by reviewing your recent online transactions, subscriptions, or any service sign ups. These charges often link to digital services or internet providers, so check if it aligns with your activities.

Verify the transaction details against your records or emails for confirmation of service enrollment or purchase. If the charge still does not ring a bell, contacting your bank or the service provider for clarification is a wise move. This can help confirm the legitimacy of the charge and ensure your account’s security.

Frequently asked question

Why might an ISPA PIMDS charge vary each month?

The ISPA PIMDS charge might vary each month due to different subscription rates or usage of variable-cost online services. Changes in your digital consumption or subscription upgrades can affect the charge.

How can I identify the service provider of an ISPA PIMDS charge?

Identifying the service provider of an ISPA PIMDS charge can be done by reviewing your recent online transactions and matching them with the charge date and amount on your statement. Your bank may also provide details or contact information for the service provider.

How can I protect myself from unauthorized ISPA PIMDS charges?

To protect yourself from unauthorized ISPA PIMDS charges, regularly review your bank statements, use secure payment methods, and enable transaction alerts. Promptly report any suspicious activity to your bank or card issuer.

How long does it take to resolve an ISPA PIMDS inquiry?

Resolving an ISPA PIMDS inquiry can take anywhere from a few days to several weeks, depending on the bank’s investigation process and the complexity of the transaction. Your bank should provide updates on the status of your inquiry.

What types of services might cause an ISPA PIMDS charge?

Services that might cause an ISPA PIMDS charge include internet service subscriptions, online streaming services, digital downloads, or any online purchases processed through Internet Service Providers Association’s payment systems. These charges reflect your engagement with digital services.

Summary

The ISPA/PIMDS charge on your bank statement is a fee applied for transactions processed through the Internet Service Providers Association’s Payment Intermediary Data Services. It typically appears when you’ve subscribed to an online service, made a digital purchase, or engaged with internet based services. This charge is the financial footprint of your digital activities, ensuring secure and efficient payment processing.

If you notice an ISPA/PIMDS charge, it is crucial to recall any recent digital subscriptions or purchases you have made. These charges are legitimate and reflect your online transactions. If the charge seems unfamiliar, it is advisable to contact your bank or service provider for clarification. Prompt action can help safeguard your account and ensure that all charges are authorized and accurate.

Alexander, our distinguished author, boasts 6 years of rich experience in finance. His profound insights and adeptness in navigating financial intricacies make him a valuable asset, ensuring content that resonates with expertise.