The Utility Store Billing transaction on your bank statement refers to a payment you have made at a utility store. This typically includes charges for essential services like electricity, water, and gas. It is a convenient way to consolidate multiple bill payments into one transaction.

Stumbled upon a “Utility Store Billing Transaction” on your bank statement and scratching your head, This line item represents a convenient payment for multiple utility services in one go. Discover how this simple transaction can streamline your bill payments and keep your finances tidy.

The Utility Store Billing transaction on your bank statement reflects payments made for various household utilities. This could include electricity, water, gas, or other essential services. It is a convenient way to handle multiple bills through a single payment at a utility store. Regularly checking these transactions helps you keep track of your monthly utility expenses.

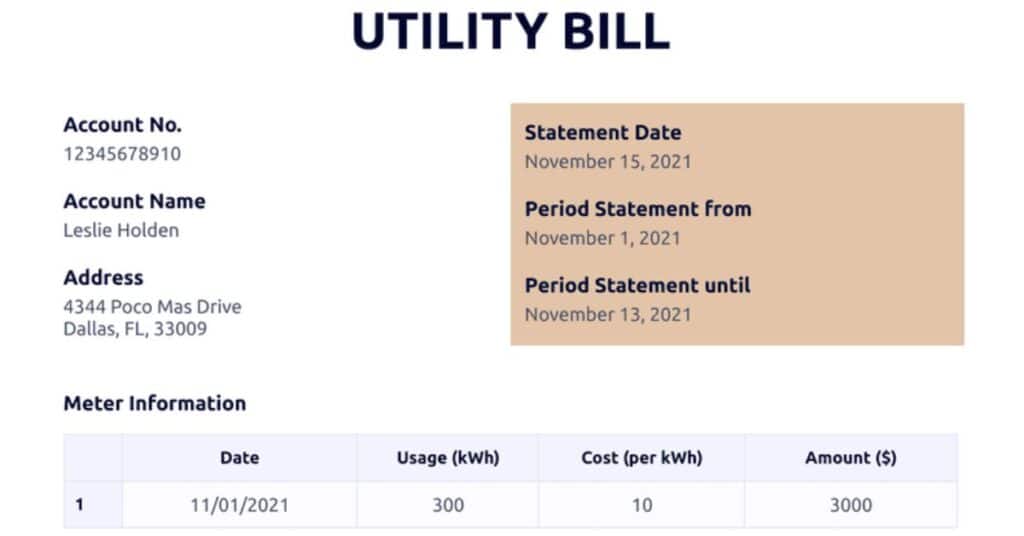

What is a Utility Bill?

A utility bill is a monthly statement that shows how much you owe for essential home services like electricity, water, and gas. It lists your usage, the cost, and when you need to pay. These bills keep your home comfortable and functioning, covering everything from lights to running water.

Each bill provides a breakdown of your service usage over the billing period. This helps you understand your consumption patterns and manage your expenses better. Keeping up with these bills ensures your home stays operational and avoids service interruptions.

More Information:https://financenexgen.com/what-is-the-ispa-pimds-charge-on-your-bank-statement/

The Role of Utility Store Billing Transactions

- Utility Store Billing transactions streamline the process of paying multiple utility bills at once.

- They provide a convenient way to manage household expenses without juggling several different payments.

- These transactions are often summarized in a single entry on your bank statement, simplifying financial tracking.

- By consolidating payments, they can save time and reduce the hassle of keeping up with due dates.

- Regularly monitoring these transactions helps in budgeting and ensures timely payment of essential services.

Managing Utility Expenses

Managing utility expenses involves keeping a close eye on your monthly bills for services like electricity, water, and gas. By understanding your usage patterns, you can identify opportunities to save money. Simple changes, such as fixing leaks or adjusting thermostat settings, can make a big difference.

Budgeting for these expenses helps avoid surprises and ensures you can comfortably cover your bills each month. Tools like budget billing or energy efficient appliances can also help manage costs. Staying proactive about utility management supports a more sustainable and financially stable household.

Components of a Utility Bill

A utility bill typically includes details about your usage and the cost for services like electricity, water, and gas, allowing you to monitor and manage your household expenses.

Customer Information

This section shows your name, address, and account number, identifying you as the recipient of the services.

Amount Owed and Due Date

It outlines how much you owe for the billing period and when the payment is due to avoid late fees.

Payment Instructions

Here, you’ll find how to pay your bill, including online, by mail, or through automatic bank deductions.

Usage Details

This part breaks down your consumption of the utility services, helping you understand your usage patterns.

Charges Breakdown

It itemizes the charges, including base fees, usage costs, and any applicable taxes or surcharges.

Previous Payments

This section reflects payments you have made since the last billing cycle, showing your account’s current standing.

Customer Service Information

Contact details for customer support are provided, in case you have questions or need assistance with your bill.

Managing Utility Store Billing Transactions

Managing Utility Store Billing transactions involves keeping track of payments for household services, ensuring they are paid on time and accurately.

Set up alerts: Many banks offer notification services to remind you of upcoming transactions, helping you stay on top of payments.

