The VIOC charge on your bank statement reflects payments for automotive services at Valvoline Instant Oil Change centers. This acronym stands for a range of maintenance tasks, including oil changes and vehicle inspections. It is a direct indicator of the quality care your vehicle has received at Valvoline outlets.

Ever noticed a mysterious “VIOC” charge on your bank statement and wondered what it was, You are looking at a sign of your car getting the TLC it needs at Valvoline Instant Oil Change centers. From vital oil changes to thorough vehicle inspections, this charge is all about keeping your ride in prime condition. Let’s dive into what makes the VIOC charge a noteworthy part of your vehicle’s maintenance history.

What is the VIOC Charge?

The VIOC charge on your bank statement is shorthand for transactions made at Valvoline Instant Oil Change locations, covering essential automotive services. This includes professional oil changes, comprehensive vehicle inspections, and a variety of maintenance tasks to ensure your car runs smoothly.

When you see “VIOC” listed on your statement, it reflects the cost of these services at Valvoline centers. It is a convenient way to track your vehicle’s upkeep expenses, ensuring you are up to date with necessary maintenance and care for your ride.

more information: https://financenexgen.com/what-is-the-ispa-pimds-charge-on-your-bank-statement/

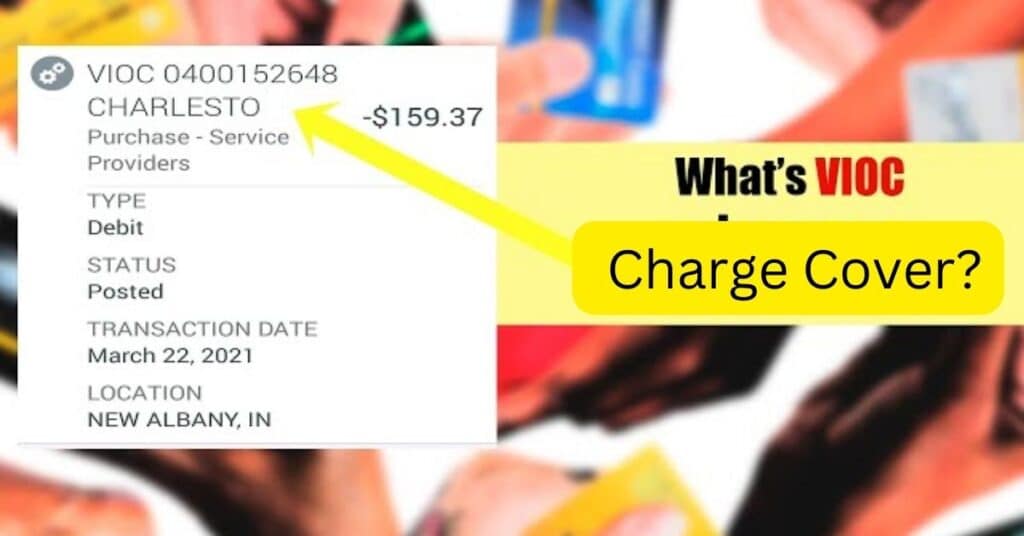

How VIOC Charges Appear on Bank Statements

VIOC charges appear on bank statements as a clear indication of payments made for services at Valvoline Instant Oil Change centers. This notation helps car owners easily identify expenses related to vehicle maintenance and care.

Upon receiving services like oil changes or vehicle inspections at Valvoline, the charge is succinctly listed as “VIOC” on your statement. This streamlined labeling facilitates straightforward financial tracking and budgeting for car upkeep.

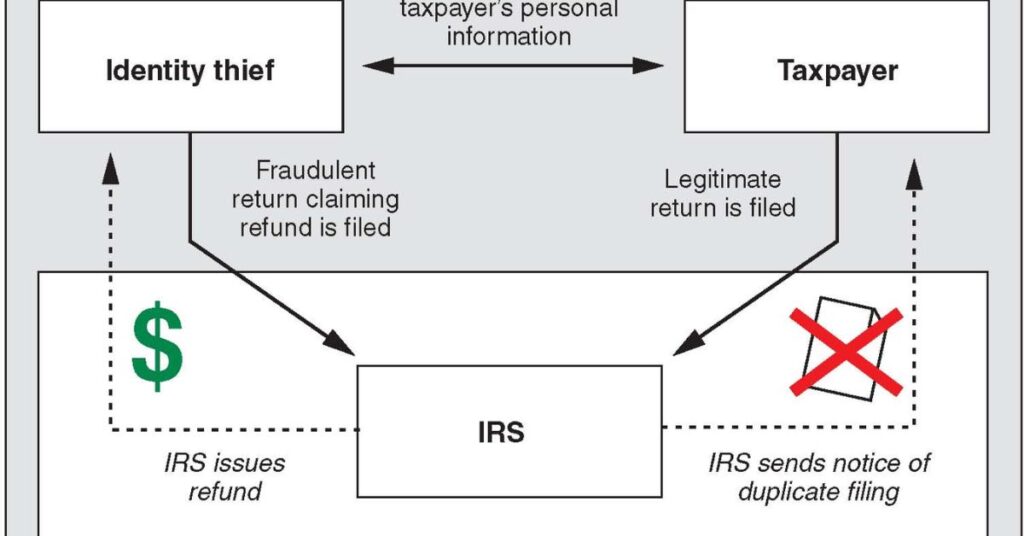

Identifying Legitimate vs Fraudulent Charges

Identifying legitimate versus fraudulent charges on your bank statement involves scrutinizing unfamiliar transactions for authenticity. Legitimate charges typically align with your purchasing history and include detailed merchant information, facilitating recognition.

Fraudulent charges, on the other hand, may stand out due to inconsistency with your spending patterns or lack of recognizable merchant details. Promptly reporting such anomalies to your bank can safeguard against potential financial loss and secure your account.

What is Jiffy Lube?

Jiffy Lube is a leading chain of automotive service centers specializing in oil changes, vehicle maintenance, and a variety of inspections. Renowned for its “quick lube” service model, Jiffy Lube offers fast and efficient care, ensuring your vehicle stays in optimal condition.

With over 2,000 locations across the United States, it is a convenient option for drivers looking to maintain their cars without delay. Jiffy Lube’s comprehensive approach to car care makes it a trusted name in automotive maintenance.

Why is it Called VIOC?

It is called VIOC because the acronym stands for Valvoline Instant Oil Change, reflecting the brand’s commitment to providing swift and efficient oil change services. This naming highlights Valvoline’s specialization in rapid, yet thorough, automotive maintenance and care.

The term VIOC has become synonymous with quality and convenience, offering drivers a reliable option for their vehicle’s upkeep. It encapsulates the essence of Valvoline’s promise for instant service without compromising on the quality of the work.

What Does the VIOC Charge Cover?

The VIOC charge encompasses the costs associated with a variety of automotive services provided at Valvoline Instant Oil Change centers. This includes oil changes, vehicle inspections, and other maintenance tasks aimed at enhancing your car’s performance and longevity.

Beyond the basic services, the charge also accounts for any additional maintenance work performed, along with applicable taxes and fees. The comprehensive nature of the VIOC charge ensures that your vehicle receives the care it needs for safe and efficient operation.

How is the VIOC Charge Calculated?

- The VIOC charge is calculated based on the specific automotive services provided at Valvoline Instant Oil Change centers.

- Factors influencing the charge include the type of oil change (conventional or synthetic) and the scope of vehicle inspections or maintenance performed.

- Additional services, such as tire rotations or fluid top offs, are added to the base cost of the oil change to determine the final charge.

- Local taxes and fees, which vary by region, are also incorporated into the total amount.

- Pricing may differ across Valvoline locations due to regional cost variations and specific service packages.

- Customers can request a detailed breakdown of services to understand the components of the charge.

- Promotions or discounts applied at the time of service can also affect the final VIOC charge.

Can I Avoid the VIOC Charge?

Avoiding the VIOC charge entirely may be challenging if you utilize Valvoline Instant Oil Change services, as the charge is directly tied to the automotive care received. However, selecting alternative payment methods, such as cash, can prevent the charge from appearing on your bank statement.

Another strategy includes using specific credit cards or loyalty programs that offer discounts or rewards for automotive services. While these approaches may not eliminate the charge, they can mitigate its impact or enhance the value received from the services rendered.

Why is the VIOC Charge Important?

- The VIOC charge serves as a clear record of maintenance services provided to your vehicle at Valvoline Instant Oil Change centers.

- It helps car owners track and manage their automotive maintenance expenses effectively.

- Recognizing the VIOC charge aids in budgeting for future car care needs.

- It ensures transparency in billing, allowing customers to see exactly what services they are paying for.

- The charge can highlight discrepancies or errors in billing, prompting further investigation.

- It facilitates easier communication with Valvoline for any questions or disputes regarding the services received.