Review regularly: Check your bank statements monthly to verify the accuracy of the Utility Store Billing entries, ensuring no errors or unauthorized charges.

Budget effectively: Incorporate these transactions into your monthly budget to avoid overspending and to allocate funds appropriately for your utilities.

Use online banking: Online platforms often allow for easier tracking and management of payments, providing a convenient way to handle your utility bills.

Seek assistance if needed: If you encounter issues or discrepancies, contact your bank or utility provider promptly to resolve them, maintaining a smooth payment process.

Tools and Apps to Monitor Bank Statements and Utilities

Tools and apps designed for monitoring bank statements and utility expenses offer a seamless way to keep an eye on your financial health. They can automatically categorize transactions, highlight spending patterns, and alert you to due payments, making it easier to manage your money.

By using these apps, you can set budgets for utility spending, track when bills are due, and even find opportunities to save on those bills. They offer a convenient platform to review all your financial activities in one place, from bank statements to utility bills, ensuring you never miss a payment or overlook an opportunity to cut costs.

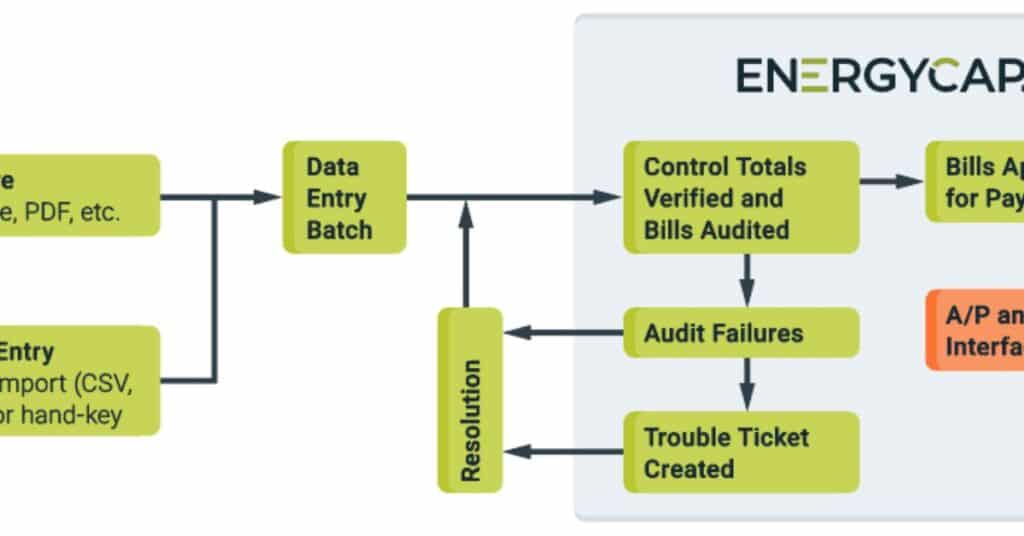

Managing and Verifying Utility Transactions

Managing and verifying utility transactions ensures accuracy in your billing and payments. Regularly reviewing your statements can catch errors or unexpected charges early.

Use online banking or budgeting apps to track these transactions and verify payments. This helps maintain control over your finances and prevents overcharges or missed payments.

Steps to Verify Utility Store Transactions

To verify Utility Store transactions, start by comparing your bank statement with receipts or emails confirming the payment. Next, check the details like the amount and date to ensure accuracy. If discrepancies arise, contact your bank or the utility provider directly to resolve them. Keeping records of your transactions and communications aids in this verification process.

Disputing Unrecognized Utility Charges

If you spot unrecognized charges on your utility bill, immediately contact your utility provider to dispute the amount. Provide them with details of the charge and any evidence you have to support your claim. The company will review your dispute and may require additional documentation. Prompt action and clear communication are key to resolving such issues efficiently.

Utility Bills and Average Costs

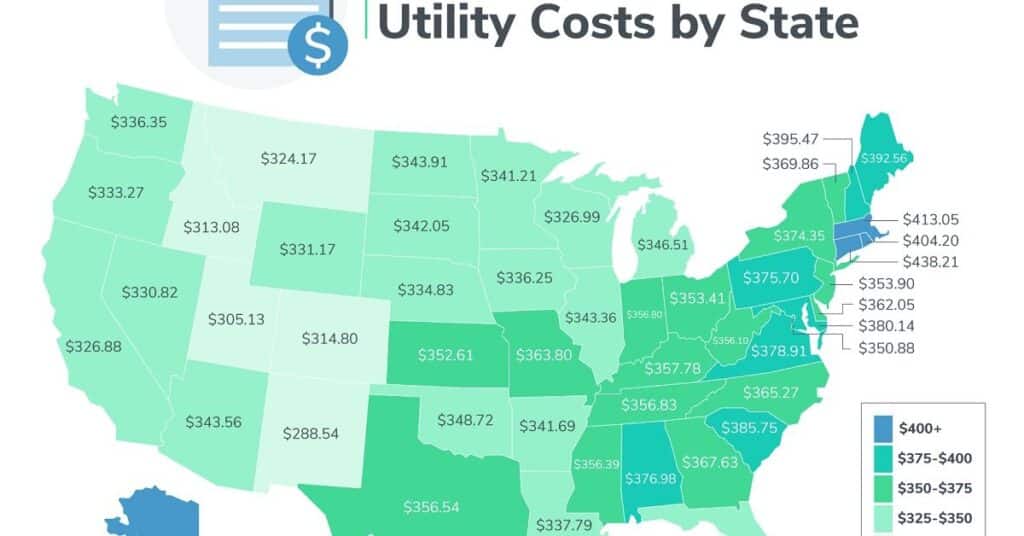

Utility bills cover essential services like electricity, water, and gas, with average costs varying by location and usage. Understanding these expenses is crucial for budgeting and financial planning.