- Keeping an eye on the VIOC charge helps in maintaining a consistent vehicle maintenance schedule, contributing to the vehicle’s longevity and performance.

What if I Don’t Recognize the VIOC Charge?

Review Your Records: Check your recent service receipts or bank transactions to match the VIOC charge with a visit to Valvoline Instant Oil Change.

Contact Valvoline Directly: If the charge remains unclear, reach out to Valvoline for detailed information on the service date, location, and specifics.

Inquire With Your Bank: For further clarification or if you suspect an error, contact your bank to investigate the charge’s origin.

Monitor Account Activity: Regularly review your bank statements to quickly identify and address any unfamiliar charges.

Report Unauthorized Charges: If you believe the charge is fraudulent, notify your bank immediately to secure your account and initiate a dispute.

Fraud Prevention Measures: Implement security measures, such as setting up transaction alerts, to prevent unauthorized charges in the future.

Seek Professional Advice: Consider consulting with financial advisors or consumer protection services for guidance on handling unrecognized charges effectively.

Why did You Get the Charge from VIOC?

You received the charge from VIOC as a result of utilizing services at Valvoline Instant Oil Change centers, primarily for routine automotive maintenance such as oil changes. These charges directly reflect the cost of the professional care and maintenance your vehicle has undergone to ensure its optimal performance and safety.

Additional reasons for the VIOC charge may include more comprehensive services like vehicle inspections, tire rotations, or fluid top offs that were performed during your visit. Each service contributes to the overall well being of your car, making the VIOC charge an investment in your vehicle’s longevity and reliability.

How to Prevent Wrong VIOC Charge?

Guard Your Card Information: Be cautious about where and how you share your credit card details, especially online or over the phone.

Regular Statement Checks: Make it a habit to review your bank and credit card statements monthly for any discrepancies or unfamiliar charges.

Use Cards with Fraud Protection: Opt for credit cards that offer robust fraud protection features, reducing the risk of unauthorized charges.

Enable Instant Notifications: Set up text or email alerts for transactions on your accounts to monitor charges in real time.

Update Personal Details: Ensure your contact information is current with your bank and credit card issuer to receive timely alerts and communications.

Strong Passwords for Online Accounts: Use unique, strong passwords for your online banking and merchant accounts to prevent unauthorized access.

Secure Storage of Cards: Keep your credit and debit cards in a safe place, minimizing the risk of loss or theft which could lead to fraudulent charges.

To prevent wrong VIOC charges safeguard your credit card information and regularly review statements for any illegal transactions.

More information: https://financenexgen.com/what-is-the-sp-aff-charge-on-bank-statement-is-it-a-scam-or-legit/

What to Do When You Receive a Charge from VIOC in Your Bank Statement?

Here’s a table summarizing the actions you can take if you encounter an unidentified VIOC charge:

| Action | Description |

| Check Your Records | Review your recent receipts or invoices to verify if the VIOC charge corresponds to a valid transaction at Valvoline Instant Oil Change centers. |

| Contact Valvoline Instant Oil Change | If the charge remains unidentified, reach out to Valvoline Instant Oil Change for clarification. They can provide details about the transaction, including the date, location, and services rendered. |

| Contact Your Bank | If you are still unsure about the legitimacy of the charge, contact your bank or credit card provider. They can assist you in disputing the charge and investigating any possible illegal transactions. |

| Monitor Your Accounts | Stay vigilant and monitor your bank statements regularly for any unknown charges. Reporting unauthorized charges promptly can help protect your financial security. |

| Report Fraudulent Activity | If you suspect that the VIOC charge is a result of fraudulent activity, notify your bank immediately. They can take steps to secure your account and prevent further unauthorized transactions. |

This table provides a structured approach to addressing and resolving issues with VIOC charges on your bank statement.