Electric Bill

The average electric bill for U.S. households was about $137 per month in 2022. Efficient appliance use and smart thermostats can help lower these costs.

Water Bill

On average, families spend around $83 per month on water. Fixing leaks and installing water efficient fixtures can significantly reduce water usage and bills.

Gas Bill

The average monthly gas bill was approximately $63 in 2021. Keeping your home well insulated and adjusting thermostat settings can help manage gas expenses.

Internet Bill

The cost of internet service varies widely but averages between $60 to $100 per month. Bundling services or shopping around can offer savings.

Trash and Recycling

Monthly fees for trash and recycling services typically range from $10 to $40. Reducing waste and recycling more can minimize the need for higher tier services.

Managing Utility Expenses in Your Budget

Incorporating utility expenses into your budget is crucial for maintaining financial stability. By forecasting these costs, you can allocate the appropriate funds, ensuring that your essential services remain uninterrupted.

Adopting energy saving habits and utilizing budget billing options can significantly reduce your monthly utility bills. Keeping a close eye on your consumption patterns also allows you to adjust your usage and save money over time.

What to Do If You Can’t Pay Your Bills?

Contact your utility provider to explore payment plans or assistance programs that can help during financial difficulties.

If you find yourself facing challenges in paying your utility bills, there are proactive steps you can take to address the situation:

Contact Your Provider

Reach out to your utility provider immediately to discuss your situation. They may offer payment plans or extensions to help you manage.

Seek Assistance Programs

Look into government or non profit assistance programs designed to support individuals struggling to pay their utility bills.

Prioritize Payments

Focus on paying for essential services first, like electricity and water, to maintain your household’s basic needs.

Consider a Loan

In some cases, a short term loan may be an option to cover urgent bills, but be cautious of interest rates and repayment terms.

Budget Adjustments

Review and adjust your budget to cut non essential expenses, freeing up funds to pay off your utility bills.

More Information: https://financenexgen.com/what-is-the-ispa-pimds-charge-on-your-bank-statement/

Why utilities charge convenience fees to pay by credit card

Utilities charge convenience fees for credit card payments to cover the processing costs imposed by credit card companies. These fees compensate for the transaction charges that utilities incur when accepting this payment method, ensuring they don’t lose money on the transaction.

This practice allows customers the flexibility to pay via credit card, which can be more convenient and offer rewards.it is important for customers to be aware of these additional costs to make informed payment decisions.

Frequently Asked Questions

What is utility bill in UK,usa?

In both the UK and the USA, a utility bill is a statement that charges households for essential services such as electricity, water, gas, and sometimes internet and waste collection. These bills vary by usage and location, and are crucial for maintaining a comfortable living environment.

What happens if you never pay a bill?

Failing to pay a utility bill can lead to late fees, service disconnection, and negative impacts on your credit score. Persistent non payment may result in debt collection efforts and legal actions to recover the owed amount.

What is utility in account

In accounting, “utility” refers to the cost of services used by a company to operate, such as electricity, water, and gas. These are considered operational expenses and are essential for the day to day functions of the business.

What Are Utility Store Billing Transactions?

Utility Store Billing transactions are payments made at utility stores or through utility services providers for multiple services like electricity, water, or gas. These are consolidated payments for convenience and efficiency.

Why Do Utility Store Billing Transactions Appear on Your Bank Statement?

Utility Store Billing transactions appear on your bank statement to provide a record of payments made for utility services. This helps in tracking expenses and managing finances by showing all utility payments in one place.

What is the meaning of utility bill in bank?

In banking, a utility bill is often used as a proof of address and identity verification for opening accounts or for other financial services. It reflects the customer’s regular payments for essential household services.

Conclusion

A Utility Store Billing transaction on your bank statement represents a payment made to a utility store or a service provider for your home’s essential services. These services can include electricity, water, gas, and sometimes internet and trash collection. This line item shows up on your statement as a consolidated payment, indicating you have settled your monthly dues for these necessities in one transaction.

Seeing this transaction helps you keep track of how much you are spending on utilities each month, simplifying budget management. It consolidates various utility payments into one, making it easier to monitor and manage your financial outgoings. Utility Store Billing transactions are a testament to the convenience offered by utility providers, allowing for efficient financial planning and organization.

Alexander, our distinguished author, boasts 6 years of rich experience in finance. His profound insights and adeptness in navigating financial intricacies make him a valuable asset, ensuring content that resonates with expertise.