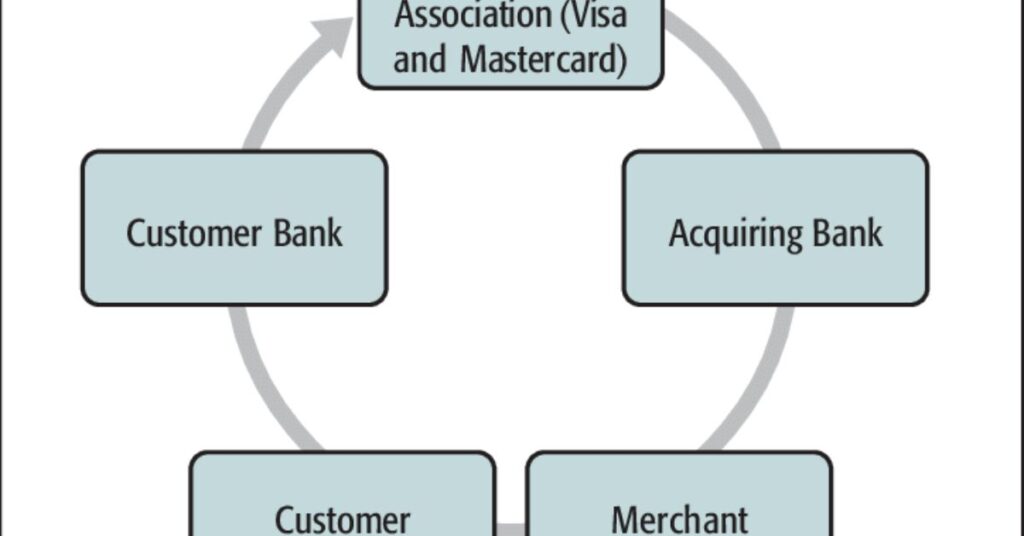

The Role of Banks and Credit Card Companies

Banks and credit card companies play a pivotal role in the financial ecosystem, serving as intermediaries that facilitate a wide range of financial transactions for individuals and businesses alike.

Their responsibilities extend far beyond mere transaction processing, encompassing areas such as fraud prevention, consumer protection, and financial education. Here’s a closer look at their key roles,

Payment Processing: They handle the processing of transactions, ensuring smooth transfers of money when you make purchases or pay bills. This includes everything from swiping your credit card at a store to transferring money online.

Credit Provision: Credit card companies extend credit, allowing consumers to borrow funds within a predetermined limit for purchases or cash advances, effectively managing short term financing needs.

Fraud Detection and Prevention: These institutions employ sophisticated algorithms to detect unusual transaction patterns that may indicate fraudulent activity, thus protecting customers’ financial assets.

Secure Transactions: Implementing encryption and secure protocols for online and card transactions to protect sensitive information against hacking and other cyber threats.

Dispute Resolution: They provide mechanisms for disputing transactions, offering consumers protection against unauthorized charges and facilitating refunds or chargebacks when necessary.

Innovative Payment Solutions: Constantly developing new technologies, such as mobile payments and digital wallets, to make transactions more convenient and accessible.

Regulatory Compliance: They adhere to strict regulations designed to ensure the stability of the financial system, protect consumer rights, and prevent financial crimes.

Economic Stability: By managing credit risk and providing lending services, these institutions contribute

Frequently asked question:

How can I prevent unauthorized VIOC charges in the future?

To prevent unauthorized VIOC charges, regularly monitor your bank statements, safeguard your credit card information, and consider setting up transaction alerts for immediate notification of any suspicious activity.

What are my rights if I dispute a VIOC charge and it’s found to be fraudulent?

If you dispute a fraudulent VIOC charge and it is proven to be unauthorized, your rights typically include receiving a refund for the fraudulent amount and having any associated fees waived by your bank or credit card issuer.

How long do I have to report a suspicious or fraudulent VIOC charge?

The timeframe to report a suspicious or fraudulent VIOC charge varies depending on your bank’s policies, but it is advisable to report it as soon as possible to minimize potential financial losses and expedite the investigation process.

Who can I contact for more information about a specific VIOC charge?

For more information about a specific VIOC charge, you can contact Valvoline Instant Oil Change directly, providing details such as the transaction date, amount, and location to obtain clarification and resolve any discrepancies.

Where can I find more resources on understanding and managing bank statement charges?

To better understand and manage bank statement charges, seek resources from reputable financial institutions, consumer protection agencies, or online financial education platforms, which offer guidance on interpreting statements and protecting against unauthorized transactions.

Summary

The VIOC charge on your bank statement represents payments made for automotive services at Valvoline Instant Oil Change centers. It encompasses expenses related to essential car maintenance tasks, including oil changes, vehicle inspections, and additional services provided by Valvoline.

When you spot the VIOC charge, it serves as a clear indicator of the care your vehicle has received, helping you track and manage your automotive expenses effectively. This charge reflects the quality services rendered by Valvoline, ensuring your vehicle stays in optimal condition for safe and reliable driving.

Alexander, our distinguished author, boasts 6 years of rich experience in finance. His profound insights and adeptness in navigating financial intricacies make him a valuable asset, ensuring content that resonates with expertise.